FX Friday Global Currency Review & Forecast For 6-3-16

Federal Reserve Open Mouth Operation Ends

Fed officials spent the better part of May telegraphing that an interest rate hike might be coming in June or July by repeating, no insisting, that June was a “live meeting” with a rate hike firmly “on the table”. Just about each regional Fed President weighed in (some of them two or three times), with the same message – rate hikes were coming. This ‘open mouth operation’ was an attempt to convince markets that while the incoming economic data may not be strong enough to warrant a rate hike, the Fed was serious about continuing its gradual rate hike journey. The Open Mouth Operation ended last Friday with Fed Chair Janet Yellen also saying that a rate hike this summer would be appropriate.

The Dollar

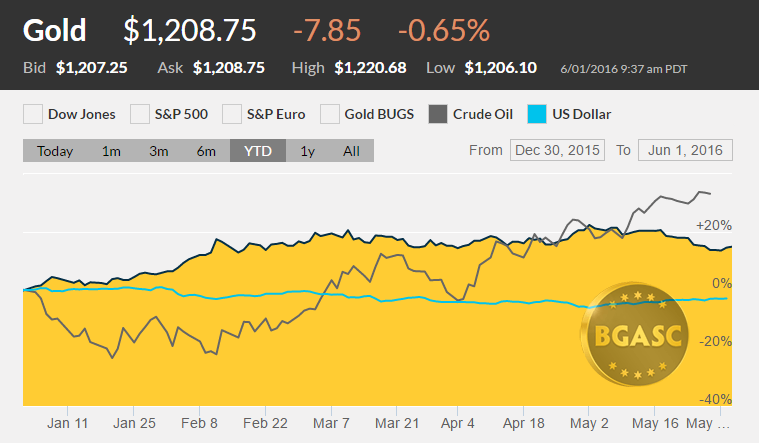

The Dollar Index* which opened the year around 100, was on a steady decline all year. The decline accelerated in March when members of the Federal Reserve’s Open Market Committee (FOMC) indicated that their expectations for the number of rate hikes in 2016 had been reduced from four to two. After a first quarter that barely registered any growth at all, markets discounted even the possibility that two rate hikes were coming in 2016. Open Mouth Operations appear to have been designed to convince the markets that at least two rate hikes were coming in 2016. The May Open Mouth Operations helped boost the Dollar index from around 92 to just shy of 96 by the end of the month.

Soft incoming economic data this week has undercut some of the Fed’s rate hike chatter momentum. The seeming inexorable march towards a June rate hike appears to have slowed. The Fed claims that it is heading towards more rate hikes at a time when the current economic expansion is very long in the tooth, making a series of rate hikes. Additionally, central banks around the world are headed in the opposite direction with increased stimulus and declining or negative interest rates. This dynamic may restrain the Fed as the dollar rises and other currencies fall creating financial instability especially in emerging markets who have dollar denominated debt obligations. A higher dollar will make those obligations more expensive to service at a time when many emerging market economies are already struggling.

Other Currencies

Chinese Yuan

The Chinese Yuan fell this week on anticipation of Fed rate hikes. The People’s Bank of China cut the Yuan fixing about a half a percent earlier in the week, further weakening the Yuan and bringing it to a three month low.

Japanese Yen

The Japanese Yen fell as the Prime Minister called off a widely anticipated sales tax and put fiscal reforms on hold.

British Pound

The British Pound’s fortunes remain tied to the polling data surrounding the Brexit vote later this month. The latest polls have shifted to “leave” causing the British Pound to fall to a two week low.

Oil

The price of oil has flirted with $50 a barrel the past two weeks. Talks of an oil freeze among oil producers appears to be elusive, giving support to the price of oil. Militant attacks on Nigeria’s oil infrastructure has led to a decline in oil output in that country. Nigeria is the 13th largest oil producer in the world and largest in Africa. Declining output from Nigeria has also provided support for the price of oil.

Gold and Silver

Gold and silver remain under pressure that began with Open Mouth Operations at the beginning of May. Gold opened May at around $1280 an ounce and ended around $1219 an ounce, a 4.8% decline. Silver opened May at around $17.85 an ounce and closed the month at $16.04 a delcine of about 10%.

Year to Date Dollar Index, Oil and Gold Prices

What’s next?

The Federal Reserve Open Market Committee Meeting is scheduled for June 14-15, followed by a press conference. If there is no rate coming out of the June meeting, there will have to be either an explicit statement that conditions are ripe for a rate hike in July (absent a “leave” vote in the Brexit initiative to be held on June 23) for the Fed to retain market credibility. Absent something close to a promise to raise rates in July there will certainly be plenty of questions at Fed Chair Yellen’s press conference regarding what exactly are the requirements for a rate hike.

If indeed there is a rate hike in June, Ms. Yellen will be peppered with questions as to the timing of the next one. There is no press conference scheduled following July’s FOMC meeting.

Here are some reports that could impact currency movements next week:

Jun 7 Productivity-Rev. Q1

Jun 7 Unit Labor Costs – Rev. Q1

Jun 7 Consumer Credit Apr

Jun 8 MBA Mortgage Index

Jun 8 Crude Inventories 06/04

Jun 9 Initial Claims 06/04

Jun 9 Continuing Claims 05/28

Jun 9 Wholesale Inventories Apr

Jun 9 Natural Gas Inventories 06/04

Jun 10 Mich Sentiment – Prelim Jun

Jun 10 Treasury Budget May

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.