FX Friday Global Currency Review & Forecast For 10-21-16

Chinese Yuan, British Pound and Euro Plummet vs The Dollar.

The Dollar Index* continued to surge against all major currencies this week. The British Pound fell to a 168 year low at $1.21 on “Hard Brexit” fears.The Euro fell to $1.08, its lowest value vs the dollar in eighteen months, on dovish comments by the European Central Bank regarding its monetary policy and the Chines Yuan fell to a five year low.

Dollar strength represents a wild card in the Fed’s deliberations on raising interest rates. A stronger dollar has a deflationary impact as imports become less expensive. Since the United States economy and Gross Domestic Product is based on consumer spending much of it done on foreign imports, a strong dollar curbs inflation. The Fed has long stated that they wish to see inflation near their 2% target. A strong dollar makes that goal harder to achieve. An interest rate hike may also strengthen the dollar further.

Perhaps, a rate hike is already baked into the current currency markets as a majority of market participants now expect a rate hike at the Fed’s December meeting. As the dollar strengthened this week and foreign currencies fell, gold and silver managed to remain stable for the past ten trading sessions, with gold eking out a small gain.

The week was light on economic data and the news cycle was dominated by the Presidential Campaign and the debate on Wednesday evening. Most polling revealed that Donald Trump had ‘won” the encounter with Ms. Clinton. Wikileaks revelations have acted to undermine Hillary Clinton’s credibility, while reports of Donald Trump’s alleged improper conduct with respect to several women have cast doubt on his candidacy.

Gold and Silver

Gold was flat again this week after falling about 5% last week. Gold traded in a range between $1308-1350 in September, further consolidating it gains from earlier in the year. Gold broke to the upside from the low end of its September trading range following the Fed’s September 20-21 meeting. Gold ended two weeks ago at $1322 an ounce. Gold, however, fell below $1,300 an ounce in the first week of October, dropping $75 an ounce to $1250 an ounce. Gold has retraced some of it losses the past two weeks.

Gold was trading at $1266 an ounce Friday morning, up $11 from last Friday morning.

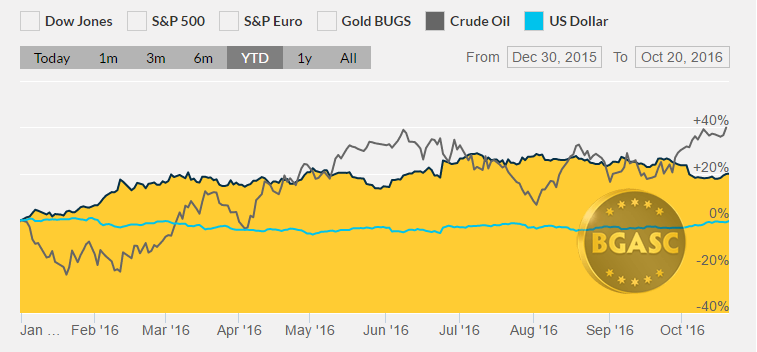

Year to Date Dollar Index, Oil and Gold Prices

Silver also stabilized this week after rebounding slightly last week after early October’s 12% downside pounding. Silver had risen significantly after the Fed’s September 20-21 meeting at which interest rates were left alone. The 12% losses in silver, erased the post Fed gains and were the worst percentage losses for silver in a week since 2013.

The price of silver Friday morning was at $17.49 an ounce, up four cents from last Friday morning.

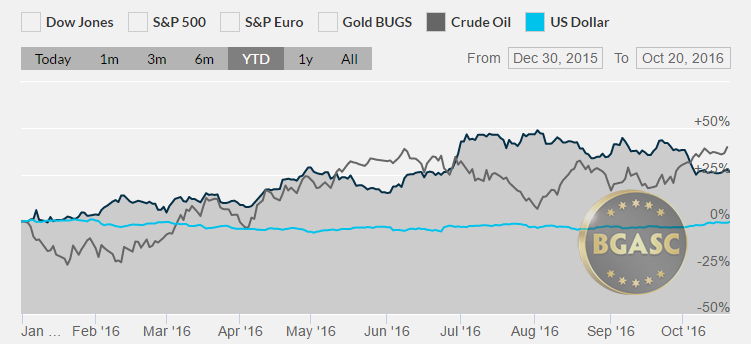

Year to Date Dollar Index, Oil and Silver Prices

Oil

Oil continues to hold its gains over $50 a barrel on the strength of OPEC’s decision to cut production. Oil rose the first six months of 2016 and levelled off during the summer, trading on news of stockpiles and the possibility of output freeze talks. The OPEC decision to cut output has pushed oil back to over $50 a barrel.

Year to date, oil is now out-performing gold and silver.

What’s next?

The Presidential campaign continues to capture the attention of market participants with odds heavily favoring Ms. Clinton. To date, daily Wikileaks revelations about Clinton conflict of interests and other unsavory items (largely ignored by the main stream media) have neither landed a knockout blow or influenced the polls.

Next week’s main economic release is the first estimate of 3rd quarter GDP. The first two quarters of 2016 showed GDP growth hovering around 1%. GDP growth for the third quarter is expected to be better than 1% but expectations have fallen from the 3.5-4% range from a few months ago to around 2-2.5%.

Here are some economic reports that could impact gold, silver and currency movements next week:

Oct 25 Case-Shiller 20-city Index Aug

Oct 25 FHFA Housing Price Index Aug

Oct 25 Consumer Confidence Oct

Oct 26 MBA Mortgage Index 10/22

Oct 26 International Trade Sep

Oct 26 New Home Sales Sep

Oct 26 Crude Inventories 10/22

Oct 27 Initial Claims 10/22

Oct 27 Continuing Claims 10/15

Oct 27 Durable Orders Sep

Oct 27 Durable Orders, Ex-Trans Sep

Oct 27 Pending Home Sales Sep

Oct 27 Natural Gas Inventories 10/22

Oct 28 Chain Deflator-Adv. Q3

Oct 28 GDP-Adv. Q3

Oct 28 Chain Deflator-Adv. Q3

Oct 28 Employment Cost Index Q3

Oct 28 Michigan Sentiment – Final Oct

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.