FX Friday – Global Currency Review & Forecast for 3-4-16

|

|

|

|

Strong February Non Farm Payroll Numbers Fail to Lift the Dollar; Gold and Silver Rise

The big story of the week was the non farm payroll (NFP) number coming in much higher than expected. The NFP published by the United States Bureau of Labor Statistics (BLS) purports to measures the number of new jobs created each month. This morning the BLS reported that 240,000 new jobs were created in February and that the unemployment rate was 4.9%. December and January’s previously released NFP numbers were revised upwards. Market expectations were for 180,000 new jobs created in February. While more than expected new jobs were created, average weekly earnings dropped.

The NFP and unemployment numbers are closely watched by Fed observers as they gives clues to Fed thinking on the direction of rate hikes. A strong NFP number makes it more likely that the Fed might raise interest rates. A strong NFP number should indicate a strong US economy and therefore a strong US dollar. A strong dollar normally spells trouble for gold which is viewed as a hedge against the dollar.

The NFP number, however, has been an outlier in the mix of recent economic data. While the NFP and unemployment numbers appear solid, other U.S. and global economic data has not been so good.

When the non farm payroll number was released, the Dollar Index soared from 97.52 just prior to the release of the NFP number at 8:30 EST to 98.03 just after the announcement. Within an hour and a half of the announcement the Dollar Index fell to 97.23 retracing its gains and more.

Gold had risen over night to $1275 an ounce, but fell immediately after the NFP number was released to $1256 then rose to $1275 within an hour and a half of the announcement.

The wild swings in gold and the Dollar Index indicate that the NFP can no longer be safely interpreted as a reliable indicator of either the health of the overall economy or the direction of interest rates.

Week Ended February 26, 2016

The U.S. Dollar Index* closed the week ended February 26, 2016, at 98.07 up from 96.63 on February 19, 2016.

Oil closed the week ended February 26 at $32.80 up from $29.89 on February 19.

Gold finished the week at $1221.80 an ounce on the week down from $1226 the prior week and silver closed the week at $14.67 down from $15.31 the prior week.

Week Ended March 4, 2016

On Monday, February 29, the US Dollar Index opened the week at 98.16, gold opened at $1220 an ounce and rose ten dollars by early afternoon to nearly $1234 an ounce. Silver opened at $14.67 and rose twenty cents to $14.87 an ounce by early afternoon. Oil opened higher and rose to $33.58 by mid afternoon after Saudi Arabia said that they would work with other oil producers to limit volatility.

Brexit Fears Weigh on the Euro & British Pound

The Euro fell to three year low and the British pound also fell as Britain’s government said that an EU exit “could lead to decade of uncertainty”

On Tuesday gold and silver rose in overnight trading and opened higher but fell by mid morning retracing their gains then losing an equal amount. Gold was down $10 and silver off $.16 cents an ounce. The dollar index rose .35 to 98.40 while oil lost .25 to $33.52 a barrel.

The dollar got a boost on stronger than expected ISM Mfg: 49.5 and construction spending that beat expectations. The U.S stock market also rallied with the Dow, NASDAQ AND S & P equity indexes all up well over 1% by mid morning.

Oil stabilized when the UAE and Russian President called again for oil production freezes among oil producing states.

Equity markets all rallied later in the day with the Dow up over 2% Nasdaq up nearly 3% and the S&P up 2.5% at the close. The US Dollar Index ended up at 98.34 and oil surged to $34.40 during the day and closed higher at 34.00.

Gold and silver attempted rallies late in the day and were flat until selling off slightly at the end of the day to close at $1232 and $14.81 an ounce, respectively

On Wednesday, oil fell after it was reported that US oil inventories had risen, potentially offsetting any production freeze that might be institued by other oil producing nations.

The US dollar opened higher at 98.40 and the Australian Dollar ,which had been on a steady decline for months, moved up 1% on reports stronger than expected economic growth.

Gold and silver opened flat as did equities.

Oil soared during the day to nearly $35 in late morning trade on more chatter about a production freeze then fell back to $34.32 by mid day.

Gold and silver rose during the day and closed higher. Gold rose $9 to $1240 an ounce and silver jumped $.14 to $14.94 an ounce, having topped $15.00 an ounce during the day. The Dollar Index fell to 98.17 despite stronger than expected ADP employment numbers and hawkish comments from San Francisco Fed President on the prospect of more rate hikes in 2016.

On Thursday morning oil glut concerns pushed oil down to $34.35 a barrel after rising overnight to nearly $35.

Initial jobless claims of 278K vs expectations of 270K and a Markit Service PMI of 49.7 vs expectations of 50.0 weighed on the US Dollar Index as it fell to 97.86. Gold and silver rose with gold approaching $1250 an ounce by mid morning and silver breaking $15.00 an ounce.

Canada announced that it had sold its remaining gold, and the Canadian dollar rose!

Gold and silver rose as the dollar fell after Dallas Fed President urged patience on further rate hikes. The Dollar Index closed down more than .5% at 97.63 and gold and silver each rose about 2% to $1264 and $15.23, respectively.

The Brazilian Real rose to a six month high after the former Brazilian President was detained on potential fraud charges which had shaken confidence in the government.

On Friday morning the NFP numbers were released, causing an immediate rise in the Dollar Index and a decline in precious metals. An hour after the announcement, gold and silver were up, with silver rising to $15.53 an ounce or over 2%.

Next week is light on US economic reports. Here are some of the report that could impact currency movements next week:

Mar 7 Consumer Credit Jan

Mar 9 MBA Mortgage Index 03/05

Mar 9 Wholesale Inventories Jan

Mar 9 Crude Inventories 03/05

Mar 10 Treasury Budget Feb

Mar 10 Continuing Claims 03/05

Mar 10 Initial Claims 03/05

Mar 10 Natural Gas Inventories 03/05

Mar 11 Export Prices ex-ag. Feb

Mar 11 Import Prices ex-oil Feb

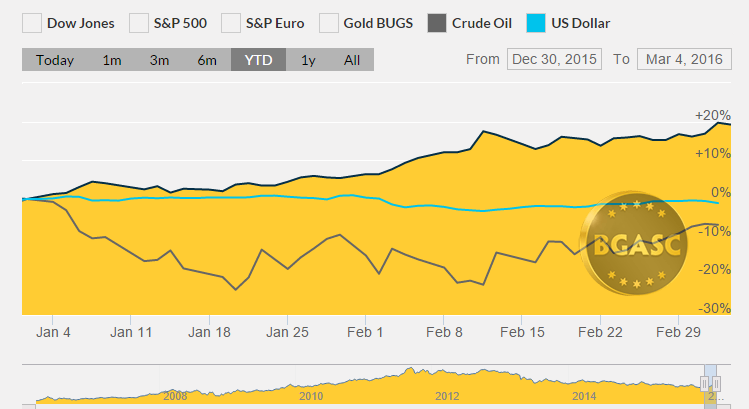

Year to Date Dollar Index, Oil and Gold Prices

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article does not necessarily reflect the explicit views of BGASC, nor should it be construed as financial advice.