India Imports 106 Tons of Gold in First Two Months of 2018

Indian Gold Imports Remain Robust at Start of 2018.

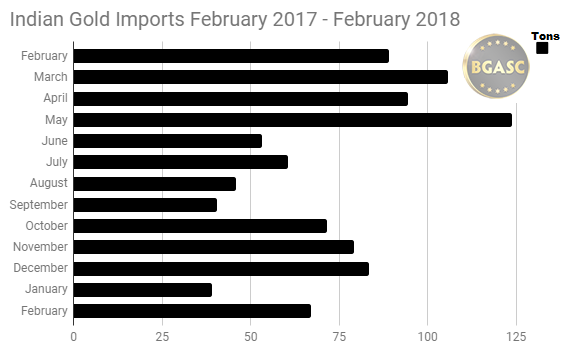

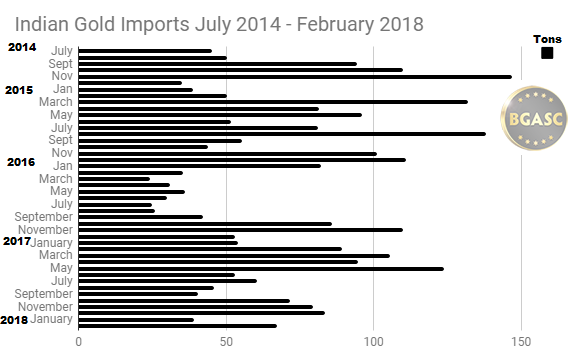

After rising 55% in 2017, Indian Gold imports cooled off in January and February, falling 26% from the first two months of gold imports in 2017. India reported importing 106.2 tons (approximately 3,414,409 troy ounces) of gold in January and February, highlighting the prodigious gold demand that continues to exist in that country, even when imports decline. Preliminary reports for March indicate that gold imports fell about 32%.

Do Lower Gold Imports Mean Demand for Gold in India Falling?

Because India does not have any significant domestic gold mining, it relies heavily on gold imports to meet demand. While gold imports are generally a good barometer of the strength of gold demand in India, there are other factors of Indian gold demand. A good portion of Indian gold demand is met from existing gold stocks in the country. Analysts believe part of the decline in Indian gold imports during the first three months of 2018 is due to an increase in recycling of existing gold in the country. Higher gold prices, tend to incentivize gold holders to bring theirs to the market.

In addition, the import of Dore bars (rough gold procured directly from mines that is about 80% pure) into India is on the rise and is not counted in the official gold import numbers. About twenty Indian refiners take the imported Dore bars and refine then into gold suitable for jewelry and gold bars and rounds. Any increase in domestically refined gold from Dore, my impact negatively gold imports.

Indians are also price sensitive and will curb their gold purchases when the price rises and increase them when the price falls. Gold demand is also subject to the fortunes of the Indian rural farmers. If crops are good, farmers will have extra cash on hand which they often use to buy gold. According to reports, farmers’ fortunes this winter have been dented by oversupply and in some instances failed crops due to lower than normal rainfall during the monsoon season.

Indian Gold Imports by the Numbers

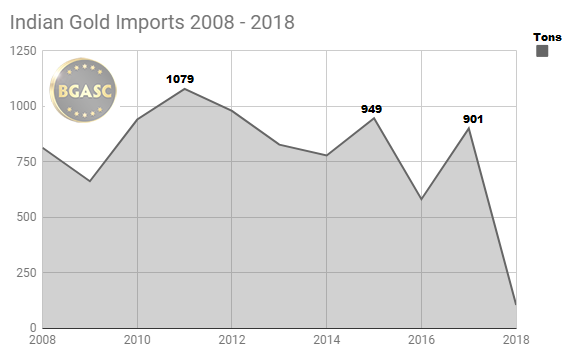

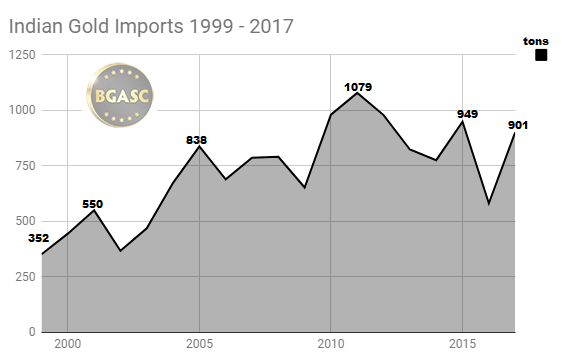

Despite rising gold prices and government efforts to reduce gold demand, India’s gold imports surged in 2017 to 901 tons up 54.8% from 2016 imports of 582 tons. Indian gold imports from 2008-2017 have averaged over 850 tons a year.

India’s 901 ton gold imports in 2017 were approximately 29 million ounces. Due to the great demand for gold in India, gold often accounts for 10-20% of overall Indian imports, wreaking havoc with India’s balance of trade.

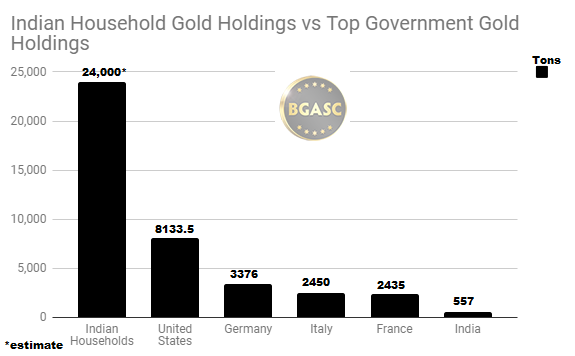

The Indian government has tried to curb gold demand with a 10% gold import tariff instituted in 2013, and a variety of jewelry and goods and services taxes. The taxes have not curbed gold demand and have resulted in increased smuggling. Analysts estimate the amount of gold in private Indian citizens’ hands and temples to be approximately 23-24K tons (approx 771,617,928 ounces), worth over 1 trillion dollars!

The World Gold Council estimates that about 190,000 tons have been mined in human history. This would mean that Indian citizens hold about 13% of the gold ever mined in the world.

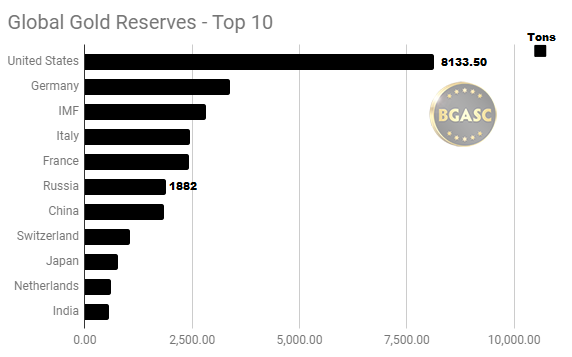

Indian household gold holdings far exceed the top gold holding nations’ gold reserves including India’s own central bank which holds 557.7 tons or the tenth largest gold holdings among nations.

India’s growing population and increase in income levels has created large and steady annual gold demand that shows no sign of abating. India launched a gold monetization scheme two years ago in an attempt to wrest some of that gold away from its citizens and temples. Under the scheme the Indian government offered Indians a chance to “loan” their gold to the government in exchange for interest payments. There was a tepid response from the Indian temples and little enthusiasm for the scheme among Indian citizen.

Tola Gold Bars – The Weight Used to Measure Gold in India

Here is a chart of Indian gold imports from 1999 – 2017.

Reserve Bank of India Gold Reserves

India has had a culture affinity with gold for thousands of years. While Indian households and temples are estimated to own nearly 20,000 tons of gold, the Reserve Bank of India lists just 557 tons of gold.

Indian central bank gold reserves are tenth among individual nation central banks.

India’s War on Gold, Coming to a Close?

The Indian government appears ready to embrace gold rather than to continue fighting it. While gold has been Indians’ preferred asset class for thousands of years, earlier this month the Indian government announced that it intends to develop gold as an asset class as a matter of policy. Some of the initiatives include encouraging financial institutions to develop gold-backed financial products, developing regional regulated gold exchanges, supporting the gold recycling market, hallmarking and revamping/relaunching its gold monetization scheme. These efforts, along with recent innovations in “digital gold” offerings, will provide Indians with more gold options to store and trade their wealth in the coming years.

Check out gold for sale at BGASC.com

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.