Chinese, Russian and Kazakh Central Bank Gold Buying Spree

Top Three Eastern Central Banks Add Nearly Nine Million Ounces of Gold To Reserves in 2016

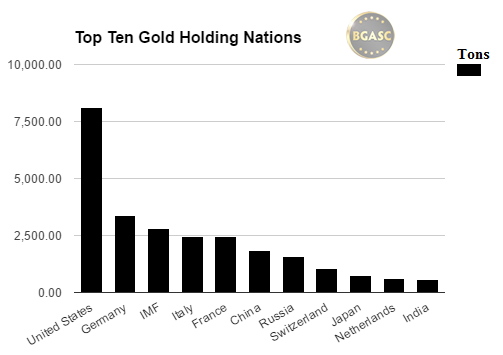

Central Bank gold buying has been on the rise for the past five years. The buying, however, has been concentrated in the central banks of China, Russia and Kazakhstan. The gold buying of the People’s Bank of China and the Central Bank of Russia has been substantial enough to vault both of them into the top ten gold holding nations of the world. Gold buying by the National Bank of Kazakhstan over the past two years has moved it from thirty-fifth place to twentieth among gold holding nations.

Western Central Banks Hold or Sell Gold, While Eastern Central Banks Add Gold

The central banks that constitute the top ten gold holding nations, other than Russia and China, have not added any gold to their reserves over the past five years. Indeed, many have not added gold for over thirty years.

Switzerland, sold over 1,000 tons of gold from 2000-2007 driving gold as a percentage of foreign reserves from 40% to about 8%. Switzerland now holds 1,040 tons of gold.

The Bank of England sold about 400 tons of gold from 1999-2002. Gordon Brown, the United Kingdom Chancellor of the Exchequer, led the sale during a period of time when gold was at multi-year low. The period of time during which the UK sold its gold is often referred to as “Brown’s Bottom”. Gordon Brown later became the UK’s Prime Minister. The Bank of England is no longer in the top ten gold holding nations and holds only 301 tons of gold and ranks 17th.

The Central Bank of Canada sold off its remaining gold reserves in 2016 and no longer lists gold as a reserve asset.

Through October 2016, the central banks of Russia, China and Kazakhstan have collectively added over 275 tons (approximately 8,873,606 million ounces) of gold to their reserves. The gold additions of these three central banks accounted for about 90% of all gold added to reserves by central banks in 2016.

China

The People’s Bank of China has added over 80 tons of gold through October 2016. China has added gold even as its overall foreign reserves have fallen significantly during the year.

Foreign Reserves: $3.06 Trillion

Gold as a percentage of foreign reserves: 2%

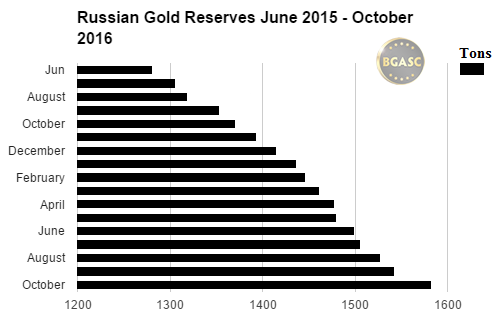

Russia

The Central Bank of Russia has added more gold the past two years than any other nation. Through October 2016, Russia has added 168 tons of gold. In 2015, Russia added 208 tons of gold.

Foreign Reserves: $390 Billion

Gold as a percentage of foreign reserves: 15%

Kazakhstan

The National Bank of Kazakhstan has added 28 tons of gold to her reserves in 2016 after adding about 23 tons in 2015.

Foreign Reserves: $30.4 Billion

Gold as a percentage of foreign reserves: 34%

Western central banks, it appears have gone all in on a debt based fiat currency system and have de emphasized gold as a reserve asset. The central banks of Russia, China and Kazakhstan appear to be hedging their bets and protecting their economies from an international debt crisis by bolstering their gold reserves.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.