FX Friday Global Currency Review & Forecast For 9-16-16

Up Next Week: Fed Meeting – Rate Hike Fears Still Linger

The Fed’s upcoming open market committee meeting on September 20-21 remains on market participants’ minds as the possibility of a rate hike, however diminished is still feared. Since Janet Yellen gave her Jackson Hole speech in August noting that conditions for a rate hike had strengthened, incoming economic data has been weak. Non-Farm payroll, retail spending, ISM manufacturing and services and industrial production readings since Jackson Hole have all been far below estimates. The only “positive” number from the Fed’s perspective was today’s consumer price index reading that showed rising prices based on increased health care and rent costs. The Fed has stated that it wants to see price inflation closer to 2% before raising interest rates.

On Monday of this week Fed Governor Lael Brainard counseled prudence in removing monetary accommodation. It would seem, yet again that the Fed would like to see more data, wait until their next meeting in December to determine if they should raise interest rates. Twice this week Republican Presidential candidate Donald Trump accused the Fed of being ‘political’ in its considerations to keep rates low and not raise them before the election. This taunt will probably not be enough to cause the Fed to raise rates this months, but will probably be part of their deliberations.

Despite the weak data and reduced possibility of a rate hike in September, the Dollar Index* strengthened this week and gold and silver fell.

The vast majority of surveyed market participants do not expect a rate hike at the September meeting. There will not be a Fed press conference following the meeting so market participants will have to rely on the speeches of Fed officials that are sure to come in the days and weeks after the September meeting to gauge whether a rate hike is probably at the Fed’s next meeting in December.

Gold and Silver

Gold fell in August after rising most of the year. Gold continued to fall in September as rate hike fears have knocked gold off its stride. Gold has held, however, above $1300 an ounce all of August and September. Gold will probably break from its trading range (up or down) following the Fed’s September 20-21 meeting.

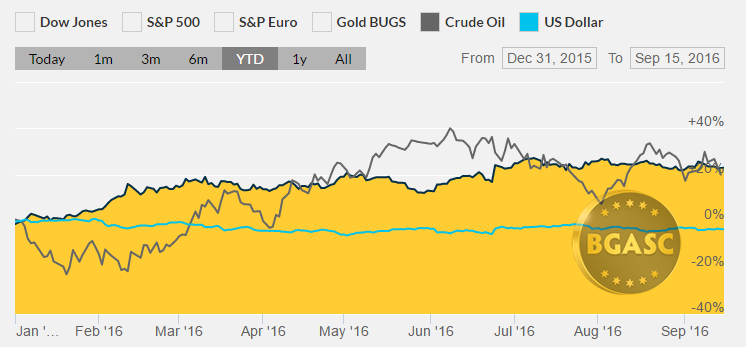

Year to Date Dollar Index, Oil and Gold Prices

Silver popped after the August job report on Friday and hit over $20 an ounce last week. Profit taking and rate hike talk has pushed silver down below $19.00 an ounce this week. Silver continues to be the best performing asset in 2016, rising well over 40% in 2016. The price of silver is at its highest levels in two years, but far below its all time higher of $50 an ounce reached in April 2011. The price action this week in silver highlights that when precious metals price rise, silver rises it generally rises more than gold.

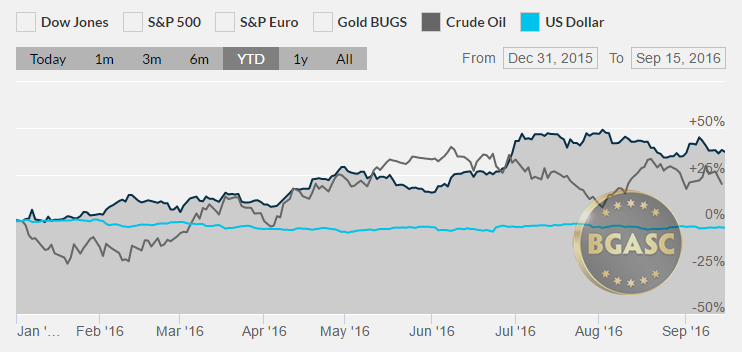

Year to Date Dollar Index, Oil and Silver Prices

British Pound

The British Pound bounced and fell again this week and remains mired in the $1.30 area. The British Pound has yet to sustain a rally from its post Brexit lows even though the economic gloom and doom predicted by a Brexit vote have not materialized.

Emerging Maarkets Currencies

Emerging markets currencies remain under pressure as the dollar has strengthened in recent weeks. The Mexican Peso

hit an all time low today. The Russian Rouble remains under pressure as it announced its second interest rate cut of this year.

Oil

Oil shot higher in the first six months of 2016. Since then oil has been trading on news of stockpiles and the possibility of output freeze talks. Oil, like gold has been stuck in a trading range and off its highs the past month. Oil continues to spike and fall on inventory reports and from talks about upcoming meetings among oil producers to discuss output freezes. The former depresses prices and the latter boosts them.

What’s next?

Next week the only important report on the calendar is the Fed’s interest rate announcement on the 21st following their two day meeting.

Here are some economic reports that could impact gold, silver and currency movements next week:

Sep 19 NAHB Housing Market Index Sept

Sep 20 Housing Starts Aug

Sep 20 Building Permits Aug

Sep 21 MBA Mortgage Index 09/17

Sep 21 Crude Inventories 09/17

Sep 21 FOMC Rate Decision Sep

Sep 22 Initial Claims 09/17

Sep 22 Continuing Claims 09/10

Sep 22 FHFA Housing Price Index Jul

Sep 22 Existing Home Sales Aug

Sep 22 Natural Gas Inventories 09/17

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.