Chinese Central Bank Adds No Gold To Reserves in November

The People’s Bank of China’s Gold Holdings are Not a Proxy for Chinese Gold Demand

The People’s Bank of China reported that it added no gold in to her reserves in November. It was the second month in 2016 that the PBOC did not add any gold to reserves. Chinese foreign reserves fell $69 billion in November after falling $48 billion in October.

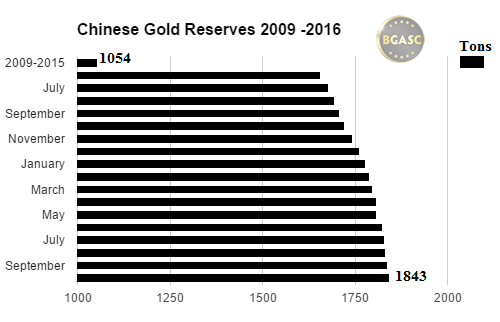

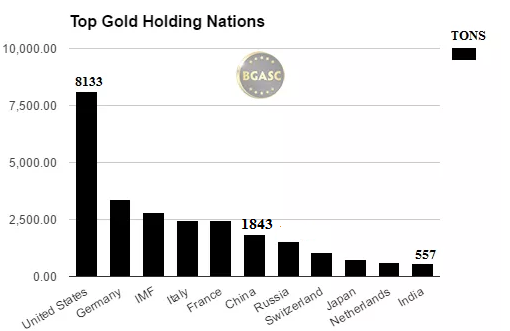

The PBOC has been reporting its gold reserves on a monthly basis since July 2015 after not updating its gold holdings since 2009. China has added about 185 tons of gold to its reserves, bringing its total to 1,843 tons, the fifth most of any nation. China’s pace of gold acquisition, however, has slowed in 2016 as Chinese foreign reserves, including her holding of U.S. Treasuries have fallen.

The People’s Bank of China’s gold reserves form a part of the PBOC’s overall foreign reserves. Gold as a percentage of Chinese foreign reserves is under 3%.

Chinese gold reserves stand at nearly 1,843 tons. While this is an impressive hoard, it does not reflect the entirety of the Chinese gold market or gold demand.

China’s Foreign Reserves Fall for Fifth Straight Month

Chinese foreign reserves have been falling for the past five months and reached a five year low in November. Despite the decrease in reserves since July, China added gold in each month except November. China’s reserves fell to $3.20 trillion in July and again in August to $3.19 trillion. In September, Chinese foreign reserves fell to $3.166 trillion, to $3.12 trillion in October and another $69 billion to $3.052 trillion in November.

Chinese U.S. Treasury Bond Holdings

China has shed $101 billion of U.S. Treasury securities from September 2015 to September 2016. As of September 2016, China held $1.157 trillion in U.S. Treasury Bonds, making China the largest foreign holder of U.S. Treasury securities, ahead of Japan’s $1.136 trillion holdings.

While the PBOC focuses on re-balancing its foreign reserves, gold demand and production in China continue at a healthy pace. Only a small portion of gold that is produced and imported into China finds its way to the foreign reserves of People’s Bank of China.

Chinese Gold Imports in 2016

Chinese gold imports through Hong Kong were at 669 tons at the end of October, 2016. In 2014 and 2015 Chinese gold imports through Hong Kong were 813 and 861 tons, respectively. China does not report additional amounts of gold imported through Shanghai.

Shanghai Gold Exchange

China operates the largest physical gold exchange in Asia, the Shanghai Gold Exchange. Through October 2016, gold withdrawals on the Shanghai Gold Exchange were 1,559 tons of which 153 tons were withdrawn in October. Gold withdrawals were 1,654 and 2,165 tons in 2014 and 2015, respectively.

Chinese Gold Mining Production

China is the world leading gold producer, having mined 460 tons of gold in 2015.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.