Chinese Gold Demand Increases in First Half of 2018

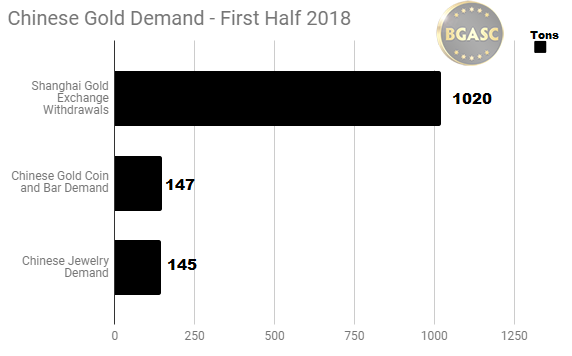

The Shanghai Gold Exchange Reports over 1020 Tons of Gold Withdrawn through June.

The Shanghai Gold Exchange reported withdrawals of 140.588 tons of gold in June 2018.

As China, grapples with responding to U.S. tariffs, the gold trade continues apace in China at the Shanghai Gold Exchange (SGE) and jewelers and coin shops. The volume of gold withdrawals on the SGE are considered by many observers to be a reliable indicator of gold demand in China. Numbers reported by the World Gold Council on Chinese gold bar and coin investment demand and Chinese gold jewelry demand are also important gauges of Chinese over all gold demand.

First half 2018 Chinese gold jewelry demand rose 5% from 137.6 tons in the first half of 2017 to 144.9 tons, Chinese gold investment demand during the first half of 2018 grew 6.5% from 137.9 tons in the first half of 2017 to 146.8 tons in the second half of 2018 and Shanghai Gold Exchange withdrawals grew 3.7% from 984 tons in the first half of 2017 to 1020 tons in the second half of 2018.

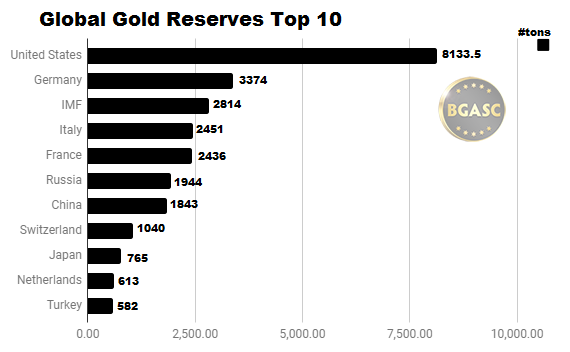

The People’s Bank of China (PBOC) has not reported adding any gold to reserves since October 2016. That was the month that the Chinese Yuan was admitted to the International Monetary Fund’s Special Drawing Rights. Since 2016, the PBOC gold reserves have stood at 1843 tons.

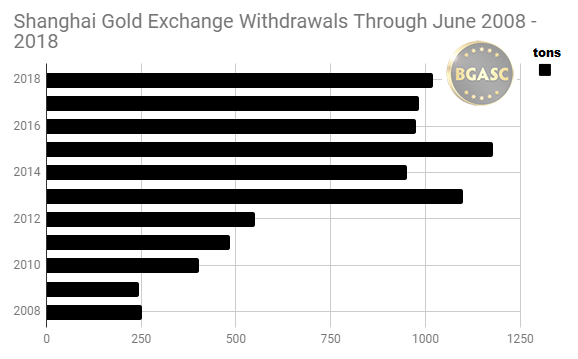

While the PBOC has not added any gold, demand for gold in China remains strong when measured by withdrawals on the Shanghai Gold Exchange (SGE) and Chinese gold investment and jewelry demand. 2018 is shaping up to be the second or third best year in terms of gold withdrawn on the SGE.

Gold withdrawals on the SGE in 2018 through June 2018 were 1020 tons. The SGE monthly gold withdrawals topped over 140 tons in June. For the first six months of 2018, gold withdrawals on the SGE were 1020 tons vs 984 tons through the first six months of 2017. Only 2013 and 2015 experienced greater gold withdrawals through June.

The SGE has been reporting significant monthly withdrawals annually since 2013. In 2015, the SGE reported a record 2,597 tons of gold had been withdrawn, an amount roughly equal to the annual global gold mining production. Robust gold demand as measured by Shanghai Gold Exchange withdrawals continued in 2017. The pace of gold withdrawals in 2018 is slightly ahead of 2017’s pace through the first five months.

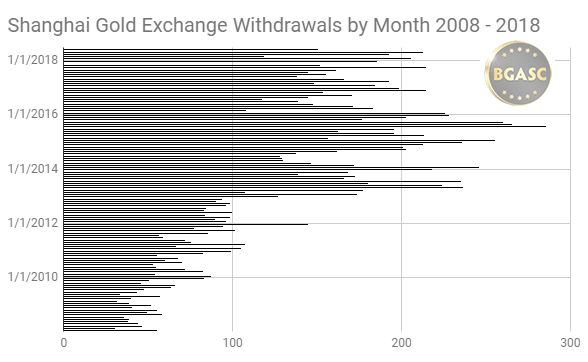

Monthly withdrawals on the SGE since 2013 have often topped 200 tons. The chart below illustrates the big jump in monthly withdrawals in recent years.

In addition to a rapidly growing SGE, Chinese gold imports have also soared in recent years through Hong Kong and Shanghai. Chinese gold imports through Hong Kong peaked at 1,158 tons in 2013 and were 861 tons in 2015 and 770 tons in 2016. In 2017, Chinese gold imports through Hong Kong were about 628 tons. From 2004- 2008 Chinese gold imports through Hong Kong were only 339 tons.

While China has aimed for increased transparency in its gold holdings and imports, it does not yet disclose gold imports through Shanghai.

China is also the world’s largest producing nation having mined approximately 450 tons of gold a year for the past two years.

With an increasingly wealthy population of well over one billion, China is expected to play a greater role in gold consumption and gold pricing in the coming years.

About the Shanghai Gold Exchange

The Shanghai Gold Exchange on October 30, 2002, by the People’s Bank of China and organizes the trading of gold, silver, platinum and other precious metals.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.