Brexit Jolts Markets – Gold and Silver Provide Safe Havens From Market Turmoil

Brexit Vote Throws Global Markets into Turmoil

The voters of Great Britain decided to leave the European Union last Thursday. The vote was close, but not too close, 52-48%. The bulk of the ‘remain’ vote came from London, Scotland and Northern Ireland. All precincts of Scotland and Northern Ireland voted to remain in the European Union and all precincts of London other than the East End voted to remain in the EU.

This dynamic has provided additional uncertainty to an already uncertain environment. Scotland’s first minister Nicola Sturgeon, said it was “democratically unacceptable” that Scotland should be pulled from the EU against its wishes. Ms. Sturgeon called for another referendum to pull Scotland out of the United Kingdom. A Scottish referendum to take Scotland out of Great Britain failed just two years ago. Ms. Sturgeon vows to put another referendum “back on the table” as a result of the Brexit vote.

The EU and Fed Scramble

Beginning last Thursday night, Asian, European and U.S. futures markets and the British Pound began to sell off as a Leave outcome came into focus. Gold and silver also started their ascent on signs that the Leave vote might win and exploded higher when it became clear a Brexit was an almost certainty.

The Brexit vote result shocked many who had expected ‘Remain’ to win the day.

The EU issued a statement:

“In a free and democratic process, the British people have expressed their wish to leave the European Union. We regret this decision but respect it.”

The Federal Reserve weighed in with the obligatory note that they were “carefully monitoring developments in global financial markets” and was prepared to provide dollar liquidity through its existing swap lines with central banks, as necessary, to address pressures in global funding markets, which could have adverse implications for the U.S. economy.”

European Union Member State Reaction

In addition to Scottish threats of a referendum to leave the United Kingdom, Italy, the Netherlands and France also made calls for their own referenda. Italy’s Five Star Movement, that won 19 of 20 mayoral races earlier this month, called for a referendum on the Euro on Tuesday last week. France’s National Front leader Marine Le Pen called for a French referendum on Thursday night to get out of “decaying Europe”. In the Netherlands a poll by Der Telegraf, a leading newspaper in the Netherlands, showed that 88% of citizens of the Netherlands want a Brexit style in/out referendum for their country.

Brexit Currency Impact

The Pound

The pound had risen to a 2016 high the day before the Brexit vote on sentiment that Remain would win. The British Pound touched £1.50 to the dollar before vote counting began. As it became apparent that Leave would win, the Pound plummeted more than 10% and touched £1.32 on Friday morning. The British Pound is expected to remain subject to volatility as the uncertain process of extricating the United Kingdom from the European Union unfolds.

The Euro

The Euro fell in reaction to the Brexit vote but rose against the British Pound. While most of the focus is on the vunerablilites of the British Pound as Great Britain goes it alone without the European Union, not much attention has been paid to the vulnerabilities of the EU as referendum fever among EU member states may damage the cohesion of the European monetary union supporting the Euro.

The Safe Havens

The Dollar

The dollar rose on news of the Brexit vote. The Dollar Index* touched $96 Thursday evening and sold off mildly during Friday. Brexit calls into question even the one rate hike that the Fed was expected to do in 2016. Indeed, if the dollar rises too much in reaction to Brexit, the Fed may be forced to do a rate cut. In addition the U.S. economy appears to be slowing and perhaps in need of some additional monetary accommodation.

Gold and Silver

Gold and silver were the undisputed beneficiaries of the Brexit vote. Both rose dramatically on the Brexit news and settled substantially higher. At one point on Thursday night gold rose over $100 an ounce!

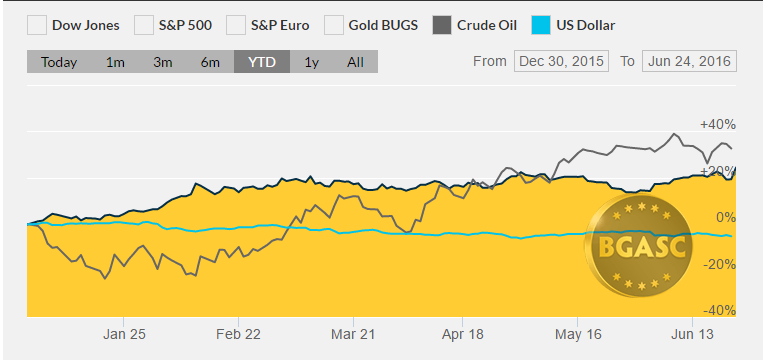

Year to Date Dollar Index, Oil and Gold Prices

What’s next?

The aftermath of Brexit is uncertain. The immediate market reaction was negative and there wasn’t much central banks could do to change that perception. Until Great Britain’s status as a nation independent of the European Union is settled, there will be continued uncertainty and that uncertainty is expected to continue at least for months, if not years.

Here are some reports that could impact currency movements this week.

Jun 30 Initial Claims 06/25

Jun 30 Continuing Claims 06/18

Jun 30 Chicago PMI Jun –

Jun 30 Natural Gas Inventories 06/25

Jul 1 ISM Index Jun

Jul 1 Construction Spending May

Jul 1 Auto Sales Jun

Jul 1 Truck Sales Jun

*The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.