The Dollar Regains its Footing in 2018

Dollar Index Rebounds in 2018, Gold and Silver Fall.

2018 has seen a realignment of currency gold and silver values. Set forth below are the highlights of this shift.

The Dollar

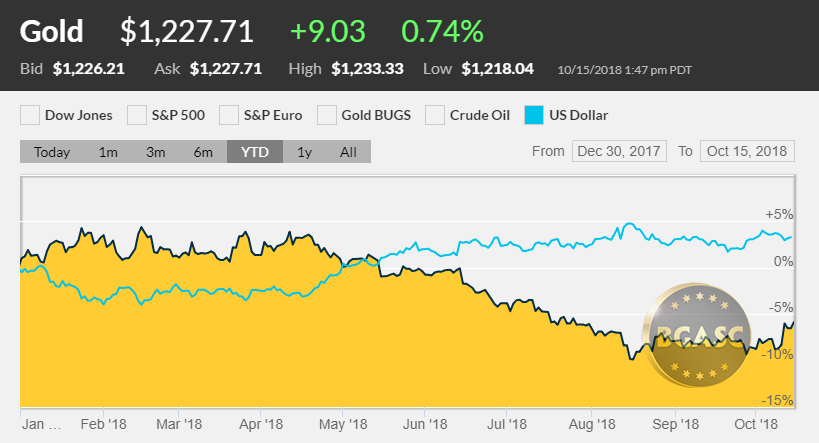

The dollar index* has risen about 3.25% in 2018 to 95.05 as of October 15, 2018. The dollar index was 102.22 in January 2017 and fell 10% in 2017 to 91.95 despite three rate hikes that year. The Fed has raised interest rates another three times in 2018. As a result of seven interest rate hikes since 2016 and an improving U.S. economy, the dollar has strengthened in 2018. Strong GDP growth and Federal Reserve official statements that the U.S. economy as no longer needs accommodative monetary policy have boosted the dollar.

Further supporting dollar strength is that Fed policy stands in start contradiction to the loose monetary policies of the European Central Bank, the Bank of Japan, the Bank of England and the People’s Bank of China all of which are engaged in some type of monetary stimulus and/or have zero or negative interest rates.

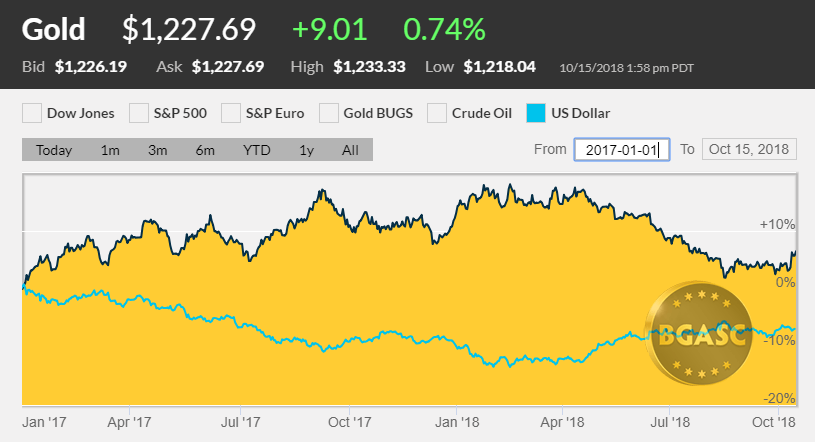

While the dollar is up in 2018, it remains down about 8% from January 2017. Gold is down in 2018 vs the dollar, but is up about 5% from January 2017.

Other Currencies

British Pound

From 2014 until early 2016, the British Pound traded in a tight range of about $1.50-$1.58. In mid-2016, the voters in the United Kingdom elected to leave the European Union. The Pound plunged to the $1.30’s following the vote and hit a low of $1.22 in October 2016. The Pound has remained below its pre-Brexit levels, despite an economy that did not collapse as many market observers predicted. The pound has been held down in part due to the uncertainty over the conditions under which the United Kingdom will be allowed to leave the European Union, conditions that have yet to be settled.

The Euro

The Euro has also been hit with bouts of political uncertainly and potential financial strain. Populist movements in Germany, Italy, Hungary and Poland have directly threatened the authority of the European Union. Italy, Hungary and Poland have challenged EU immigration policy and German chancellor Angela Merkel’s party has lost its grip on power in regional elections in 2018, in part due to immigration policy. Italy has seen an increase in its cost of borrowing as aggressive public spending and seeming inability to justify such budgetary expenses based on economic activity have increased its borrowing costs. Italy has been battling the European Union over its spending intentions, but has fallen short of threatening to leave the Euro over its disagreements.

The Euro began 2018 at $1.20 and as of October 15, 2018 was at $1.15

The Japanese Yen

The Japanese Yen has held firm against the dollar. The Japanese Yen was worth $.008842 at the beginning of the year and rose slightly to $.008948 as of October 15, 2018. The Yen is considered a “safe haven” currency despite its sluggish economy and massive domestic stimulus and negative interest rates.

The Chinese Yuan

The Chinese Yuan is approaching an all time low vs the dollar of 7 Yuan to the dollar. During the past decade, Chinese has been accused of artificially manipulating the Yuan lower to make its exports more attractive. The Yuan has been hit with a slowing economy – one that is heavily dependent on loose credit to fuel infrastructure and other government projects. China’s credit in recent years has exploded causing one former People’s Bank of China governor to state that China may have reached a Minsky Moment (a sudden major collapse of asset values after a period increased credit fueled speculation).

The Yuan has fallen 5% in 2018 from $.01538 to $.0146 as of October 15, 2018

The Shanghai Stock Exchange is down over 24% the past 12 months.

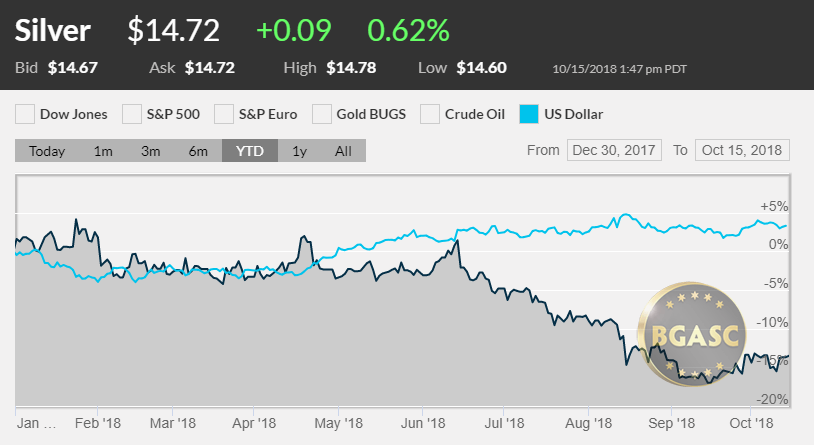

Due to the strong dollar, gold and silver have fallen this year.

Gold

While gold is down 6.8% in 2018 vs the dollar, Gold has risen against many currencies in 2018. Gold opened the year at $1316 an ounce and was at $1227 an ounce on October 15, 2018.

Silver

Silver has fallen 14.3% in 2018 from $17.19 an ounce in January 2018 to $14.73 an ounce on October 15, 2018.

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.