FX Friday – Global Currency Review & Forecast – 2-26-16

Markets Trading on News and Chatter

The markets traded on news and chatter this week. The price of oil was influenced by talk of a potential oil production freeze agreement among oil producing nations. The price of oil went up when it appeared the agreement might happen and on speculation of how long it might remain in effect. The price of oil fell when it seemed that no oil production freeze deal was imminent. The dollar rose and fell on Fed President chatter that interest rates were still on the table (Fed President Lacker) and talk that they shouldn’t be (Fed President Bullard).

Gold also rose and fell on news and chatter but was generally a beneficiary of the uncertainty in the markets and after falling sharply earlier in the week, rallied mid week and held its gains.

Week Ended February 19, 2016

The U.S. Dollar Index* closed the week ended February 19, 2016, at 96.63 up from 95.96 on February 12, 2016.

Oil closed down about 3% on Friday the 19th and finished the week at $29.89 up slightly from $28.99 the week ended February 12.

Gold finished at $1226 an ounce on the week down from $1238.50 and silver $15.31 down from $15.72.

Week Ended February 26, 2016

On Monday, February 22, the US Dollar Index opened the week strong, up to 97.54, gold fell $20 to nearly $1200 an ounce and silver dipped below $15 an ounce. Oil was up to 31.50 on predictions that U.S. shale oil output would decline.

The British pound sunk on the City of London Mayor’s comments that he would advocate Britain leaving the Eurozone. The Euro also fell on the news of increased odds of a Brexit.

Venezuela said oil prices could rise $10-15 a barrel if an output freeze agreement could be reached, giving a boost to the price of oil.

On Tuesday the Dollar Index opened lower, oil was stable then fell on doubt that Iran would support an oil production freeze. Gold and silver rebounded from their losses that began on Sunday evening. Gold opened higher, recovering from its Sunday night decline and rose on “safe haven demand.”

Later on Tuesday, it was reported that Iran would not support a production freeze calling the idea “ridiculous”. Oil stayed down after Saudi Arabia said it would not cut oil production.

Oil and Brexit Fears Slam Currencies/Boost Others

The Russian Rouble which is sensitive to the price of oil fell on the oil announcements that no production freeze was in the works.

The Brazilian Real fell on insolvency risks. Brazil is the 12th largest oil producer in the world.

The British Pound slid to $1.40 on continued Brexit fears.

The Swiss Franc and Japanese Yen posted gains today on Brexit fear safe haven bids.

On Wednesday oil opened down another 3%+ falling under $31 a barrel, gold after falling over night rose $10. Silver opened up $.05. The Dollar Index rose to 97.75.

Richmond Fed President Lacker said in a speech that he still sees case for further rate hikes and that no U.S. recession is imminent.

Later in the day, St. Louis Fed President James Bullard expressed concerns about raising interest rates.

Oil, Stocks, The Dollar, Gold and Silver Rise and Fall

Oil fell sharply as did stocks early in the day and gold soared to $1252 an ounce. Later in the day, oil rose and stocks bounced off their lows to finish higher on the day. Gold gave up nearly $25 of its $28 price gain. Silver which had been up over $.10 an ounce earlier in the day closed down $.05. The Dollar Index rose to a high of 97.90 and fell to 97.27 but ended even at 97.45.

The British pound continued to tumble on Brexit fears, approaching seven year lows.

January new home sales came in at 494,000 vs below expectations of 523,000.

On Thursday, gold opened higher after rising in Wednesday evening trading, silver lower, the Dollar Index flat at 97.47 and oil lower at 31.71. The Dollar Index rose after a better than expected U.S. Durable Goods report was released in the morning.

Initial jobless claims were 272,000 for the prior week slightly higher than expectations of 270,000.

Fed President Bullard was at it again on Thursday, this time on CNBC repeating his belief that the Fed should not raise rates.

Fed Presidents William and Lockart also spoke but didn’t move markets in any meaningful way as Willlams saw little risk of a recession and Lockart said rising rates would be a risk for U.S. banks and repeated the line that further rate hikes would be “data dependent”.

On Friday, the US Dollar Index opened flat at 97.47, Gold up slightly to $1235 an ounce, silver down at $15.05 and oil up about 2% to $32.60 a barrel.

On Friday morning, the second estimate of U.S. 4th quarter 2015 GDP was released. Expectations were for an increase of 0.4% up from the first revision of 0.4%. The second estimate showed a 1.0% gain. Immediately after the GDP announcement, the Dollar Index rose .28% to 97.70, oil tacked on $.34 to $32.94 a barrel, gold fell $6 to $1229 an ounce and silver remained unchanged.

On Deck Next Week

Next week’s February non farm payroll number could provde some clarity on the potential for further Fed rate hikes. A strong reading (175,000+ new jobs) could create trader sentiment in favor of a rate hike at one of the next two Fed meetings in either March or June. Anything lower than 175,000 jobs created may remove a rate hike from traders’ minds, at least for the upcoming March Fed meeting.

Reports that could impact currency movements next week:

Feb 29 Chicago PMI Feb

Feb 29 Pending Home Sales

Mar 1 Construction Spending Jan

Mar 1 ISM Index Feb

Mar 1 Auto Sales Feb

Mar 1 Truck Sales Feb

Mar 2 MBA Mortgage Index 02/27

Mar 2 ADP Employment Change Feb

Mar 2 Crude Inventories 02/27

Mar 2 Fed’s Beige Book Mar

Mar 3 Challenger Job Cuts Feb

Mar 3 Initial Claims 02/27

Mar 3 Continuing Claims 02/27

Mar 3 Productivity-Rev. Q4

Mar 3 Unit Labor Costs-Rev. Q4

Mar 3 Factory Orders Jan

Mar 3 ISM Services Feb

Mar 3 Natural Gas Inventories 02/27

Mar 4 Nonfarm Payrolls Feb

Mar 4 Nonfarm Private Payrolls Feb

Mar 4 Unemployment Rate Feb

Mar 4 Hourly Earnings Feb

Mar 4 Average Workweek Feb

Mar 4 Trade Balance

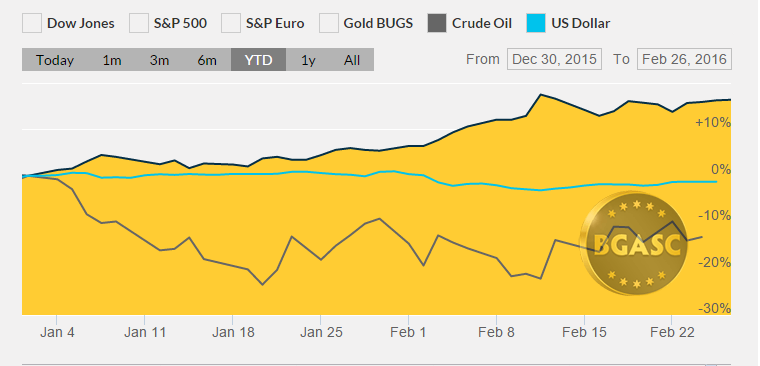

Year to Date Dollar Index, Oil and Gold Prices

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

All Blog Articles are provided by a third party and do not necessarily reflect the explicit views of BGASC, nor should they be construed as financial advice.