FX Friday Global Currency Review & Forecast For 7-08-16

Brexit Continues To Cast its Shadow Over the Currency Gold and Silver Markets

A few months ago, global currency movements and the prices of gold and silver were influenced primarily on what the Fed did and more importantly what they said. That has changed. In the weeks leading up to the Brexit vote on June 23, all currencies and the price of gold and silver were influenced by the polls that indicated the likely outcome of the United Kingdom’s referendum regarding their status in the European Union.

The looming Brexit vote held sway of the British pound for months before the Brexit vote was held. The value of the Pound changed with the Brexit poll results. Polls showing that the remain vote was in the lead boosted the Pound. Polls showing that the leave vote was in the lead would depressed the Pound. The British Pound traded with the volatility of an emerging markets currency.

On June 23, 2016, Britons voted to leave the European Union. Since then, the value of the British Pound, all currency movements and the prices of gold and silver have been largely influenced by the Brexit vote. The Pound tumbled on the news of the Brexit vote, and gold and silver headed higher. It’s been two weeks since the vote and the Pound is still near thirty one year lows and gold and silver continue to march higher. The dollar caught a small safe haven bid, rose slightly and held its gains.

Uncertainty Persists

The future is always uncertain, but the Brexit vote created a known set of uncertainties that will persist for a long time. The Brexit vote was unambiguous, but did nothing to remove the uncertainty of what the vote meant. When and how would Britain leave the European Union? Would Britain actually leave? What would the consequences of an actual Brexit be on Great Britain, on the European Union, on the member states of the European Union thinking of ‘pulling a Brexit’ themselves?

The Federal Reserve met in mid-June before the Brexit vote and held off raising rates in part due to a perception that the labor market was weakening, but mostly because it was concerned about the upcoming Brexit vote and the uncertainties that would be involved if the leave camp prevailed. Indeed, the Fed’s short June minutes contained the word “uncertainty 38 times.

What the Fed does or how economies do will be less important in the coming months as to how central banks respond to Brexit and the possibility of other European Countries holding their own referendum to leave the European Union.

Overview of Major Currencies and Gold and Silver Post Brexit

Gold and Silver

Gold and silver have been stellar performers in 2016. Their ascents went into overdrive immediately after the Brexit vote.

Gold has risen more than 20% from $1097 an ounce on January 4 to $1364 an ounce on July6.

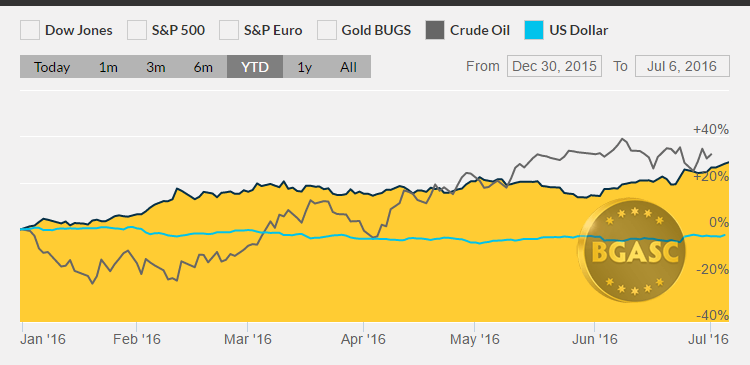

Year to Date Dollar Index, Oil and Gold Prices

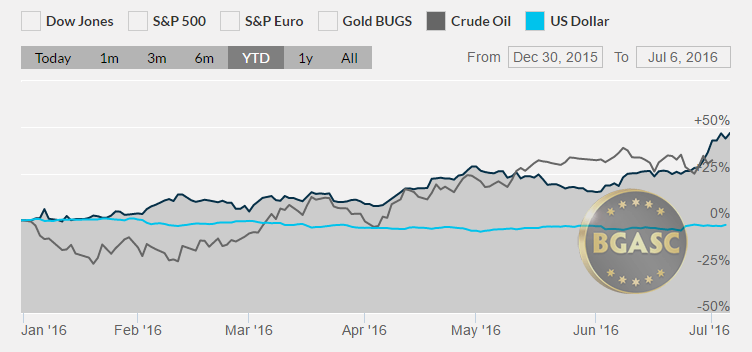

Year to Date Dollar Index, Oil and Silver Prices

Silver has risen over 40% from $14.00 an ounce on January 4 to $20.00 an ounce on July 6.

Oil

Oil is up about 35% in 2016, at $48 a barrel on July 6.

The gloom and doom surrounding gold and silver at the beginning of the 2016, was matched only by the negative sentiment about oil. All three commodities have soared in 2016.

The Dollar

The dollar has under performed so far in 2016. Lower GDP growth and the Fed’s failure to raise rates also weighed on the dollar in the first half of the year. Rate hike talk in May boosted the dollar. That burst was short lived when it became clear that the labor market was no longer improving at the pace the Fed had projected and therefore a rate hike in June or July was unlikely. The Brexit vote has given the dollar a slight boost. As of July 6 the Dollar Index* was about 96 and down about 4%.

British Pound

The British pound is down over 10% on the year and now mired at 31 year lows. The Pound hit its highest level of 2016 the day before the Brexit vote and was essentially even on the year . The day after, the pound fell over 11%.

The Euro

The Euro is up slightly this year in part due to Pound and Dollar weakness. The Euro fell slightly post Brexit but has since rebounded and recouped half of its small losses.

The Japanese Yen

The Japanese Yen strengthened against the dollar about 10% in the first half of 2016 on ‘safe haven’ trading.

The Chinese Yuan

The Chinese Yuan has undergone a series of devaluations and is about 2% weaker against the US dollar year to date.

What’s next?

Brexit and Other Member States

Fed, European Central Bank, Bank of England and Bank of Japan monetary policies will remain in focus in 2016. Due to Brexit, the Bank of England has announced they would probably add more stimulus. The Fed appears to have put its interest rates hikes on hold. The Bank of Japan and the ECB will probably remain ‘highly accommodative”. Against this back drop of global financial uncertainty and monetary accommodation, it is widely expected that gold and silver will do well.

As we saw in first half of the year, the conventional wisdom can get turned on its head in short order. By the end of the year perhaps we will see sharply higher gold and silver prices but we can’t tell what surprises the second half of 2016 will have in store for us.

Here are some reports that could impact gold, silver and currency movements next week:

Jul 12 Wholesale Inventories May

Jul 13 MBA Mortgage Index 07/09

Jul 13 Export Prices ex-ag. Jun

Jul 13 Import Prices ex-oil Jun

Jul 13 Crude Inventories 07/09

Jul 13 Fed’s Beige Book Jul

Jul 13 Treasury Budget Jun

Jul 14 Initial Claims 07/09

Jul 14 Continuing Claims 07/02

Jul 14 PPI Jun

Jul 14 Core PPI Jun

Jul 14 Natural Gas Inventories 07/09

Jul 15 Empire Manufacturing Jul

Jul 15 Retail Sales Jun

Jul 15 Retail Sales ex-auto Jun

Jul 15 CPI Jun

Jul 15 Core CPI Jun

Jul 15 Capacity Utilization Jun

Jul 15 Industrial Production Jun

Jul 15 Business Inventories May

Jul 15 Mich Sentiment Jul

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.