Why Does Gold Matter To China and Russia But Not the United States?

Gold was important to the U.S. to nationalize in 1933, to build Fort Knox in 1936 to store it and to stop foreign central bank redemptions of dollars for gold in 1971, but not important enough to ever add more to its reserves.

The Closing of the Gold Window

On August 15, 1971, President Richard Nixon went on national television, interrupting popular program ‘Bonanza”, to announce that the United States would no longer adhere to the gold standard established in 1944 by the Bretton Woods Agreements. Under those agreements, the dollar was to be the world’s reserve currency, backed by gold under which other central banks could redeem their dollars for gold held by the United States Treasury. Coupled with Mr. Nixon’s television appearance, he also signed an executive order directing the U.S. Treasury to “suspend temporarily” the right of foreign central banks to redeem their dollars in exchange for gold.

That suspension is still in effect today, and the dollar is no longer backed by gold.

Nixon’s closing of the gold window was precipitated by the increase in gold redemptions by foreign central banks prompted by the alarming deficit spending the United States was engaged in at the time, including borrowing to fund President Johnson’s massive new government welfare program (the “Great Society”), the United States’ increasing engagement in the Vietnam War and expenditures for the “space race” designed to leap frog the Russians and land a man on the moon. Foreign central banks grew concerned that the U.S. did not have enough gold to back their increasing deficit expenditures and preferred to have gold instead of dollars and increased their redemption requests until Nixon cried “enough’ and closed the gold window.

Having avoided a total drain of her gold reserves by closing the gold window, the United States didn’t try to rebuild them and set about instead to make the dollar the only foreign reserve asset that might matter.

Introducing the Petro Dollar

After gold no longer backed the U.S. dollar, U.S. entered into agreements with the oil producing nations, including Saudi Arabia and convinced them to price their product in dollars and accept only dollars as payment. In exchange the United States would provide military protection. These ‘petro dollar’ agreements coupled with U.S. military and economic preeminence created foreign demand for dollars and U.S. Treasury Bonds. This demand supported the dollar as the world’s reserve currency, even if it was no longer convertible into gold.

Since 1971, the dollar has retained its world reserve currency status, backed only by the ‘full faith and credit” of the United States (and the petro dollar agreements), which to date have been deemed ‘good enough’ for the rest of the world. The United States has issued trillions dollars in U.S. Treasury Notes over the years and they are considered safe and liquid. Nearly all central banks hold U.S. Treasuries as their main reserve asset.

The Way It Was

On April 5, 1933, President Franklin Delano Roosevelt issued an executive order requiring U.S. citizens to turn in their gold, including any U.S. gold coins then in circulation. People turning in their gold got the then market price of $20.67 an ounce. The gold the U.S. collected from its citizens became the gold of the nation and formed the bulk of the United States’ gold reserves. On January 30, 1934, Congress passed the Gold Reserve Act of 1934 that, among other things, revalued gold to $35 an ounce thus provided the United States with a devaluation of the dollar and a tidy profit on their gold confiscation.

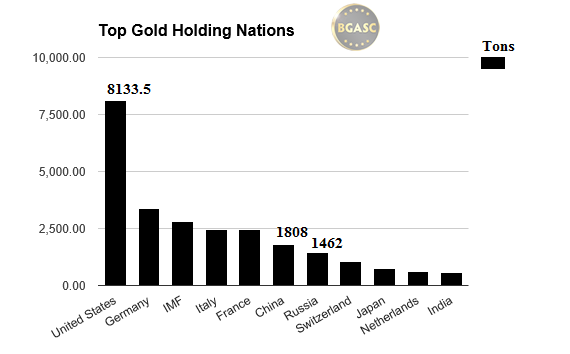

To store the nation’s gold, in 1936, the United States built Fort Knox, a massive vault facility in Kentucky. When Fort Knox opened in 1937 the United States shipped the bulk of the nation’s gold to Fort Knox. At one point in 1941, Fort Knox held nearly 650 million ounces (approximately 20,200 tons) of gold. By August 1971 due in part to a “run on the Treasury” by foreign central banks requesting gold for their dollars, the United States gold held at Fort Knox had fallen to about 150 million ounces, or about 4,600 tons. The rest of the United States’ gold totaling 8,133.50 tons, was and is still held at other locations, including West Point and the vaults of the New York Federal Reserve.

The U.S. gold holdings are the largest in the world but are frozen in time, with no official additions or subtractions since 1971.

In recent decades, U.S. Presidents and Fed Reserve officials almost never talk about gold, unless asked.

De-Dollarization Begins

During and after the financial crisis of 2008, the United States Federal Reserve, the issuer of the nation’s currency, engaged in ‘quantitative easing’ (QE) whereby they printed dollars out of thin air in order to purchase U.S. Treasury Bonds and mortgage backed securities to alleviate worsening financial conditions. The Fed also took interest rates down to zero percent where they stayed until December 2015.

QE caused a foreign central bank reaction to U.S. monetary policy similar to the foreign central bank reaction to U.S. excessive fiscal policy in the 1960’s. Foreign central banks became concerned about the value and stability of the dollar and U.S. Treasury Bonds. QE was viewed by some central banks, including the People’s Bank of China as undermining the value of the Treasury bonds they had accumulated as reserves. QE made foreign central banks nervous that the U.S. Federal Reserve would print as many dollars as it needed in an unrestrained fashion and thus undermine the value of their U.S. Treasury reserve holdings.

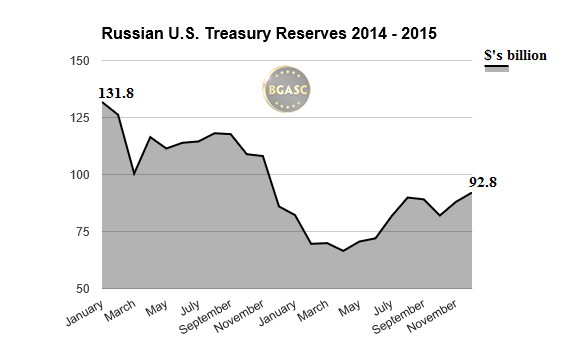

Over the past two years, the central banks of Russia and China, in particular, have diversified their foreign reserves away from U.S. Treasury Bonds and into gold.

Chinese Reserves

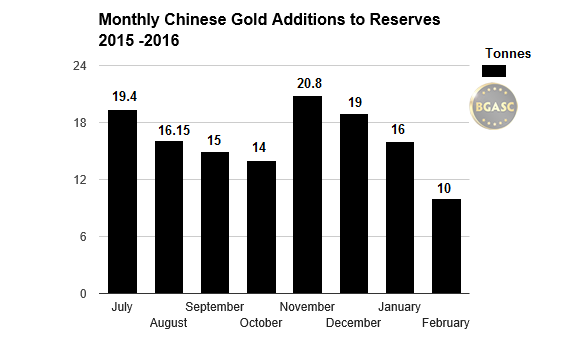

China has added significant amounts of gold to her reserves in recent years and reduced her holdings in U.S. Treasury Bonds.

Russian Reserves

The Central Bank of Russia, while smaller than the Central Bank of China, has added even more gold to its reserves in recent months.

Why are central banks adding to their gold reserves?

Perhaps they believe, like Former Federal Reserve Chairman Alan Greenspan that “gold is a currency, it is still by all evidences the premier currency where no fiat currency, including the dollar, can match it. If you are looking at a question of turmoil, we will find as we always have in the past it moves into the gold price.”

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.