Central Bank of Russia Adds Another 12.44 tons of Gold To Reserves in September

The Central Bank of Russia added 400,000 ounces (12.44 tons) of Gold to Reserves in September.

Russian Gold Mining Production Powers Russian Central Bank Gold Reserves

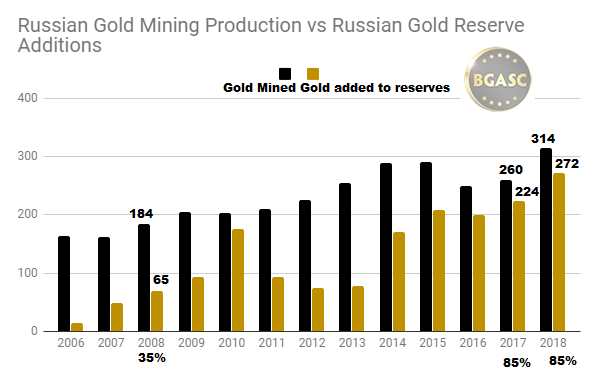

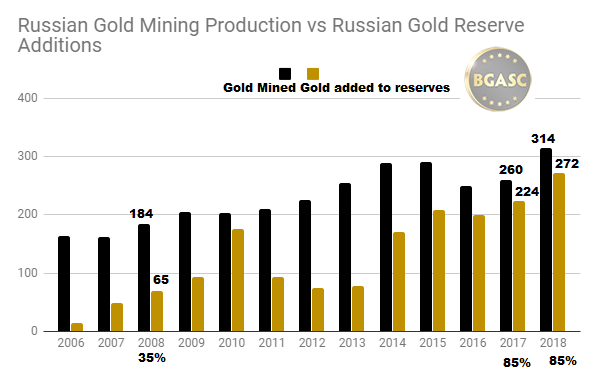

The Central Bank of Russia has the world’s third largest gold mining production of any nation. Russia has been putting that gold mining production increasingly to bolster its own gold reserves. In 2017 and 2018, Russia added approximately 85% of domestic gold mining production to reserves up from 35% in 2008. In 2018 Russia mined 314 tons and put 272 of those tons into the Central Bank of Russia.

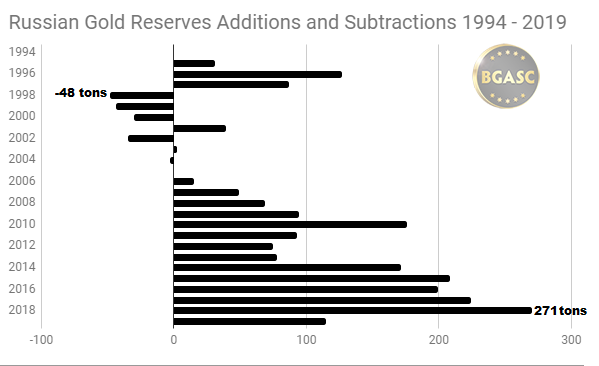

Russian continues to lead the world central banks in gold acquisition. In 2018 the CBOR added a record 271 tons to her reserves and continues to add prodigious amounts of gold to reserves through September 2019, albeit at a slower pace than last year.

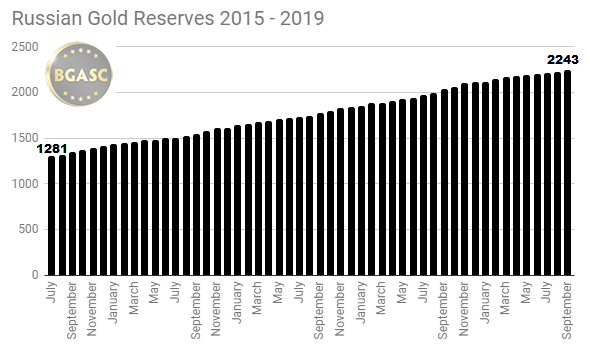

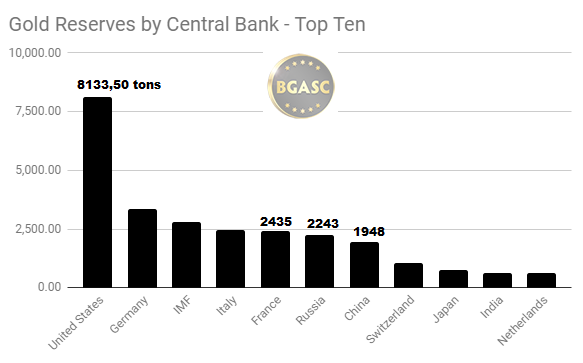

The Russian Central Bank announced recently that its gold reserves had reached 72.1 million troy ounces (approximately 2,243 metric tons). The total included an additional 400,000 ounces (approximately 12.44 metric tons) of gold added in September.

With the world’s third largest gold production and facing sanctions from the United States and Europe over the past few years, the Central Bank of Russia has increased its foreign reserves to over $500 billion, largely by increasing their gold reserves, which now account for nearly 21% of overall reserves.

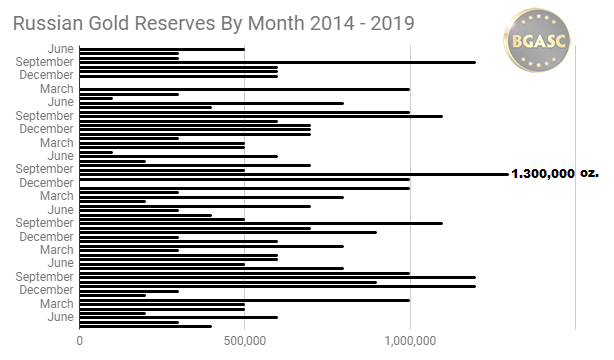

The Central Bank of Russia added 208 tons of gold to reserves in 2015. In 2016, Russia added 199 tons of gold to her reserves.

In 2017, the Russian Central Bank added a record 7.2 million ounces or approximately 224 tons of gold to reserves. Over the past two years, Russia has led the world in adding gold to her central bank reserves, ahead of the People’s Bank of China, the central bank that has added the second largest of amount of gold. Indeed, in 2017 the Russian Central Bank’s gold holdings surpassed the People’s Bank of China’s gold reserves to take sole possession of fifth place among the gold holding nations of the world. The Central Bank of Russia continues to add gold to reserves at a faster pace than the People’s Bank of China.

In 2018, the Russian central bank added about 271 tons of gold, the largest amount ever added. Through September 2019, the Central Bank of Russia has added over 127 tons of gold to reserves.

The Central Bank of Russia has been adding an average of over 200 tons of gold to reserves the past few years.

As a result of Russia’s gold buying binge, Russia has vaulted into fifth place among holding nations and should over take France and Italy within two years assuming Russia continues to add gold to reserves at the pace of the past five years and France and Italy continue NOT to add gold to their reserves.

The Central Bank of Russia holds over 2,243 tons of gold.

In addition to increasing its gold hoard, Russia’s overall foreign reserves have grown from $371 billion in January 2016 to $530.922 billion as at September 2019, a 43% increase.

As of September, 2019, Russia’s 2,243 tons of gold constituted about 20.3% of the Central Bank of Russia’s $531 billion reserves with her gold hoard valued at approximately $107.846 billion, up from $52 billion or 12% of overall reserves as at August 31, 2016.

The Central Bank of Russia has added over 37 million ounces (approximately 1,142 tons) of gold to her reserves from June 2014 – September 2019.

Alan Greenspan said recently that “Gold is currency… the premier currency, no fiat currency, including the dollar, can match it”. Russian gold mining produces the second largest annual output in the world behind China. Russia adds a substantial percentage of its domestic mining production to her reserves. By retaining a large percentage of its gold mining output the Central Bank of Russia has been in effect converting its currency, the rouble, into gold.

Russian Gold Reserves data: Central Bank of the Federation of Russia

| Today’s Gold Prices | Today’s Silver Prices | See Gold & Silver Price Charts | Receive Gold & Silver Price Alerts |

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.