FX Friday Global Currency Review & Forecast For 11-04-16

U.S. Non-Farm October Payroll at 161K Misses Estimate of 175K.

The United States non-farm payroll report by the Bureau of Labor Statistics showed that 161,000 new jobs were created in October, 14,000 less than the consensus estimate of 175,000. Wages grew 0.4%.

The Federal Reserve looks closely at the labor market as an indicator of the health of the economy. The Fed has called job growth the past year “solid” but has noted that wage growth and inflation were below their targets. Today’s report sends a mixed message to interest rate prognosticators. The lower than expected headline non farm payroll number argues against a rate hike in December, while the surge in wage growth argues in favor.

The Fed, however, has been very reluctant to raise interest rates usually citing that they would like to see further progress in the economy and labor market before raising rate. A one month increase in wage growth may be an anomaly and not represent a trend. Given the Fed’s predilection for waiting, a December rate hike may be off the table. Yet, the Fed may raise rates in December on their rosy future projection and to preserve their credibility. After all, the Fed has report a positive view of the economy all year and at one time was promising four interest rate hikes. To date in 2016, the Fed has not raised interest rates at all.

One rate hike in 2016, whether warranted by the Fed’s internal data, might restore some credibility in the Fed.

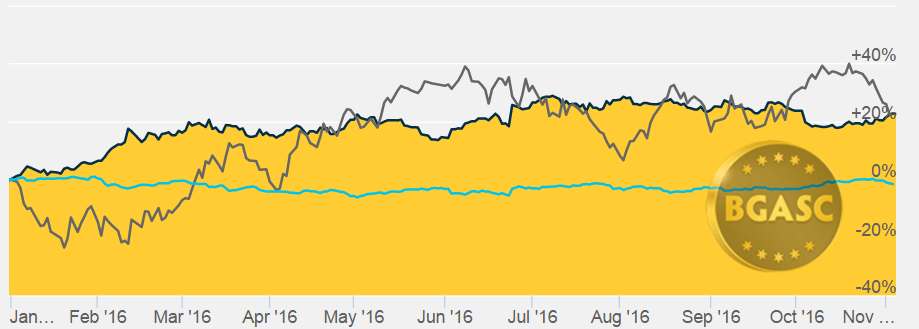

The Dollar Index* fell all week on the political turmoil created by the uncertainty of the presidential election. Last week the Dollar Index reached 99 earlier in the week and was at 98.75 last Friday morning after a higher than expected second quarter GDP number was reported. After a week of daily declines the US Dollar Index stood at 97.19 this morning.

The British Pound remains mired at a 168 year low at $1.24 on “Hard Brexit” fears. The Pound rose slightly from its low of $1.21 on talk that the Bank of England would not cut rates. The Euro rose slightly to $1.10, off its lowest value vs the dollar in eighteen months, on dovish comments by the European Central Bank regarding its monetary policy and the Chinese Yuan rebounded off a five year low.

If the Dollar continues to slide, it may give the Fed the impetus to raise rates in December. Dollar strength represents a wild card in the Fed’s deliberations on raising interest rates. A stronger dollar has a deflationary impact as imports become less expensive. Since the United States economy and Gross Domestic Product is based on consumer spending much of it done on foreign imports, a strong dollar curbs inflation.

The halt in the rise in the Dollar Index is probably welcome relief for the Fed. The Fed has long stated that they wish to see inflation near their 2% target. A strong dollar makes that goal harder to achieve and reduce the chanced of an interest rate hike.

Gold and Silver

Gold tacked on $25 dollars this week after adding about $10 last week. Gold traded in a range between $1308-1350 in September, further consolidating it gains from earlier in the year. Gold broke to the upside from the low end of its September trading range following the Fed’s September 20-21 meeting. Gold ended two weeks ago at $1322 an ounce. Gold, however, fell below $1,300 an ounce in the first week of October, dropping $75 an ounce to $1250 an ounce. Gold has retraced more than half of its losses the past two weeks.

Gold was trading at $1303 an ounce Friday morning, up $31 from last Friday morning.

Year to Date Dollar Index, Oil and Gold Prices

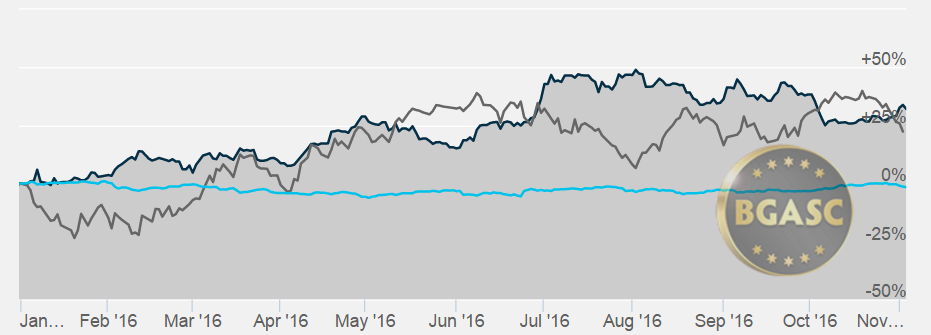

Silver also rose this week after stabilized last week. Silver had risen significantly after the Fed’s September 20-21 meeting at which interest rates were left alone. The 12% losses in silver, erased the post Fed gains and were the worst percentage losses for silver in a week since 2013.

The price of silver Friday morning was at $18.40 an ounce, up $0.75 from last Friday morning.

Year to Date Dollar Index, Oil and Silver Prices

Oil

Oil took a nose dive this week to on news of a global supply glut despite news that production cuts are coming. Oil rose the first six months of 2016 and leveled off during the summer, trading on news of stockpiles and the possibility of output freeze talks.OPEC’s decision to cut output had pushed oil back to over $50 a barrel. Since that announcement, oil has fallen back to $44 a barrel.

What’s next?

The presidential election on Tuesday will dominate all news.

Here are some economic reports that probably will have little impact on the gold, silver and currency markets next week:

Nov 7 Consumer Credit Sep –

Nov 8 JOLTS – Job Openings Sep

Nov 9 MBA Mortgage Index 11/05

Nov 9 Wholesale Inventories Sep

Nov 9 Crude Inventories 11/05

Nov 10 Initial Claims 11/05

Nov 10 Continuing Claims 10/29

Nov 10 Natural Gas Inventories 11/05

Nov 10 Treasury Budget Oct

Nov 11 Mich Sentiment Nov

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.