China Was The World’s Largest Gold Consumer in 2017

Chinese Jewelry and Gold Coin and Demand Kept China as the Number One Gold Consumer in the World in 2017.

The World Gold Council Numbers.

According to the World Gold Council, (WGC) Chinese gold demand in 2017 was nearly 1,000 tons. This figure does not include gold traded on the Shanghai Gold Exchange or gold acquired by the People’s Bank of China or other Chinese state owned enterprises. Chinese jewelry demand grew 3% from 2016 to 646.9 tons and gold bar and coin demand rose 8% to 306.4 tons.

Chinese total jewelry, gold coin and bar demand of 953.3 tons topped India’s 726.9 tons of gold demand. Indian jewelry demand grew 12% in 2017 to 562.7 tons up from 504.5 tons in 2016. Indian gold coin and bar demand grew 2% in 2017 to 164.2 tons.

The numbers from the World Gold Council do not, nor could they adequately, reflect any black market gold that may have been smuggled into India and China.

The China Gold Association Numbers

The China Gold Association (CGA) reported that Chinese Gold demand in 2017 was 1089.07 tons, up nearly 10% from 2016. The CGA numbers for jewelry demand were 696.5 tons vs the 646.9 tons reported by the WGC, and 276.39 tons (vs. 306.4 tons) for gold coin and bar demand. The CGA also included 90.18 tons of Chinese gold demand for use in industry.

Chinese Gold Pandas

Here are some other sources of gold demand in China.

Shanghai Gold Exchange

The Shanghai Gold Exchange has grown over the past ten years. Gold withdrawals on the Shanghai Gold Exchange have averaged over 2000 tons a year since 2013.

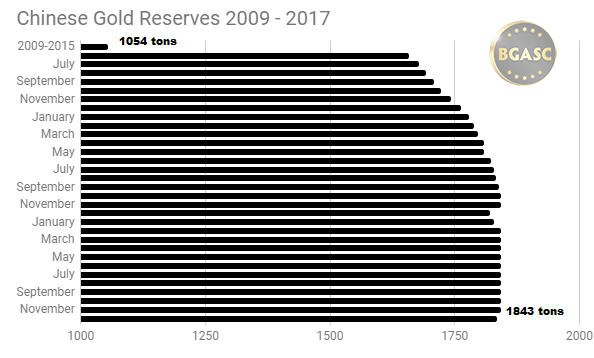

People’s Bank of China

Where does all China’s Gold Come From?

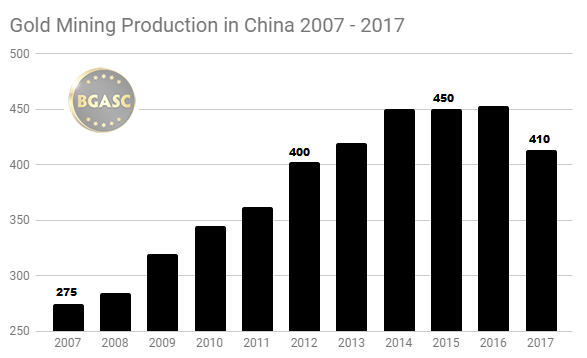

Unlike India that has virtually no domestic mining production, China leads the world in gold mining production for the past five years averaging nearly 450 tons a year.

In addition, China imports hundreds of tons of gold a year through Hong Kong and unreported amounts through Shanghai.

Outlook

Unlike India, the Chinese government does not try to limit gold consumption. Indeed for well over a decade the Chinese government has encouraged private ownership of gold which had been previously outlawed. With the recent clampdown on cryptocurrency exchanges, gold remains the preferred Chinese alternative asset.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.