Why the threat of inflation is different this time

Is Inflation Starting to Accelerate?

The Consumer Price Index (CPI) reading this week showing a 0.5% increase in January vs. expectations of 0.3%, has market observers on inflation watch. After nearly a decade of false inflation alarms, the most recent CPI reading may be the beginning of much higher readings in the future.

Back in 2009, when the Federal Reserve embarked on a multi-year, multi-trillion dollar quantitative easing (QE) program than involved printing dollars out of thin air to purchase mortgage backed securities and U.S. Treasury bonds, many market participant believed that was a sure fire way of creating price inflation. The Federal Reserve also lowered interest rates to zero and kept them there for several years adding further to the expectation of higher price inflation.

Much of the Fed’s money printing went to fighting the deflation that occurred after the housing bubble burst. With many homeowners underwater or bankrupt, demand for goods, services and large ticket items like cars and houses were severely diminished. The additional liquidity that banks gained by selling their severely discounted mortgage backed securities to the Federal Reserve, merely helped to shore up the large banks balance sheets. With this additional capital however, they did not increase their loans having little incentive to do so at such historically low rate interest rates and consumer demand and inflation remained subdued for years.

Government stimulus programs like cash for clunkers and the Fed’s low interest rates eventually managed to spur greater demand. The areas where the fiscal and monetary stimulus were directed – cars, homes, stocks and bonds – saw prices soar to all-time highs. In these areas we have seen significant price inflation even though the CPI showed very low inflation in recent years often below 2% annually. Some argue that part of the reason for low consumer price inflation as measured by the CPI the past ten years is due to the way the CPI is calculated, and doesn’t properly account for soaring health insurance premiums, housing costs, and college tuition. While the CPI may not have captured housing, education and asset inflation the past ten years, the CPI itself may also be set to rise significantly in the coming months and years as a result of the factors set forth below.

Trumpflation

Much of the anticipated price inflation may be attributed to the policies of President Donald Trump.

Tax Cuts

The U.S. Congress recently passed the largest tax cut in over thirty years. The new lower tax brackets kick in this month and will result in most Americans receiving larger amounts in their paychecks. Historically, tax cuts stimulate consumer spending. Increased consumer spending often results in higher inflation as more dollars chase the same amount of goods and services.

The Trump tax cuts also include lower corporate tax rates which are expected to lead to increased corporate spending and investment and to attract foreign capital. Companies have also announced plans to take advantage of a favorable provision in the tax bill that will allow them to repatriate billions in cash at lower tax rates. Corporations with greater available cash balances in the United States is expected to lead to greater corporate spending which will add to increased consumer spending and drive price inflation.

Wage increases & bonuses

Not only will U.S. workers take home a greater percentage of their paychecks this month, many will also be receiving raises and/or bonuses as a result of many large corporations choosing to pass along some of their tax savings to their employees, providing workers with yet more cash to spend.

Increased Deficit

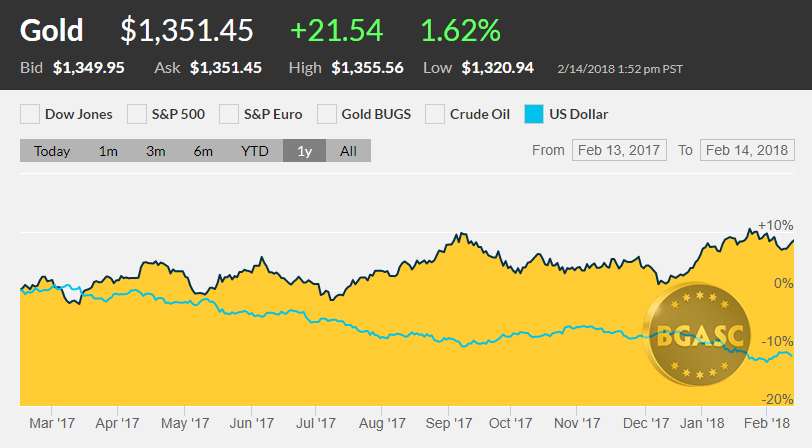

Since Donald Trump took office the Dollar Index* has fallen over 10%. Part of the reason for decline was a result of the massive gains in the Dollar Index from 2014-2017 following the Federal Reserve’s termination of its QE program at the end of 2014. The Dollar Index rose from 2014-2017 in anticipation that the Fed would engage in monetary tightening activities including tapering QE, ending it, raising interest rates and beginning to unwind its balance sheet. The Fed did not raise interest rates for over a year after they concluded QE and did not begin to raise them in earnest until the mid-2017. As a result, the Dollar Index had risen in expectation of a hawkish Fed that did not begin to take action until 2017. The Dollar Index has fallen due to a perception that the Fed has been behind the curve in its monetary tightening.

The Presidency of Donald Trump has furthered the perception that the Fed is behind the tightening curve as the Trump tax cuts are seen as boosting economic activity and GDP to levels that will require more aggressive tightening than has already been undertaken.

Lower Dollar

As a result of lagging dovish Fed policy, combined with the Trump tax cuts, increased deficit, and incessant political turmoil in the U.S., including an ongoing controversial special counsel investigation into supposed Russian meddling in the U.S. Presidential election of 2016, a press hostile to the President and a combative Trump, the Dollar Index has continued to fall in 2018.

A lower dollar adds to inflationary pressures as many consumer goods are imports purchased largely from China. As such, the cost of imported goods are expected to become more expensive as the devalued dollar will buy less on a relative basis than a year ago when the Dollar Index was higher.

Tariffs

The Trump administration has threatened to place tariffs on imported goods, including imports from China. Such tariffs will make prices for imported goods more expensive. Indeed, the Trump administration has placed a 30% tariff on solar panels imported from China and this week placed tariffs on cast iron solid pipe fittings imported from China. The Trump administration is also considering tariffs on Chinese steel imports and other products.

Tariffs on imported goods, coupled with a lower dollar will cause prices on imported goods subject to tariffs to become more expensive.

Inflation Hedges – Gold and Silver

Precious metals often provide a hedge against price inflation because gold and silver are in limited supply and have historically served as money and as stores of wealth. Having an inflation hedge is especially important for workers who do not receive pay increases as prices rise or do not receive pay increases at least equal to the increases in price inflation.

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.