FX Friday Global Currency Review & Forecast For 10-14-16

A Resurgent Dollar Continues its Climb.

The Dollar Index* continued to surge all week on a majority of market participants expecting a rate hike in 2016. Most market participants now factor in a rate hike at the December meeting. As the dollar strengthened this week, foreign currencies fell, but gold and silver managed to remain stable and to rise slightly off last week’s lows.

The British Pound fell to a 168 year low below $1.22 as post Brexit woes continue to hammer its value. During the week, S & P threatened to remove the pound’s reserve currency status. The British Pound is the third most widely held currency by central banks behind the Dollar and the Euro.

Friday morning, The University of Michigan preliminary index of consumer sentiment fell to 87.9 in September from 91.2 in August. Other reports Friday morning showed that retail sales rose 0.6% in September as expected and the Producer Price Index rose .03%, higher than expected. Despite the mixed economic data, that Dollar Index continued to climb, touching 98 early Friday morning.

Fed President Rosengren added to the Fed’s rate hike mantra on Friday, saying a rate hike in December is most likely appropriate.

Gold and Silver

Gold was flat this week after falling about 5% last week. Gold traded in a range between $1308-1350 in September, further consolidating it gains from earlier in the year.Gold broke to the upside from the low end of its September trading range following the Fed’s September 20-21 meeting. Gold ended two weeks ago at $1322 an ounce. Gold, however, fell below $1,300 an ounce in October. Last week, gold lost $75 an ounce and retraced only a small amount of its losses this week.

Gold was trading at $1255 an ounce Friday morning.

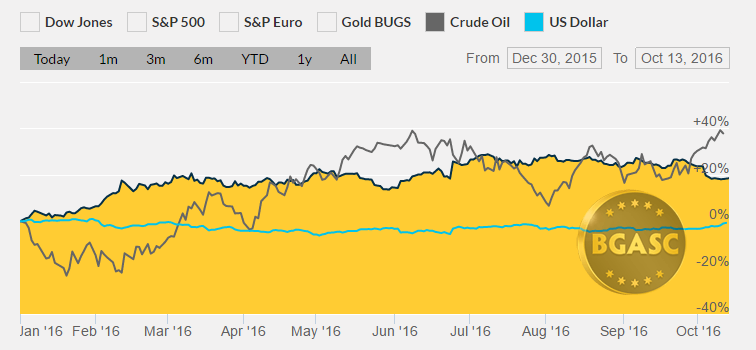

Year to Date Dollar Index, Oil and Gold Prices

Silver also rebounded slightly after last week’s 12% downside pounding. Silver had risen significantly after the Fed’s September 20-21 meeting at which interest rates were left alone. The 12% losses in silver, erased the post Fed gains and were the worst percentage losses for silver in a week since 2013.

The price of silver Friday morning was $17.45.

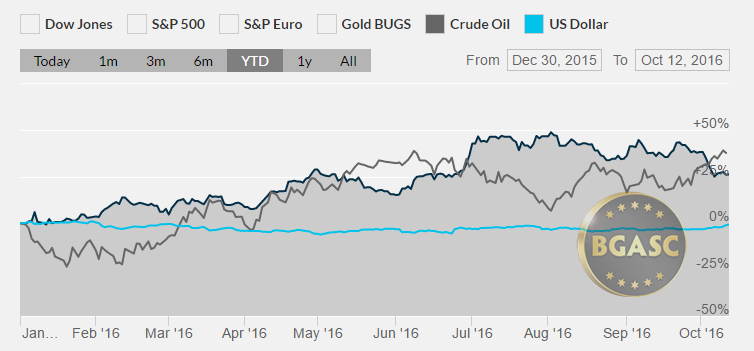

Year to Date Dollar Index, Oil and Silver Prices

Oil

Oil continued to shoot higher this week as a result of OPEC’s decision to cut production. Oil rose the first six months of 2016 and levelled off during the summer, trading on news of stockpiles and the possibility of output freeze talks. The OPEC decision to cut output has pushed oil back to over $50 a barrel.

What’s next?

The Presidential campaign has taken an unexpected turn with Donald Trump stepping up the rhetoric, Wikileaks continuing to release emails damaging to the Clinton campaign and the main stream media running Trump profane language tapes and allegations of Trump’s alleged unwanted sexual advances on several women. As such, the Presidential campaign will probably continue to dominate market participants’ attention. Indeed, the decline in the University of Michigan preliminary index of consumer sentiment in September, not the Presidential election as partially responsible for the fall in sentiment.

Here are some economic reports that could impact gold, silver and currency movements next week:

Oct 17 8:30 AM Empire Manufacturing Oct

Oct 17 9:15 AM Industrial Production Sep

Oct 17 9:15 AM Capacity Utilization Sep

Oct 18 4:00 AM Net Long-Term TIC Flows Aug

Oct 18 8:30 AM CPI Sep

Oct 18 8:30 AM Core CPI Sep

Oct 18 10:00 AM NAHB Housing Index Oct

Oct 19 7:00 AM MBA Mortgage Index 10/15

Oct 19 8:30 AM Housing Starts Sep

Oct 19 8:30 AM Building Permits Sep

Oct 19 10:30AM Crude Inventories 10/15

Oct 19 2:00 PM Fed’s Beige Book Oct

Oct 20 8:30 AM Initial Claims 10/15

Oct 20 8:30 AM Continuing Claims 10/08

Oct 20 8:30 AM Philadelphia Fed Oct

Oct 20 10:00 AM Existing Home Sales Sep

Oct 20 10:30 AM Natural Gas Inv.s 10/15

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.