Trump and the Dollar, Markets, Gold and Silver

Trump in Theory vs Trump in Reality – Uncertainty in Action

When it appeared that Donald Trump would be elected as the 45th President of the United States, equity markets tanked, the Dollar Index* fell and gold and silver soared. The immediate market reaction was based in part on the shock value of Trump’s upset victory. Main stream media outlets and major pollsters all had projected that Hillary Clinton would win handily. In addition, the conventional wisdom was that Donald Trump was somewhat of an unknown quantity and what was known about him was he was a volatile personality. The initial market reaction, reflected that, like Brexit, Trump would be a disaster for the markets as markets hate uncertainty. A Hillary Clinton victory would have meant more of the same and markets were comfortable with the steady rise in markets the past several years.

Within a day, however, the “Trump will be a disaster” mentality abated and reversed. From mid-November until early January, the Dollar Index soared, equity markets caught a bid higher and gold and silver gave up a good portion of their 2016 gains. The prevailing market participant wisdom changed to the view that Trump would be good for markets as he would push for tax cuts and fiscal stimulus that would boost the U.S. economy. Thus, markets believed that Trump would inject new life into the several years old bull market.

Trump Reality – Not Fake News

As Trump’s inauguration approached the market mindset of a theoretical President Trump shifted to the mindset of the reality of an imminent Trump Presidency. The volatility of Donald Trump came into sharp focus. His contentious relationship with the main stream media that prevailed during the campaign injected an uncertainty into the mix that many had discounted or expected would fade as Mr. Trump assumed the Presidency. President-elect Trump showed that he hadn’t changed his attitude towards the press and that his tactics for dealing with them hadn’t either. After a report by Buzzfeed that was also carried by CNN, that Donald Trump had engaged in some unsavory behavior while in Russia, Mr. Trump met the press head on in his first press conference as President-Elect. During that press conference, Donald Trump referred to Buzzfeed as a “failing pile of garbage” and shut down a CNN reporter by saying his media outlet was terrible and “fake news”.

Yesterday, Donald Trump continued his assault on the press, referring to CNN as “very fake news”.

The President-Elect also has continued his habit of sending out tweets containing his opinions and lashing out at those he disagrees with. These tweetstorms, in effect mini-policy statements, have also put markets on edge.

Markets got the message – the reality of Trump had sunk in. Not only did it appear that Donald Trump would not become “more Presidential”, he was going to move aggressively to implement his campaign promises of curbing immigration, building a wall along the U.S. Mexican border, repealing ObamaCare, cutting taxes, renegotiating NAFTA and NATO and cancelling the Trans Pacific Partnership. Thoughts of fiscal stimulus and a growing economy have faded as the likelihood of tax cuts, repeal of ObamaCare and fiscal infrastructure spending seem less certain or imminent. What does appear certain is that Donald Trump will pursue his agenda. While the parts of his agenda that require Congressional approval (the parts the markets liked) may be delayed, the parts that the President can pursue on his own will be addressed in rapid succession, creating a vocal opposition from Democrats and protesters.

This type of turmoil should keep markets on edge.

The Dollar, Dow, Gold and Silver

Against the backdrop of a President-Elect and President Trump, the Dollar Index has fallen about 3% since early January when it peaked at 103.2. The Dollar index stood at 100.90 at the close of trading on Friday. The Dollar Index was 98.50 on November 9, 2016.

Surprisingly, equity markets continue to march higher and set all time highs with the Dow Jones Industrial Average passing 20,000 for the first time in late January. The Dow was at 18,569 on November 9 2016 and stood at 20,624 at the close of trading on Friday, up over 10% since election day.

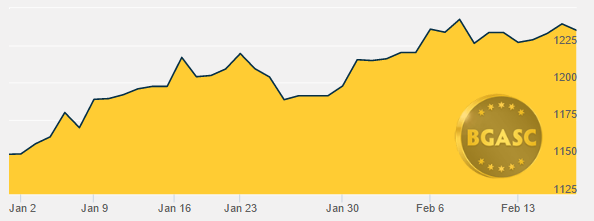

Year to date gold is up over 7% from $1151 an ounce on January 3 to $1236 at the close of trading on Friday. Gold has risen seven out of the last eight weeks.

Year to Date Gold Prices

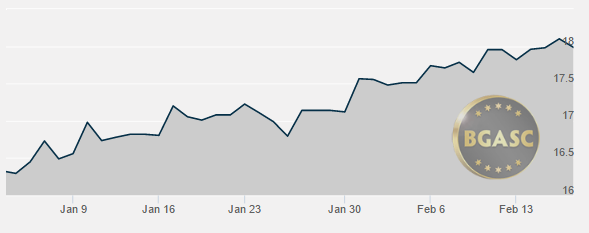

Year to date silver is up 12.8% from $15.95 an ounce to $17.99 at the close of trading on Friday. The price of silver has risen eight weeks in a row.

Year to Date Silver Prices

Oil

The price of oil has seasawed all year trading on news of size of stockpiles. OPEC’s decision to cut output had pushed oil back to over $50 a barrel. Oil continues to trade on vacillating sentiment whether output cuts will be enough to offset the current oil glut.

Oil was trading at $53.37 a barrel at the close on Friday.

Other Currencies

The Euro has weakened over the past year and has been trading just over parity to the U.S. Dollar. Concerns over Brexit, the ongoing Greek debt crisis, a potential Italian referendum to leave the EU and the possibility of Marine Le Pen becoming the President of France this year have weighed on the Euro. Ms. LePen has vowed to take France out of the Euro and re denominate France’s debt in Francs.

The British Pound has been range bound since the Brexit vote in June 2016. The pound fell from $1.50 to about $1.25 and has traded on news of what type of Brexit might be in store for Great Britain once Article 50 is invoked in March.

What’s next?

Trump uncertainty will continue to keep markets off-balance. The Federal Reserve raised interest rates a quarter of a point in December and projected three to four more hikes in 2017. January’s Fed meeting, however, passed with out a rate hike. Market participants will continue to monitor economic data, including inflation and jobs data as well as Fed President pronouncements for hints of further rate hikes.

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.