Fed Cries “Rate Hike”… Again

Federal Reserve Holds Off Again on Raising Interest Rates

The Federal Reserve held its two day April meeting last week. From it emerged a “hawkish” statement hinting that interest rate hikes were appropriate and forthcoming.

The market reaction was predictable- the dollar rallied immediately after the announcement, but the retreat was also predictable as currency traders had seen this movie before. After all, the Fed has been talking about raising rates for years. To date, the Fed has managed one small rate hike in December of .25%. That rate hike was supposed to be the kick off a gradual tightening cycle.

All Talk, No Action?

It seems that rate hikes are appropriate for the Fed to talk about, include in Fed meeting statements and in Fed officials’ interviews but are inappropriate in practice. Last week Dallas Fed President Robert Kaplan said he’d advocate gradual rate hikes IF inflation rises and “full employment” continues and added of course if Britain decides to leave Europe all bets for a rate hike may be off.

Mr. Kapan’s latest remarks follow a long line of qualified pro rate hike statements that many Fed Presidents and MS. Yellen the Fed Chair have made on numerous occasions. Rate hike intentions have been conditioned on the unemployment rate, the inflation rate and other data points. The Fed claims that any rate hike is “data dependent” and subject to “global uncertainty.” Exactly what data might be the trigger for a rate hike and how certain the global economy has to be for the Fed to raise rates, no one, including the Fed can (or will) say for sure.

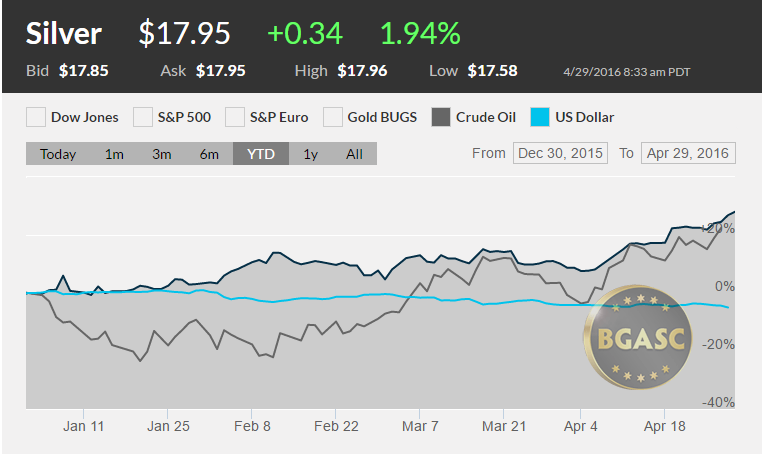

The dollar strengthened all during 2015 as the Federal Reserve talked all year about raising interest rates. Even though the Fed did not raise rates until December 2015, the dollar held its gains. Talking about raising interest rates in 2016, but not following through hasn’t had the same impact on the dollar as it did in 2015. Indeed, all talk and no action by the Fed has taken a big bite out of the dollar this year and some of the Fed’s credibility.

The underlying narrative that gave the dollar strength in 2015 was that the U.S. economy was improving and the Fed would raise interest rates while the U.S. economy sailed along. Further helping the dollar was the notion that other central banks would be adding stimulus to their flagging economies and lowering interest rates further into negative territory. For example, the Bank of Japan was supposed to go on an endless stimulus binge.

It hasn’t worked out the way many market participants and traders thought. The Fed has talked about rate hikes in 2016, but hasn’t pulled the trigger and the Bank of Japan announced last week they would hold off on further stimulus. The U.S. economy also has not performed in accordance with the Fed’s growth projections.

Q1 GDP Near Recession Levels

Last week we got the first reading of the GDP for first quarter of 2016. It showed growth of just .05%. The second quarter doesn’t look much better. The New York Fed’s most recent 2nd quarter GDP projection is for growth of 0.8%.

The Fed might raise rates in 2016, but not because the economy will be heating up, but perhaps because they will have to as inflation increases due to soaring gold, silver, oil and commodity prices and a declining dollar that makes imports more expensive. Under those circumstances the Fed would not be raising rates in a manner that would validate that their quantitative easing and zero interest rate policies worked. Rather, the Fed would be reacting to events outside of their control.

Fed Inaction To Lead to Action?

The Fed’s inaction on interest rates will probably be the impetus for their action on interest rates. Because the Fed has not raised interest rates, the dollar has cratered. If the dollar falls further and commodities continue to rise, the Fed will get their price inflation – but without any corresponding economic growth. Raising rates in that scenario would be a necessity to stave off inflation but it would most likely crush any hope of GDP growth.

The Fed has blamed the higher dollar for harming GDP growth as it made U.S. exports less attractive. The dollar, however, was weak in the first quarter of 2016 but so was GDP. The Fed has also praised low gas prices as providing stimulus for U.S. consumers. (an ironic twist since lower gas prices are deflationary and the Fed wants inflation to increase) Lower gas prices, the Fed has argued, would act as a tonic for consumer spending. They haven’t. Any savings on lower gas prices have gone to soaring rents and health care and insurance costs. What ever benefit low gas prices might have had earlier in 2016, are evaporating as the price of oil continues to rise.

Waiting for the Fed to raise interest rates has been like waiting for the Great Pumpkin. The Fed statements continually stress that they need to see further improvement in the labor market and MORE inflation. The right amount of improvement or inflation never seems to come. With a Presidential election in the fall, the Fed may be reluctant to raise interest rates even if it looks like they have to.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.