Mid-Year FX Review

Mid Year Market Assessment

The first half of the year did not turn out as expected. At the end of 2015, many financial commentators were projecting a stronger dollar and continued gold and oil weakness. The dollar was expected to rise because the Fed had announced a policy of tightening interest rates, that supposedly had begun in December 2015 and would continue through 2016. Higher rates were expected to bolster the dollar. As 2015 drew to a close, oil was falling because there was a massive supply glut and declining demand. Gold and silver were in the doldrums having fallen steadily since their respective peaks in 2011. Gold and silver hit multi-year lows in December 2015.

Something Changed

What a Difference Six Months Makes!

The stock market opened 2016 with one of the worst performances ever. One generally accepted reason for the sharp stock market decline in January, was markets were bracing for the end of a ten year period without meaningful interest rate increases. The December 2015 quarter point U.S. rate hike was coupled with language that the Fed expected to raise rates four times during 2016. The stock market recovered when the Fed changed its guidance in March to just two rate hikes. As U.S. and global growth slowed in the first quarter, market participants began to take the view that perhaps the Fed wouldn’t raise rates at all, or perhaps just once in 2016.

In May, the Fed determined to change market perception that no further rate hikes were coming in 2016 via open mouth operations. At least a half a dozen regional Fed Presidents gave interviews or speeches that indicated not only was the Fed going to raise rates in 2016, but they were going to raise them two or three times and that the next rate hike might happen as soon as June.

Non Farm Payroll and Brexit Shut Down Rate Hike Talk

In early June, the dismal May non farm payroll was released. That coupled with the prospect of voters in Great Britain voting to leave the European Union later in the month, made it clear there would be mostly likely be no rate hike in June. There was not rate hike announced at the Fed’s June meeting. After the Fed’s mid-June meeting, prior to the Brexit vote, Federal reserve Chair Janet Yellen said that a rate hike in July was “not impossible” if conditions improved.

On June 23, 2016, 52% of Britons voted to leave the European Union, immediately crashing equity markets and the Britsh Pound. By yesterday, the markets had recovered most of their post Brexit vote losses and the pound regained a little of its footing. Post Brexit, however, many market watchers, reduced the prospect of Fed rate hikes in 2016 to lower than the prospect Fed rate cuts!

Mid 2016 Prices

Gold and Silver

Gold and silver have been stellar performers in 2016.

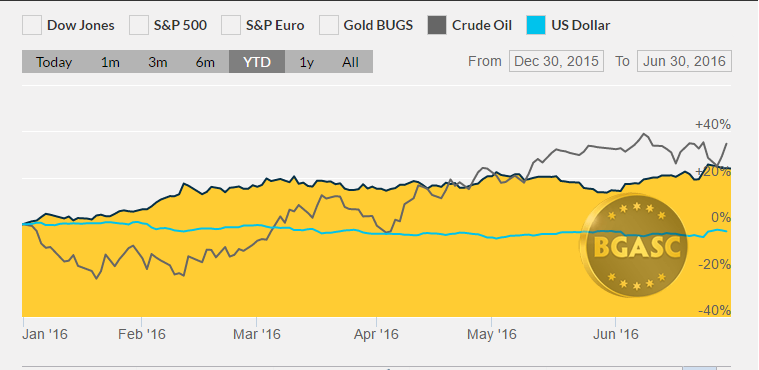

Gold rose 20% from $1097 an ounce on January 4 to $1320 an ounce on June 30.

Year to Date Dollar Index, Oil and Gold Prices

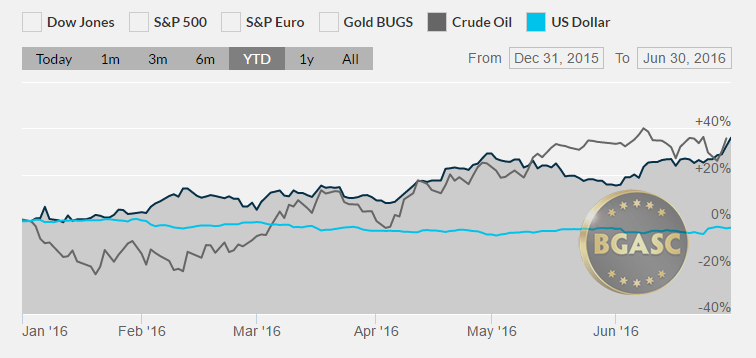

Silver rose 31% from $14.00 an ounce on January 4 to $18.36 an ounce on January 30.

Year to Date Dollar Index, Oil and Silver Prices

Oil

Oil is up 35% in 2016, at $49 a barrel on June 30.

The Dollar

The Dollar Index* is down about 4% this year. Lower GDP growth and the Fed’s failure to raise rates weighed on the dollar in the first half of the year.

British Pound

The British pound is down 10% on the year. The pound hit its highest level of 2016 the day before the Brexit vote and was essentially even on the year . The day after, the pound fell over 11%.

The Japanese Yen

The Japanese Yen strenthened against the dollar about 10% in the first half of 2016 on ‘safe haven’ trading.

The Chinese Yuan

The Chinese Yuan has undergone a series of devaulations and ended the first half of 2016 about 2% weaker against the US dollar.

What’s next?

Brexit Fall Out in the Second Half of 2016

Fed, European Central Bank, Bank of England and Bank of Japan monetary policies will remain in focus in 2016. Due to Brexit, the Bank of England has announced they would probably add more stimulus. The Fed appears to have put its interest rates hikes on hold. The Bank of Japan and the ECB will probably remain ‘highly accommodative”. Against this back drop of global financial uncertainty and monetary accommodation, it is widely expected that gold and silver will do well.

As we saw in first half of the year, the conventional wisdom can get turned on its head in short order. By the end of the year perhaps we will see sharply higher gold and silver prices but we can’t tell what surprises the second half of 2016 will have in store for us.

Here are some reports that could impact gold, silver and currency movements next week:

Jul 5 FOMC Minutes Jun 15

Jul 5 Factory Orders May

Jul 6 MBA Mortgage Index 07/02

Jul 6 Trade Balance May

Jul 6 ISM Services Jun

Jul 6 Crude Inventories 7/02

Jul 7 Challenger Job Cuts Jun

Jul 7 ADP Employ Change Jun

Jul 7 Initial Claims 07/02

Jul 7 Continuing Claims 06/25

Jul 7 Nat Gas Inventories 07/02

Jul 7 Crude Inventories 07/02

Jul 8 Nonfarm Payrolls Jun

Jul 8 Nonfarm Pri.Payrolls Jun

Jul 8 Unemployment Rate Jun

Jul 8 Hourly Earnings Jun

Jul 8 Average Workweek Jun

Jul 8 Consumer Credit May

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.