FX Friday Global Currency Review & Forecast For 5-20-16

Four Non Voting Fed Presidents Repeat Their Call For Rate Hikes In 2016, Possibly in June

The Dollar

For the past three weeks, Fed Presidents have been insisting that the Fed would raise interest rates at least twice in 2016, with the first rate hike coming possibly in June. The rate hike chatter intensified this week with Dallas Fed President Robert Kaplan saying that a rate hike would be appropriate “at an upcoming meeting”.

San Francisco Fed President John Williams mentioned that two OR three rate hikes might be on the table in 2016 with one potentially in June. Fed President John Williams gushed about the state of the U.S. economy “First of all, I think the U.S. economy is doing great.” adding that he thought growth would be about two percent this year.

Richmond Fed President Jeffrey Lacker said that the case for a rate hike at the next Fed meeting was strong.

Atlanta Fed President Lockhart said that he saw at least two rate hikes in 2016 and that June was a “live” meeting, meaning a rate hike discussion was on the table.

None of Messrs. Kaplan, Williams, Lacker, Lockhart, Williams and Kaplan are voting members at the Federal Reserve Open Market Committee Meetings (FOMC) this year.

Yet comments by the non voting Fed Presidents regarding the potential for rate hikes finally boosted the dollar as the Dollar Index* got some traction mid last week and early this week rising to three week highs of over 94.75. If there is no rate hike in June or July, the four aforementioned Fed Presidents will not lose face, as they can always maintain they would have voted for one. But having expressed their pro rate hike views they helped boost the dollar.

Wednesday’s release of the minutes from the FOMC April meeting confirmed that the committee had a bias for a rate hike in June if conditions warranted. The release of the FOMC April meeting drove the Dollar Index over 95.

Other Currencies

Most other currencies fell against the dollar this week as traders focused their attention on the Fed President statements. The belief that a June or July rate hike is now a possibility has taken hold with many traders who had previously discounted the chance to near zero. The belief that the Fed may be serious about raising interest rates has boosted the dollar relative to other currencies.

British Pound

The British Pound was a standout exception as it rose against all currencies this week on news that the latest Brexit poll showed the “stay” vote pulling ahead. The pound had fallen all year on concerns that Britain would leave the Euro Zone. The Pound has also experienced much higher price volatility than in recent years as it has been reacting more to polls than to economic fundamentals and other central banks actions.

Oil

Oil moved higher this week to nearly $49 a barrel. Oil has been trading higher on news rather than supply/demand dynamics as it appears oil output and stock piles continue to grow without any significant increase in current or projected demand.

Gold and Silver

Gold and silver continue to consolidate their gains from earlier in the year and are trading range bound off their highs of the year. Gold and silver have pulled back on recent dollar strength.

What’s next?

Janet Yellen speaks June 6. The Fed June meeting is 14-15. The Brexit vote is June 23. The Fed may determine that conditions warrant a rate hike at their June meeting and raise rates or pass, subject to the Brexit vote.

Here are some reports that could impact currency movements next week:

May 24 New Home Sales Apr

May 25 MBA Mortgage Index 05/21

May 25 FHFA Housing Price Index Mar

May 25 Crude Inventories 05/21

May 26 Initial Claims 05/21

May 26 Continuing Claims 05/14

May 26 Durable Orders Apr

May 26 Durable Orders, ex-trans Apr

May 26 Pending Home Sales Apr

May 26 Natural Gas Inventories 05/21

May 27 GDP – Second Estimate Q1

May 27 GDP Deflator-2nd Estimate Q1

May 27 Michigan Sentiment-Final May

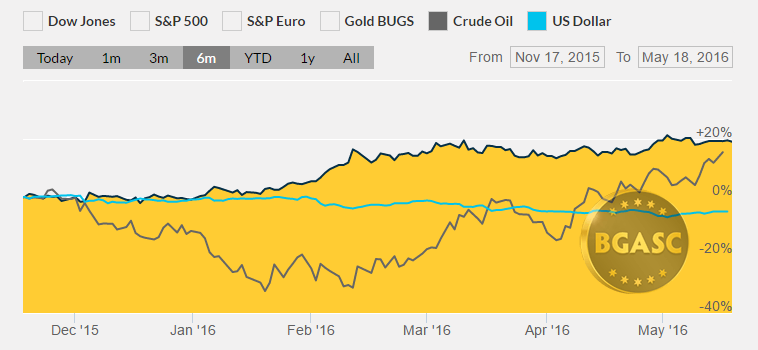

Year to Date Dollar Index, Oil and Gold Prices

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.