German Bundesbank Shows Off Its Gold

Western nations rarely discuss their gold holdings. U.S. Presidents and Federal Reserve officials do not comment on the United States gold position unless asked. Last year, United States Treasury Secretary Steven Mnuchin visited Fort Knox where more than half of the United States gold is held. It was the first visit of a U.S. public facility in over thirty years.

German Talks Up and Exhibits its Gold

Since 2013, Germany has been discussing its gold a lot. In January 2013, Germany stunned the gold community by making gold repatriation request of United States Federal Reserve in New York and Banque de France in Paris where Germany held nearly 700 tons of gold. Germany mentioned that having more of their gold nearby would be useful in the event of a currency crisis.

The original response from the Federal Reserves was that Germany could get her gold back – over the next eight years! The response had many questioning whether any or all of Germany’s gold was actually being held at the NY Fed’s gold vaults in southern Manhattan.

From 2013 through 2016 the German Bundesbank would announce the progress they were making towards reaching their goal of having more than half of their gold back in Germany.

By February 2017, the German Bundesbank announced that it had received all its requested gold back from abroad. As a result of the repatriation, Germany now has just over 50% of their gold within Germany’s borders with about 37% still held at the New York Federal Reserve and 13 percent held at the Bank of England in London.

Now that half the gold is back, Germany is putting on a near half year gold exhibition to show off the country’s gold bars and coins. They have also published a book “The Gold of the Germans” that also showcases some of Germany’s gold collection.

In this video, Jens Weidman, President of the Deutsche Bundesbank explains the historic reasons for storing Germany’s gold abroad and the value of gold to Germany. Since the advent of the Euro, there is no longer a need to hold gold in France, while London and New York provide sufficient geographic diversity and dollar and pound exchange capabilities.

Germany Gold Facts

Gold represents about 67% of Germany’s Reserves.

The value of Germany’s gold is about $120 billion.

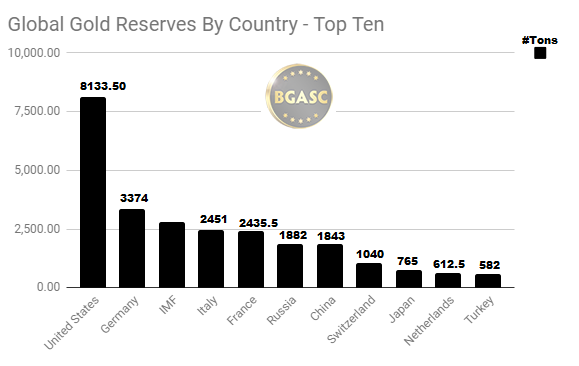

Germany holds 1.8% of the world’s gold.

German gold reserves decline a small amount each year as the Bundesbank sells gold to the Federal Government to mint gold coins.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.