China and Japan Lead Foreign Sales of U.S. Treasuries in December 2015

Foreign Selling of U.S. Treasuries Accelerated in December

According to the Treasury International Capital (TIC) Data released earlier this week by the U.S. Treasury Department, China’s U.S. Treasury Reserves fell by $18.2 billion, Belgium’s by $21.9 billion and Japan’s by $22.4 in December 2015.

The Treasury Department’s press release indicated that “The sum total in December of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a monthly net TIC outflow of $114.0 billion... and that net sales by foreign official institutions were $51.3 billion.”

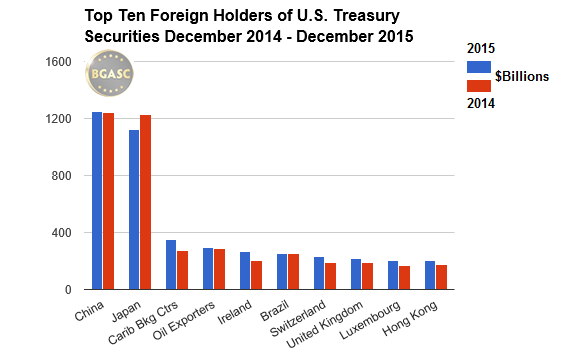

Analysts suggest that the sale of U.S. Treasury Securities by foreigners reflects prudent reserve management (selling) by sovereigns to support their currencies. The two largest holders of US Treasury Securities, China and Japan sold a combined total of $40.6 billion in December.*

While China and Japan have been selling some of the their U.S. Treasury Securities, both countries still possess over $1 trillion worth of U.S. Treasury Securities.

The chart below shows the U.S. Treasury Securities holdings of the top ten foreign countries as of December 2015 vs. their holdings as of December 2014.

Why Foreign Entities Hold U.S. Treasury Securities

Countries add U.S. Treasury Securites to their reserves as they are the world’s most liquid securities and can be held safely and sold when required to purchase oil, balance payments or defend currencies. Countries like China, that are net exporters to the United States, receive dollars that they use to buy U.S. Treasuries and build their reserves.

The United States benefits from foreign purchases of its debt securites as it allow it to incur massive deficits without having to raise taxes to pay for deficit spending. A reduction in demand for U.S. Treasuries by foreign purchasers may cause interest rates to rise and make servicing existing U.S. debt more expensive.

As oil producing countries struggle with the negative impact that the decline in oil prices has had on their currencies, selling U.S. Treasuries has become a viable option. Canada, whose currency, the Canadian Dollar, has been under pressure due to declining oil prices chose recently, however, to sell off half of their remaining gold reserves instead of selling some of their U.S. Treasury holdings. Canada’s Treasury holdings grew $4.1 billion in December 2015 to $72.4 billion from $68.3 billion in November.

In contrast, China has chosen to support its currency by selling U.S. Treasuries while adding to their gold reserves.

Declining oil prices also mean that countries that are net purchasers of oil need fewer dollar reserves to fund oil purchases and therefore need to hold fewer U.S. Treasuries adding to the potential selling pressure on U.S. Treasuries by foreigners.

To date, however, net sales by foreigners of U.S. Treasuries have not resulted in higher interest rates. “Safe Haven” buying by institutional investors has kept overall demand for U.S. Treasuries strong.

*The U.S. Treasury notes that the data in its chart of Major Foreign Holders of U.S. Treasury Securites is “collected primarily from U.S.-based custodians and broker-dealers. Since U.S. securities held in

overseas custody accounts may not be attributed to the actual owners, the data may not provide a precise accounting of individual country ownership of Treasury securities.”

A complete set of TIC Data can be found here.

All Blog Articles are provided by a third party and do not necessarily reflect the explicit views of BGASC, nor should they be construed as financial advice.