China Slashes Foreign Reserves by $99.5 Billion in January But Adds 16 tonnes of Gold To Its Reserves

Chinese Foreign Reserves Fall to Four Year Low

After growing its foreign reserves for nearly a decade, China has been slashing them recently. In January, the People’s Bank of China (PBOC) announced that it had shed $99.5 billion in foreign reserves, bringing their reserves to $3.23 trillion.

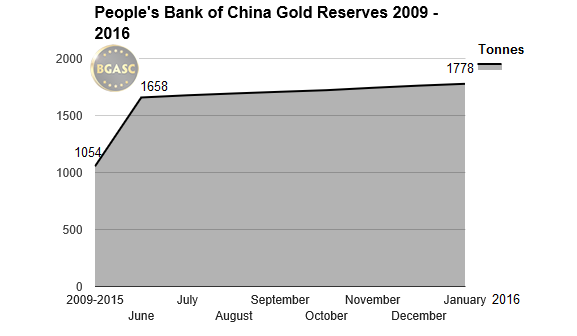

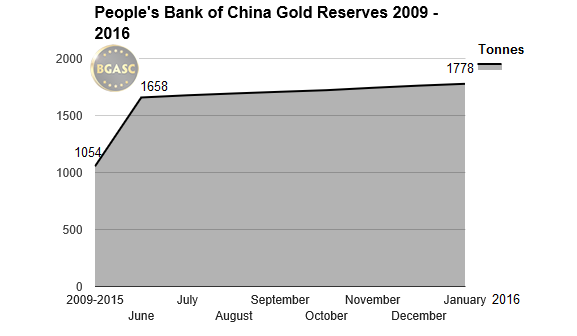

Chinese Gold Reserves Grow to 1778 Tonnes

The PBOC also announced that it had increased their gold reserves 515,000 ounces (16 tonnes) to 57.18 million ounces (1778 tonnes).

China began reporting its gold reserves in July 2015 after a six year hiatus. That month the PBOC announced that it had added 604 tonnes to its reserves. Many gold observers thought the number reflected far less than China actually had because China is the world’s leading gold producer, imports massive amounts of gold through Shanghai and Hong Kong and operates the Shanghai Gold Exchange, a robust physical gold market. One widely held theory regarding the PBOC seemingly low gold reserves is that many more tonnes of gold are in China, just not on the PBOC’s balance sheet, but with related PBOC entities like state owned banks and funds.

Irrespective of any “hidden” Chinese gold, the official PBOC stated gold reserves are 1778 tonnes putting China in fifth place among gold holding countries. Only the United States, Germany, Italy and France (in that order) have more.

A Trend? Sell US Treasuries and other reserves/add gold

As China sold a half a trillion dollars of its reservees in 2015, it added 708 tonnes of gold. Russia has followed a similar path of reducing its reserves (many in the form of US Treasuries) while adding a record amount of gold to their reserves in 2015. China continued the trend of selling reserves and adding gold in January 2016.

We will get an indication if the trend continues when Russia reports its January reserves later this month.

All Blog Articles are provided by a third party and do not necessarily reflect the explicit views of BGASC, nor should they be construed as financial advice.