Mexican Silver Mining Production Set To Fall in 2016

World’s Largest Silver Mining Country Sees Decline in Output in 2016

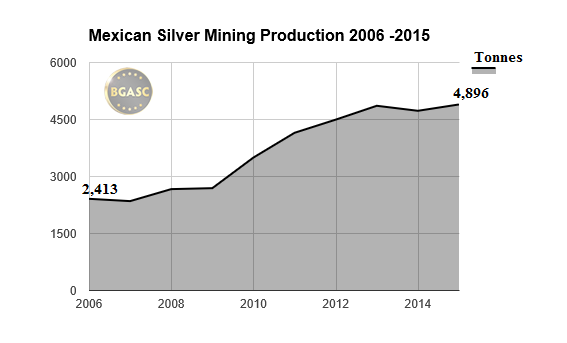

After a Decade of Increasing Silver Production, a Slow Down Is Projected

2015: Mexican Silver Miners Peak Year?

After many primary silver miners reported increases and or record silver mining production in 2015, global silver mining production is projected to fall in 2016. Last month investment Bank Société Générale projected that silver mining output will fall 9.2% in 2016 from 2015 levels and fall 13% in 2017 from 2015 levels. Last fall, the Silver Institute projected a 5% decline in 2016 silver mining production.

After those announcements, the Mexican government released their 2015 silver mining production figures showing a 3.5% growth in output over 2014. Mexico’s silver mining production in 2015 was the highest in a decade.

Mario Cantu, the economy ministry’s general mining coordinator has noted that Mexican silver production would not grow in 2015 and is expected to fall by more than 6 percent in 2016.

Silver Supply Declining as Demand is Increasing

Because silver at least 50% of silver’s demand is for industry, physical supply of silver is necessary in the production of electronics, medical devices, military hardware and solar panels. Monetary uses of gold and silver can be and have been satisfied largely via futures contracts that provide exposure to the prices of those precious metals but do not require delivery of them. While industrial silver demand has grown steadily in recent years due to increases in demand for silver from the solar industry, investment demand for silver coins, bars and rounds has risen exponentially.

The major sovereign mints have reported record sales of silver in each of the past few years. The US. Mint sold 47 million one ounce American Silver Eagle coins in 2015 up from 8.4 million sold in 2005. Silver coin and bar demand has gone from about 5% of overall silver demand in 2005 to over 20% in 2015. This demand can only be met by a physical supply of silver.

Why Mexico is Important to Silver

About 85% of silver demand each year is met through mining production. The remaining 15% is met through recycled silver. Mexico is not only the largest silver mining producer in the world, but its silver production comes mostly from primary silver mines.

Secondary Silver Mining

Of the silver mined each year, about 70% of it comes as a by-product of the mining of base metals, lead, copper and zinc. Base metal mining is reliant on a growing global economy and higher metal prices. With declining base metal prices and stagnant global economic growth, demand for copper, lead and zinc has been and is expected to remain flat or decline. As prices and demand for base metals decline, base metal miners either cut production or, in the worst cases, go bankrupt. A decline in the base metal mining industry means that less by product silver is also not produced. When there is a decline in silver production from base metal mining, primary silver mines and scrap silver have to make up the difference to meet demand.

Primary Silver Mining

Mexican silver miners have produced increasing amounts of silver the past few years despite the declining price of silver. As the price of silver declines, it is necessary to produce more to make the same amount of money. Fortunately for the silver miners, the past few years have seen an increase in silver demand coupled with declining prices (a market anomaly). The increased demand gave the silver miners the opportunity stay in business by increasing production, an option some base metal miners did not have as they saw demand for their mining products decline.

Some Mexican miners resorted to “high grading” their mines to save money whereby they extract the cheapest and easiest silver they can while cutting back on exploration costs. These miners were able to achieve higher levels of production of this strategy, but at the expense of being able to meet their targets in future years as they depleted a good portion of their low hanging fruit.

As a result of a high grading and a decline in exploration, overall Mexican silver mining production is expected to fall in 2016. Some of the larger Mexican miners are reporting that they will exceed 2015’s silver production, mostly through the acquisition of other mines or bringing new mines online. Other companies with mines in Mexico have told investors they expect their production to fall in 2016.

Higher silver prices won’t change the 2016 silver production outlook as it takes months and sometimes years to get mining production started again in closed mines or to get new discoveries into production.

Scrap Silver

If Mexican miners can’t produce enough silver to meet what is expected to be another year of silver deficit when demand outstrips supply, scrap silver will have to make up the deficit. Higher prices normally bring more old silverware, coins and bars to market. Scrap silver, however, also has a long lead time before it can be brought to market. The used silver has to be sold, recycled and recast into useable forms for industry or struck into coin blanks or bars for sale to investors and collectors and then delivered.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.