FX Friday Global Currency Review & Forecast For 6-10-16

Fed Open Mouth Operations Cut Short By Reversal in the Labor Market

Former heavyweight boxing champion Mike Tyson once said, “Everyone has a plan until they get hit in the mouth.” For the better part of May and early June Fed Presidents put the markets on notice that the Fed was serious about instituting its plan for a series of rate hikes in 2016. Chatter from Fed officials about interest rate hikes in 2016 was incessant during May. The Fed open mouth operations rescued the dollar from its year long slide. The Dollar Index* hit its nadir around 92 just as the Fed officials began their constant jawboning about raising rates at the beginning of May. By the end of May, markets had priced in a Fed rate hike to happen after the Fed’s June or July meeting and the Dollar Index was back up around 96.

Then the May non farm payroll report was released last Friday morning. The report from the Bureau of Labor Statistics (BLS) showed that just 38,000 new jobs were created in May. The job numbers from the March and April reports were also revised downward. The report was like a punch in the mouth to every Fed official who had been talking up the Fed’s plans to raise rates, possibly as soon as June or July.

Fed minutes, Fed officials’ and Fed Chair Janet Yellen’s statements regarding the possibility of rate hikes have been predicated on the further strengthening of the labor market. The downward revisions of the number of jobs created in March and April and the stunning decline in May of new jobs reported by the BLS caused a rethink about the health of the labor market and the Fed’s plans to raise interest rates.

The Dollar Index gave up most of its open mouth operation gains falling to under 93.50 by mid week.

Lael Brainard, a member of the Federal Reserve’s Board of Governors was the first Fed official to speak after the release of the dismal job numbers and the impact those numbers might have on the Fed’s plans to raise interest rates. “Recognizing the data is mixed (emphasis added) there would appear to be an advantage to waiting until developments provide greater confidence.” said Ms. Brainard in a speech to the Council on Foreign Relations.

Fed Chair Yellen was next to speak on Monday and put a brave face on the job numbers. Ms. Yellen spoke as if the job report was an aberration and indicated that rate hikes were still appropriate in 2016 if the labor market continued to strengthen.

On Wednesday the U.S. Labor Department reported in its March Job Openings and Labor Turnover Survey, or JOLTS, that the rate of hiring fell to 3.5 percent from 3.7 percent, the slowest rate since August 2014.

Other Currencies

Most other currencies rose vis a vis the dollar after the U.S. Jobs report on Friday. The British Pound continues to remain under pressure as new polls show a Brexit now more likely than unlikely when Britons go to the polls on June 23.

Gold and Silver

The gold and silver price reaction to the poor Friday U.S. job report was swift. Gold and silver rose and erased their losses sustained earlier in the week on continued concerns that an upcoming rate hike would undercut the price of precious metals. Gold and silver finished the week higher. Janet Yellen’s dovish/hawkish speech on Monday muted any further gold and silver price gains. By Wednesday, gold and silver resumed their ascents, with gold hitting above $1260 and Silver over $17 in mid day trading.

Oil

Oil continued its rise this week, settling well above $50 a barrel by mid-week. Rising oil prices may not be welcomed by consumers but they help the Fed’s case for a rate hike. In addition to wanting to see a stronger labor market before raising interest rates, the Fed also wants to see higher inflation. Higher oil prices make gas and finished goods more expensive and help the Fed achieve their “inflation target” of 2%.

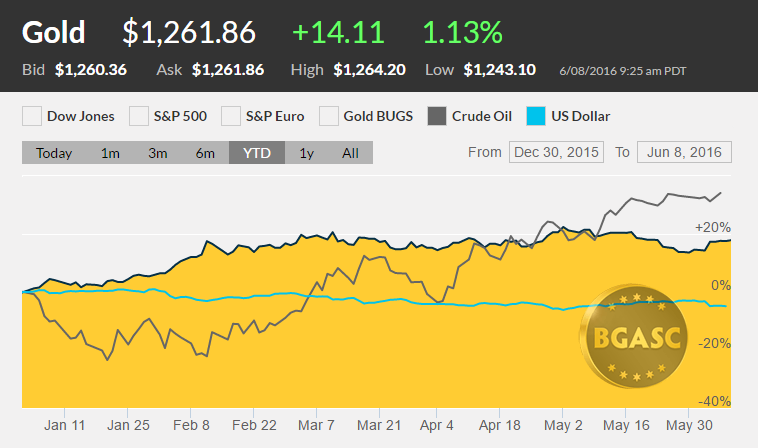

Year to Date Dollar Index, Oil and Gold Prices

What’s next?

All eyes will be on the Fed’s announcement on June 15 following their two day meeting. While virtually no one is expecting a rate hike to emerge from the meeting, the Fed statement will be reviewed for hints about the potential for future rate hikes. The Fed press conference following the meeting may also provide further clues.

Here are some reports that could impact currency movements next week:

Jun 14 Export Prices ex-ag. May

Jun 14 Import Prices ex-oil May

Jun 14 Retail Sales May

Jun 14 Retail Sales ex-auto May

Jun 14 Business Inventories Apr

Jun 15 MBA Mortgage Index 06/11

Jun 15 PPI May

Jun 15 Core PPI May

Jun 15 Empire Manufacturing Jun

Jun 15 Capacity Utilization May

Jun 15 Industrial Production May

Jun 15 Crude Inventories 06/11

Jun 15 FOMC Rate Decision Jun

Jun 15 Net Long-Term TIC Flows Apr

Jun 16 CPI May

Jun 16 Core CPI May

Jun 16 Initial Claims 06/11

Jun 16 Continuing Claims 06/04

Jun 16 Philadelphia Fed Jun

Jun 16 Current Account Balance Q1

Jun 16 NAHB Housing Mkt Index Jun

Jun 16 Natural Gas Inventories 06/11

Jun 17 Housing Starts May

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.