The 2019 1 oz Platinum American Eagle Bullion Coins Have Arrived!

The 2019 Platinum Eagles Are Now Available to Order.

The 2019 American Eagle Platinum Bullion coin are now in stock and usually shipping next business day. The U.S. Mint has not indicated the size of their 2019 American Platinum Eagle coin inventory, though it is believed that coins will be in limited quantity and on a strict allocation basis to dealers.

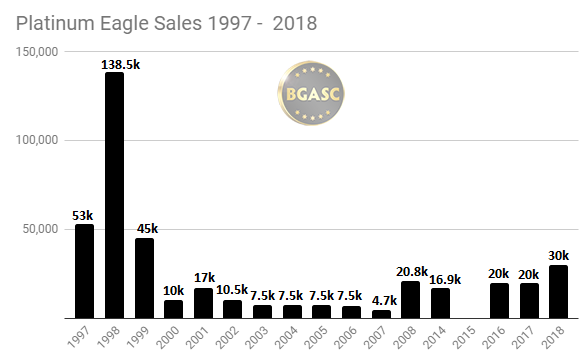

Limited Mintage History of the American Platinum Eagle Coin

From 1997 – 2008 the U. S. Mint produced one tenth, one quarter, one half and one ounce American Eagle Platinum bullion coins. After a five year hiatus the U.S. Mint produced resumed production of one ounce American Platinum Eagle coins but did not produce smaller denominated coins. The U.S. Mint did not issue any American Platinum Eagle coins in 2015. The one ounce American Platinum Eagle coins returned again in 2016 and were also produced in 2017 and 2018.

Source: US Mint

About the 2019 American Eagle Platinum Bullion Coin

The 2019 American Eagle Platinum Bullion coin is minted in .9995 pure platinum and weighs 1.0005 ounces. The coin has reeded edges and a diameter of 32.7 mm. The obverse of the coin was designed by former United States Mint Chief Engraver John. M Mercanti and its reverse by former United States Mint Sculptor-Engraver Thomas D. Rogers Sr. The face value of the one ounce American Eagle Platinum bullion coin is $100 though the bullion value far exceeds that amount.

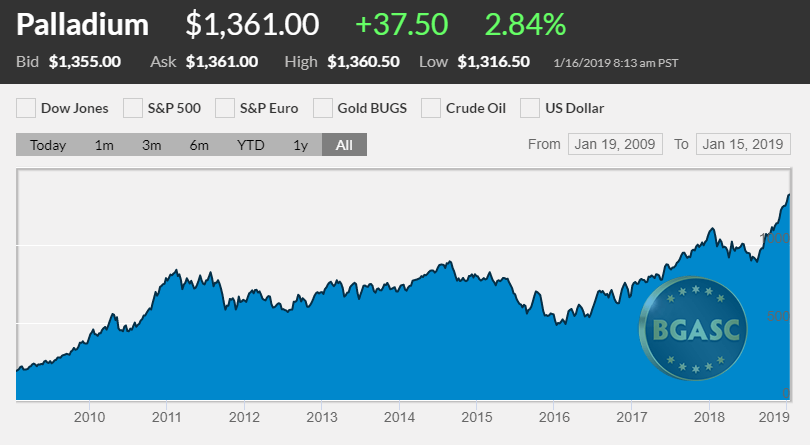

Gold, Platinum and Palladium Prices Diverge Over Ten Year Period

The price of platinum has fallen nearly in half since 2014. Historically, platinum trades at a premium to gold. As of January 2019, however, Gold was valued about 1.5X the price of platinum.

Palladium historically has traded between 1/3 and 1/2 the price of platinum. Over the past eighteen months, due to the dramatic decline in the price of platinum and increase in the price of palladium, the price of palladium has surpassed platinum for the first time.

Facts About Platinum and Palladium

Symbols

The symbol for platinum on the periodic table of the elements is Pt. The symbol for palladium is Pd.

Properties

Platinum and palladium are extremely rare precious metals with many unique properties that make them, like their white metal cousin, silver, prized for their beauty and use in industry. Platinum is the most dense precious metal (the ratio of the mass of an object to its volume) Platinum has a density of 21.4, Gold 19.3, Palladium 12.0 and Silver 10.5.

As a result of its unique density, platinum is nearly impossible to counterfeit.

Rarity

Platinum is an extremely rare metals mined mostly in South Africa and Russia. There is limited platinum in Canada and the United States. Annual platinum mining production is about 10 times lower than annual gold mining production. Platinum coins are also very rare. American Platinum Eagle production at the U.S. Mint has been limited. In total, 415,700 one ounce American Platinum Eagle coins have been minted in the coin’s history that began in 1997, with 138,500 minted in 1998.

History

Platinum was discovered in South America around 1735. About ninety years later, platinum was found in the Ural Mountains of Russia. Soon after its discovery, the Russian Emperor Nicolas I had platinum coins minted that circulated from 1828-1845 within Russia. These coins are the only examples of platinum serving as a monetary metal. In 1865, platinum deposits were discovered in South Africa. Today South Africa (approximately 72%) and Russia (13%) supply the bulk of the world’s platinum. Total annual platinum production is about 200-250 tons a year (approximately 6.5-8 million ounces a year).

Uses

Industrial

Platinum’s use in the automotive industry accounts for about 45% of overall demand. Platinum is used in automobiles’ catalytic converters that reduce Nitrogen Oxide emissions. Platinum demand has increased the past two decades as countries like China and India have seen massive growth in their national auto fleets. In 2000, Chinese demand for platinum for catalytic converters was 32,000 ounces. By 2014, demand had grown to 527,000 ounces.

About half of palladium’s industrial use is also for catalytic converters, which convert harmful gases from automotive exhaust.

Jewelry

Platinum is less “white” than silver and has a greyish tinge that is popular in many jewelry designs. Platinum jewelry is especially popular in China and Japan. Jewelry demand accounts for about 30% of overall jewelry demand.

Other Uses

The remaining platinum demand comes from the chemical petroleum refining industry (about 10%), electronics (3%) and various other applications including electrodes, anticancer drugs, fuel cells, dental applications, oxygen sensors, spark plugs and turbine engines (about 13%).

Monetary/Investment

Platinum demand for investment purposes is small. While the Canadian Mint, Perth and U.S. Mint produce platinum products they are not produced in large quantities. An Exchange Traded Fund launched in 2013 in South Africa now holds about 900,000 ounces of platinum.

The American Platinum Eagle coins are IRA eligible.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.