Global Currency Review & Forecast for 3-28-16

Dollar on the Ascent Again

The dollar is back on the rise. The Dollar Index* has been climbing steadily for over a week after declining for most of 2016. The dollar fell most of 2016 because the stock market fell and market participants and currency traders believed with equity markets heading down, that the Fed would hold off on raising interest rates. In March, the U.S. equity markets reversed course and headed higher.

At the Fed’s March meeting, despite the stock market advance, the Fed decided not to raise rates and lowered expectations for interest rate increases in 2016 from four to two. The Fed claims that its primary considerations in whether to raise interest rates are the health of the labor market as measured by job growth and the unemployment rate and inflation expectations, not short term stock market gyrations.

The Fed’s hesitancy to raise rates at their March meeting and the change in outlook from four rate hikes in 2016 to just two, immediately impacted the Dollar Index negatively and gold and silver rose on the prospect of rate hikes being cut in half in 2016. The Dollar Index continued its descent in the days following the March 16th Fed meeting until some Fed President spoke out.

In a scenario that often follows Fed meetings, Fed officials attempt to clarify the Fed’s position. Last week, six Fed Presidents spoke and while they did not contradict the Fed’s outlook for just two rate hikes this year, they all intimated that one of those rate hikes might happen as soon as the next Fed meeting in April. Fed Presidents struck a much more hawkish tone than minutes of the Fed’s March meeting, citing an improving job market and increased consumer price inflation. Indeed, Philadelphia Fed President Patrick Harker said the Fed needs to “get on with it” regarding raising interest rates and St. Louis Fed President James Bullard said the next rate hike could be “around the corner.”

View Gold & Silver Price Charts; Receive Gold & Silver Price Alerts

Some Fed Presidents also cited the perception that the price of oil had bottomed and that a rise in the price of oil would add to inflationary pressures they see building.

The Dollar Gets Safe Haven Boost

Further boosting the dollar this week were the terrorist attacks in Brussels. The dollar is viewed as a safe haven during times of geo-political unrest and bombs striking at the heart of Europe, the seat of the European Commission, created a sense of instability in Europe. Elsewhere in Europe “Brexit” fears were stoked further when former conservative leader Iain Duncan Smith came out in favor of Britain leaving the EU. The terrorist attacks also boosted the chance of a Brexit as many Britons see the issue of terrorism as stemming from the European Union’s border policy.

The British pound fell vs. the dollar on fears that the terrorist attacks would strengthen further the argument of Brexit. The Swiss Franc and Japanese Yen also moved higher on safe haven bids. The Russian Rouble which had been rising in tandem with the rise of the price of oil fell.

While the U.S. job market, as measured by the unemployment rate, non-farm payroll and initial jobless claims readings, is ostensibly improving and consumer prices as measured by the consumer price index appear to rising to and beyond the Fed’s inflation target of 2%, a rate hike in April may not happen. Other U.S. economic data shows that the U.S. economy is not firing on all cylinders and that the economic recovery is at best, uneven. New home sales and existing home sales have slowed recently and durable goods fell in February.

It seems that the Fed lost some credibility after not raising rates at their March meeting and reducing their interest rate out look for 2016 from four rate hikes to two. The decline in the Dollar Index reflected that loss of credibility. Trotting out six Fed Presidents and putting the markets on notice that the Fed stands ready, willing and able to raise rates at the next meeting has stopped the falling Dollar Index and put it back on an upward trajectory.

If the Fed does not raise rates at its next meeting in in April, the Dollar Index may retreat again. If so, expect another round of Fed President pronouncements after the April meeting threatening that rate hikes will be on the table at their next meeting in June.

Here are some reports that could impact currency movements this week, the most important, Friday’s non farm payroll number:

Mar 28 PCE Prices Feb

Mar 28 Personal Income Feb

Mar 28 Personal Spending Feb

Mar 28 Pending Home Sales Feb

Mar 29 Case-Shiller 20-city Index Jan

Mar 29 Consumer Confidence Mar

Mar 30 MBA Mortgage Index 03/26

Mar 30 ADP Employment Change Mar

Mar 30 Crude Inventories 03/26 –

Mar 31 Challenger Job Cuts Mar

Mar 31 Continuing Claims 03/19

Mar 31 Initial Claims 03/26

Mar 31 Continuing Claims 03/19

Mar 31 Chicago PMI Mar

Mar 31 Natural Gas Inventories 03/26

Apr 1 Average Workweek

Apr 1 Nonfarm Payrolls

Apr 1 Nonfarm Private Payrolls

Apr 1 Unemployment Rate

Apr 1 Hourly Earnings Mar

Apr 1 Unemployment Rate Mar

Apr 1 Average Workweek Mar

Apr 1 Hourly Earnings Mar

Apr 1 Construction Spending

Apr 1 ISM Index Mar

Apr 1 Michigan Sentiment – Final

Apr 1 Construction Spending Feb

Apr 1 Michigan Sentiment – Final Mar

Apr 1 Auto Sales Mar

Apr 1 Truck Sales Mar

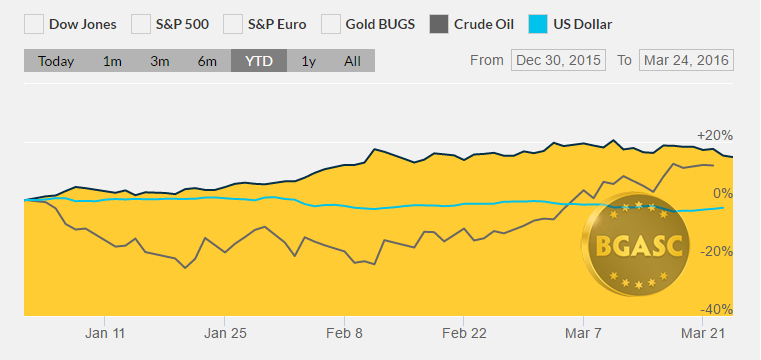

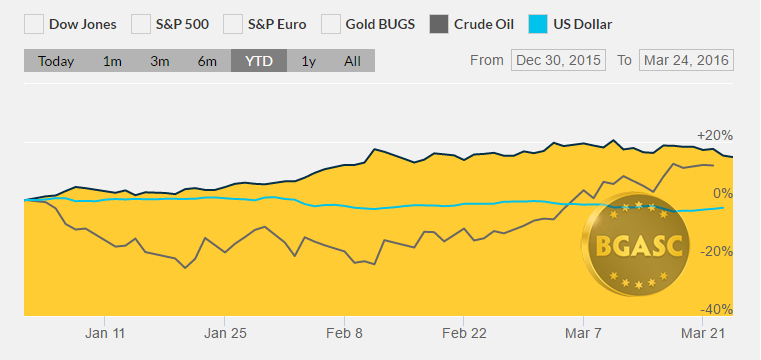

Year to Date Dollar Index, Oil and Gold Prices

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article does not necessarily reflect the explicit views of BGASC, nor should it be construed as financial advice.