China and Russia Increase Gold Reserves, Shed US Treasuries

China and Russia ‘De-Dollarize” Their Foreign Reserves Swapping Gold For U.S. Treasuries

The United States dollar has been the world’s reserve currency since 1944. Countries hold their dollar assets in the form of United States Treasury Bonds. Much of the world’s international trade is conducted using U.S. dollars. As result of increases in trade, countries built up their dollar/U.S. Treasury reserves.

Under the 1944 Bretton Woods Agreements, the U.S. dollar was redeemable for gold by other central banks until August 1971 when Richard Nixon unilaterally cancelled that arrangement and instructed the U.S. Treasury to no longer honor dollars for gold requests. The U.S. Dollar remained the world’s reserve currency despite the lack of gold backing. The U.S. convinced the world that dollar’s strength came not from gold, but from the strong U.S. economy and superior military strength.

In the early 1970’s, the United States made deals with the oil producing nations, including Saudi Arabia, that would require them to price their oil and accept only dollars in exchange for oil. In exchange for doing so, the United States would guarantee their military protection. These “petro dollar” arrangements created demand for dollars as countries would be required to have dollar reserves in order to purchase oil. Conducting international trade continues to this day to be largely conducted in United States dollars.

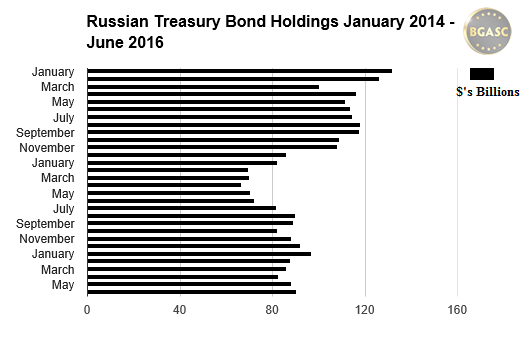

Over the past two decades, China has engaged in enormous trade with the United States, exporting inexpensive goods to American in exchange for dollars. As a result, China has amassed a large portfolio of U.S. Treasuries. Russia historically, has done little trade with the United States and next to none since sanctions have been in effect the past few years. Russia, however, like most countries has always held a good portion of their reserves in United States Treasury Bonds.

China is the world’s largest holder of U.S. Treasuries with over $1.4 Trillion (behind the Federal Reserve holdings of nearly $2.5 Trillion.) Chinese holdings of U.S. Treasury Bonds increased though most of the 2000’s. In the past two years, Chinese holdings of U.S. Treasury Bonds have decreased as shown below.

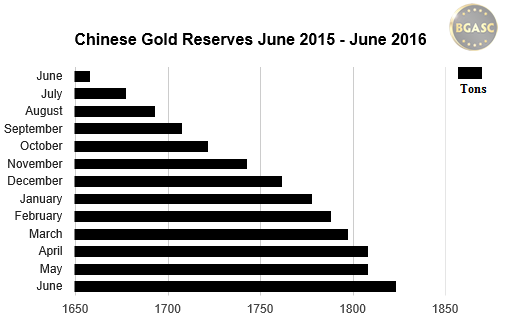

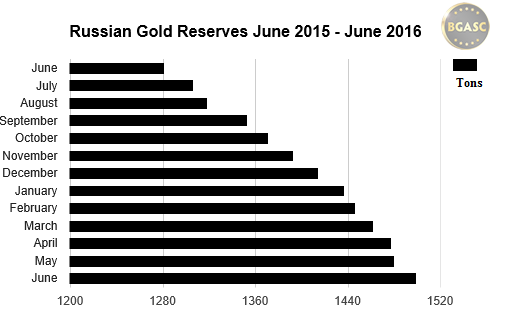

Over the past two years, China and Russia have decreased their U.S. Treasury Bond holdings and increased their gold reserves as they seek to diversify their foreign reserves. China has been making a play to have its currency the Yuan, acceptible in regional and international trade. The Russians have no such pretentions for the Rouble..

The People’s Bank of China has added significantly to its gold reserves, which are now about 2.3% of overall reserves.

Russia’s U.S. Treasury bond holding are down about 30% since January 2014.

Russia is also adding gold to her reserves at a faster pace than the Chinese central bank. Russia’s gold reserves are about 15% of their overall reserves and total about 1,500 tons.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.