Indians Love Gold And Their Government Hates It

Indian Government Tries to Get Indians to Turn in Their Gold

India is by most measures the world’s largest gold consuming nation. Some years China takes the title, but India usually regains it the following year. India’s consumption of gold is remarkable in that its government actively campaigns and passes laws to prevent gold consumption.

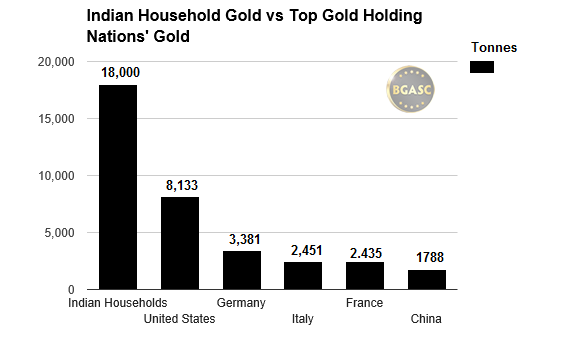

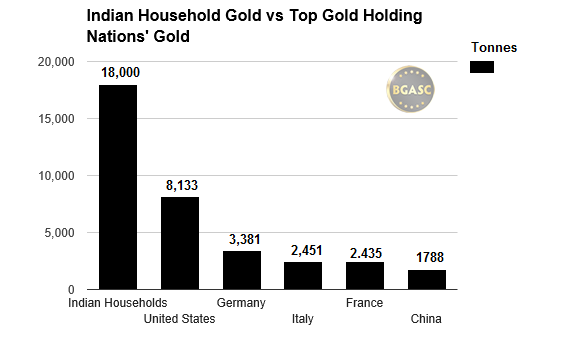

According to the World Gold Council, Indian households are estimated to hold 18,000 tonnes of gold- that amount is roughly equivalent to the combined amounts of the central banks of the top gold nations: the United States, Germany, Italy, France and China. The Indian government itself has under 600 tonnes.

It is estimated that Indians spend 8% of their daily consumption on gold coins and jewelry! In India there are gold giving holidays (Diwali) and giving gold is involved in significant life events like weddings.

Indians exchange physical gold, not gold certificates of shares of gold ETFs.

All this physical gold consumption has become a problem for the Indian government.

View Gold & Silver Price Charts; Receive Gold & Silver Price Alerts

Indians’ insatiable demand for gold messes up India’s import/export balance as India has no significant gold mining industry and therefore imports large amounts of gold. To combat this, the Indian government has placed excessive import duties on gold that have been largely ineffective as such import restrictions have merely served to fuel black market gold imports. Having difficulty in getting Indians to stop buying gold, the Indian government recently came up with a gold monetization scheme.

India’s Gold Monetization Scheme

Late last year, the Indian government announced a scheme to get Indians to become less interested in acquiring gold and to get them to part with the gold they currently hold. The scheme involves having Indians turn over their gold in return for a government issued interest bearing bond. To sweeten the deal, the Indian Sovereign Gold Bonds are exempt from income and capital gains taxes.

Gold Doesn’t Pay Interest – But Indians Don’t Care!

The offer so far has been a massive flop as very little gold has been exchanged for the gold bonds. Reuters India reports that just three tonnes of gold have been turned in for Indian Sovereign Gold Bonds. The Indian government has turned its attention to the vast hoards of gold held in its temples. Certainly temples, would be interested in “monetizing” their gold. No dice. One large temple in Mumbai, the Shree Siddhivinayak temple has agreed to turn in some of its gold in exchange for gold bonds. The Shree Siddhivinayak temple said it would deposit 44 kg of its 160 kg of gold (28%) later this year. Forty four kilograms is .044 tonnes.

The Indian government got its hopes up ealier this month when India’s richest temple, the Sri Venkateswara Swamy Temple (“Tirupati”), which holds 7 tonnes of gold, said it might participate in the scheme and deposit 5.5 tonnes of its gold in exhange for gold bonds. THe Indian government’s enthusiasm was curbed when Tirupati requested repayment in gold rather than cash for any of their deposits held longer than three years. Such a request, defeats in part the purpose of the scheme but highlight the enormous value Indians place on physical gold.

In addition to the near disastrous gold monetization scheme, the Indian government currently has record duties on gold imports and in late February placed an excise tax on gold. The announcement of the sale tax led immediately to a strike by Indian jewelers that lasted 19 days.

Indians view gold as wealth that can be stored or worn and passed on from generation to generation. In many areas of India there are no banks and gold serves as a measure of savings. Outside of banning gold or outright confiscation, the Indian government might find that weaning Indians off gold may be impossible to achieve in a generation.

This article does not necessarily reflect the explicit views of BGASC, nor should it be construed as financial advice.