Dollar Soars On Trump Win – Global Currency Review and Forecast

Donald Trump Gets Elected, Dollar Soars, Gold and Silver Fall.

The United States electorate went to the polls last week and elected Donald Trump to become its 45th President. The President elect won 306 electoral votes comprising 29 states, while Ms. Clinton took 231 electoral votes and 21 states. Markets reacted initially by plunging. Gold and silver skyrocketed and the dollar fell. By the end of the trading day on Wednesday and the end of the week, markets recovered their losses, the Dow Jones hit an all time high and gold fell nearly $100 an ounce off its initial post election high. Anti-Trump protests broke out in the U.S. coastal cities of Baltimore, New York, Portland, Seattle and even the Canadian city of Vancouver.

The political uncertainty caused by a Trump election that initially shocked markets, lasted only for a few hours. Markets focused later in the week on Trump’s infrastructure plans that may be a boom for the US economy. Copper rose the most in a week in thirty five years on renewed protections of demand for the metal to complete as of yet unannounced and unfunded infrastructure programs.

The economic outlook of a coming Trump presidency overshadowed a potential Fed interest rate hike in December and the rioting in a few U.S. cities.

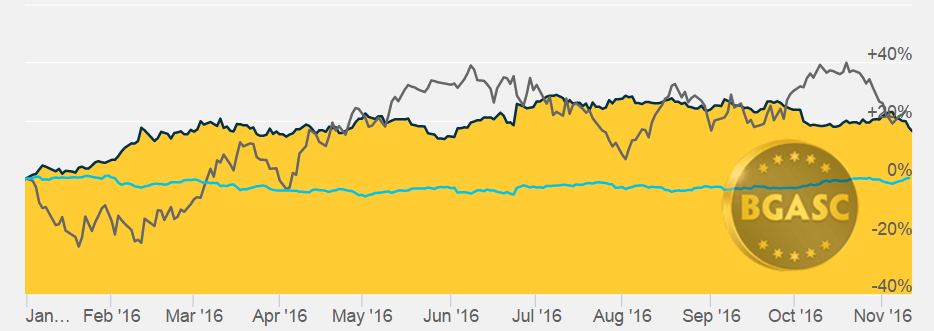

The Dollar Index* had been falling the past three weeks in the run up to the election. The Dollar Index was at 97.00 a week ago. By yesterday, the Dollar Index was over 100. A stronger dollar may influence the Federal Reserve’s plans to raise interest rates in December. If civil unrest continues and the dollar rises further the Fed may delay yet again an interest rate hike. A strong dollar is deflationary as imports become less expensive. The Fed has stated that it wants more price inflation having set an inflation gold target of 2% that has not yet been met.

Emerging markets currencies took a big hit after the U.S. Presidential election. The Indian Rupee tumbled on fears of a potential U.S. interest rate hike, the Trump election and Prime Minister Modi’s shock announcement that Indian Rupee 500 and 1000 notes would cease to be legal tender. The Mexican Peso also fell, hitting a record low on fears that a Trump Presidency may reverse current trade and immigration policies with the United States.

The British Pound showed some sign of life this week after being mired at a 168 year low at $1.21 on “Hard Brexit” fears. The Pound rose to $1.26 this week on news that Parliament may be required to vote on Brexit, making Brexit, perhaps less likely. The Euro however, remains near its multi-month low at $1.08.

Gold and Silver

Gold added about $40 an ounce early Wednesday morning, as soon as it became clear that Donald Trump was going to win the Presidency. Gold touched a high of $1342 an ounce. During the trading sessions on Wednesday through Friday, the price of gold slid, settling near $1230 an ounce late yesterday morning after having touched $1,224 an ounce on Friday.

Gold was trading at $1233 an ounce Friday morning, down $80 from last Friday morning.

Year to Date Dollar Index, Oil and Gold Prices

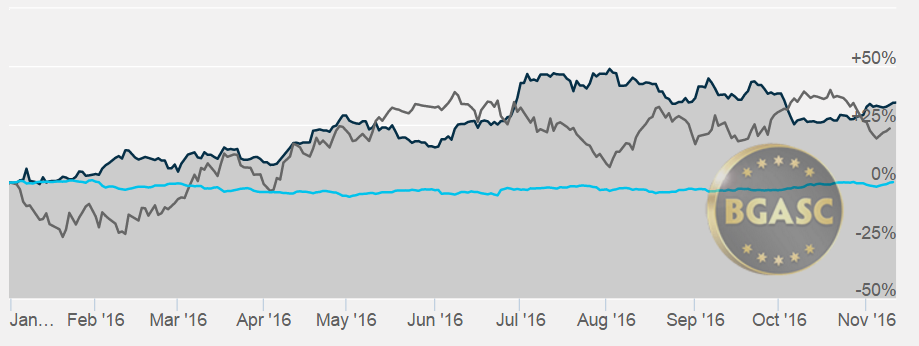

Silver also rose and fell and sharply during the week. Silver did not rise as much on the initial Trump win and actually rose on Thursday, while gold fell. On Friday, however, silver gave up its gains, falling over $1 an ounce to a low of $17.43 an ounce. Silver fell into the sixteen dollar an ounce range on yesterday.

The price of silver late Friday morning was at $17.64 an ounce, down about $0.80 from last Friday morning.

Year to Date Dollar Index, Oil and Silver Prices

Oil

Oil continued to fall this week on further news of global supply gut concerns, even though OPEC had announced production cuts two weeks earlier. Friday morning news reports indicated that OPEC believed there might be an even bigger oil surplus next year. Oil rose the first six months of 2016 and leveled off during the summer, trading on news of stockpiles and the possibility of output freeze talks. OPEC’s decision to cut output had pushed oil back to over $50 a barrel. Since that announcement, oil has fallen back to about $43 a barrel.

What’s next?

Clues to what a Trump administration might look like will probably dominate the news cycle and the financial markets’ attention this week. Given the dramatic reversal in the markets to the Trump win last Wednesday, markets may see increased volatility in the coming weeks as markets attempt to digest what a Trump presidency might mean politically and fiscally for the United States and the world.

Here are some economic reports that probably will have little impact on the gold, silver and currency markets this week:

Nov 15 Retail Sales Oct

Nov 15 Retail Sales ex-auto Oct

Nov 15 Export Prices ex-ag. Oct

Nov 15 Import Prices ex-oil Oct

Nov 15 Empire Manufacturing Nov

Nov 15 Business Inventories Sep

Nov 16 MBA Mortgage Index 11/12

Nov 16 PPI Oct

Nov 16 Core PPI Oct

Nov 16 Industrial Production Oct

Nov 16 Capacity Utilization Oct

Nov 16 NAHB Housing Market Index Nov –

Nov 16 Crude Inventories 11/12

Nov 16 Net Long-Term TIC Flows Sep

Nov 17 CPI Oct

Nov 17 Core CPI Oct

Nov 17 Housing Starts Oct

Nov 17 Building Permits Oct

Nov 17 Initial Claims 11/12

Nov 17 Continuing Claims 11/05

Nov 17 Philadelphia Fed Nov

Nov 17 Natural Gas Inventories 11/12

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.