India’s War on Gold

Indian Gold Imports Plunge In March

Indian Government Policies That Discourage Gold Imports and Physical Gold Ownership Factor in the Decline

Yesterday we reported on the staggering increase in Indian silver imports. Indian gold imports in contrast are falling considerably. It’s not because Indians have suddenly lost interest in gold and have switched their precious metals preference to silver. A series of government actions have curbed Indian gold demand in 2016.

India And Gold

India has historically been the world’s largest consumer of gold. In recent years, China has surpassed India in some years as the largest gold consumer, only to be supplanted the next year by India. The Chinese government itself adds gold to its reserves monthly and encourages its citizens to buy gold. China is also the world’s largest gold mining country so it has a readily available supply of about 450 tons of gold a year to add to its hoard.

In contrast, the Indian government does not add gold to its reserves, discourages gold imports, taxes gold sales and has no domestic gold mining supply and relies almost entirely on imports and existing gold within its borders to satisfy demand.

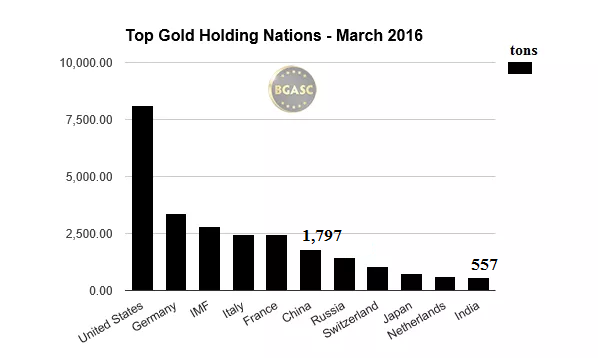

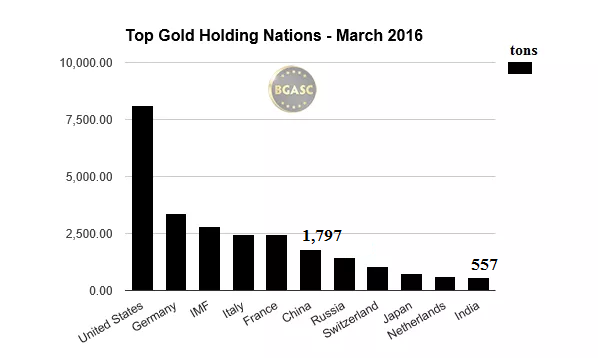

According to the World Gold Council, India holds the tenth most gold of any nation.

India’s foreign reserves have grown to an all-time high of nearly $360 billion as of April 2016. India’s gold holdings were 5.5% of its total foreign exchange reserves in April 2016, down from 9.2% in September 2011. The percentage decrease is due in part because India has added any gold to its reserves in recent years, even though her total reserves have grown.

Indian Gold Imports

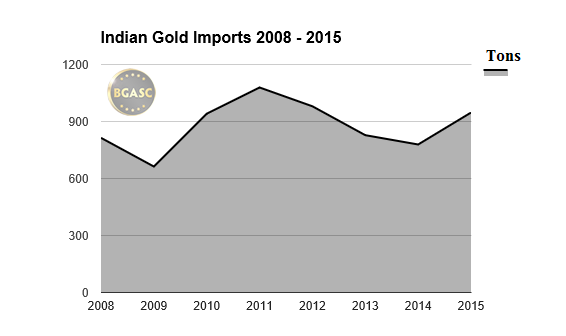

Indian gold imports have been significant in recent years. They would be higher but for the Indian government’s anti-gold policy. Indeed, as a result of the Indian government actions outlined below, Indian gold imports fell 16% in March 2016. In contrast Chinese gold imports increased 49% in March.

Import Duties

Despite increased demand, Indian gold imports have been hampered by government actions. India has placed record import duties on gold in order to slow the amount of gold coming into the country. The government’s rationale for trying to stop gold imports is that it creates an international trade imbalance with imports exceeding exports due to the swelling gold imports.

Indian gold demand must be met by importing gold because it can not be met by domestic gold mining supply as India is devoid of any significant operating gold mines. While there is significant gold already inside India, most of that gold is held by millions of Indians who have no intention of selling it. Therefore, in order to correct the trade imbalance, the Indian government believes it has to curb gold imports. India does have some gold deposits but recent efforts to get India’s gold mines operational have been unsuccessful due to bureaucratic red tape.

Gold Monetization Scheme

The government hopes not only to stop gold from coming into India, but to get Indians to turn their gold in to the government in exchange for interest bearing bonds. In late 2015, the Indian government launched a gold monetization scheme in an effort to get some of the estimated 18,000 tons of gold held by Indian citizens. India’s gold monetization scheme has yielded little gold from Indian citizens. Failing to extract any significant amounts of gold from its citizens, the government turned its attention to negotiating with Indian temples that hold substantial hoards of gold. At least two temples in India have agreed to take bonds in exchange for their gold but on the condition that they eventually be repaid in gold, not Indian rupees.

Sales Tax

Earlier this year the Indian government imposed a sales tax on gold on top of the record import duty that immediately prompted jewelers across the country to go on strike. The jewelry strike had a knock on effect of decreasing gold imports further as jewelry stores that were closed had decreased need for gold to replace their inventory. As of mid-April, half of India’s jewelry stores are still closed.

Additional Duty on Indians Returning From Abroad

In April 2016, the Indian government imposed an additional 15% duty on gold and silver for Indians returning home after one year abroad.

Indians have a long history of gold ownership. It seems unlikely that current government actions will have any immediate impact on the desire of Indians to acquire and hold gold. The most likely outcome is an increase in gold smuggling into India.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.