Chinese Gold Reserves Unchanged In May

Chinese Central Bank Reports 1,808 Tons of Gold as Reserves

Chinese Gold Reserves

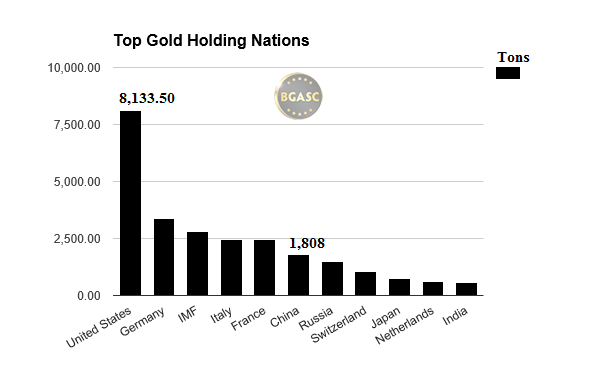

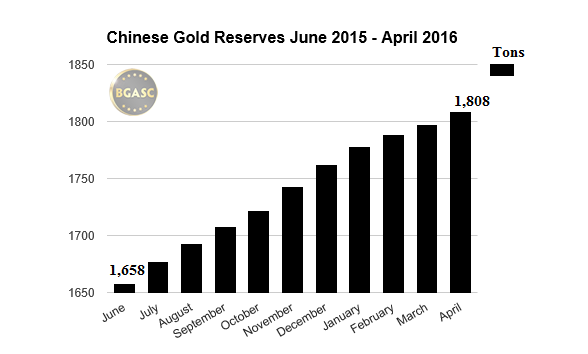

In May 2016, the People’s Bank of China added no tons of gold to its reserves. Since starting monthly gold reporting in July 2015, China has added about 150 tonnes of gold to its reserves, bringing its total to the fifth most of any nation. May, however, marked the first time since China began monthly reporting of gold reserves that it did not add any.

The People’s Bank of China now has over 1808 tons of gold as reserves. While this gold hoard places China in fifth place among gold holding nations, it only represents 2.2% of China’s overall reserves. As the price of gold rises, however, the value of China’s gold and overall reserves increases. It may be that the swift rise in price of gold in 2016 has caused the People’s Bank of China to curtain its purchases.

Gold imports to China are still strong, so perhaps the Chinese government is still accumulating gold, but just not at the People’s Bank of China.

China’s Foreign Reserve Position – A Rebalancing

After months of declining foreign reserves, China’s foreign reserves grew in March from $3.20 trillion to $3.21 trillion. China’s foreign reserves rose again from $3.21 trillion in March to $3.22 trillion in April. China’s foreign reserves fell, however, in May to $3.19 trillion in May. This highlights that while China’s overall reserves fell but their gold reserves did not.

China’s slowing growth over the past year has caused concern in the global markets that China’s growth phase may come to a crashing halt – and with it the global economy. Since China is a voracious consumer of imported resources to fuel its growth, a decline in China’s growth harms commodity producing countries as demand slows. The increase and stabilization of China’s reserves has been seen as a sign that China’s growth is also stabilizing.

During the period of declining overall reserves last year and earlier this year, China continued to add gold to its reserves. In March and April when her overall reserves increased, China also added more gold to its reserves.

In May, when China’s overall reserves decreased, her gold reserves stayed the same.

U.S. Treasury Bonds

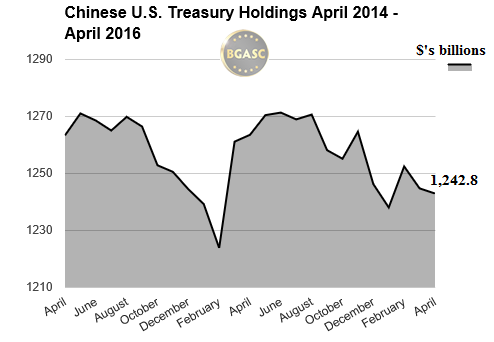

As of April, 2016, China held $1.242 trillion in U.S. Treasury Bonds, making Chinas the largest foreign holder of U.S. Treasury securities, slightly ahead of Japan’s $1.137 trillion holdings. China has sold off a portion of its Treasury bonds over the past year, but still holds more than any other nation. China accumulated its U.S. Treasuries in large part as a result of its exports to the United States for which it received dollars and in turn converted them into U.S. Treasury Bonds.

What’s Next For China and its Gold and U.S. Treasury Holdings

Over the past ten years China’s trade with the U.S. has resulted in massive exports of goods to the United States who in turn ‘exported’ massive amounts of dollars to China. Imports from China to the United States provided the United States inexpensive goods because Chinese manufacturing costs were lower than those in the United States and the Chinese Yuan had been suppressed lower vs. the United States Dollar.

A Trump presidency may undo that dynamic as he has spoken out against China as a “currency manipulator” and threatened to place tariffs on imported goods. China already has a prodigious amount of U.S. Treasury Bonds. Any decline in trade with the U.S. in the future would mean Chinese demand for U.S. Treasuries would also decline. It would seem, however, with gold at just 2.2% of China’s reserves, China will continue to add gold to reserves whether trade with the U.S. decreases, increases or stays the same.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.