Indian Gold Demand Soars During The War on Cash

The Removal of 86% of India’s Currency Almost Overnight Has Led to an Indian Gold Rush

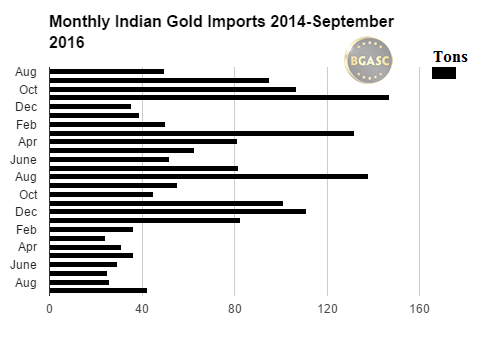

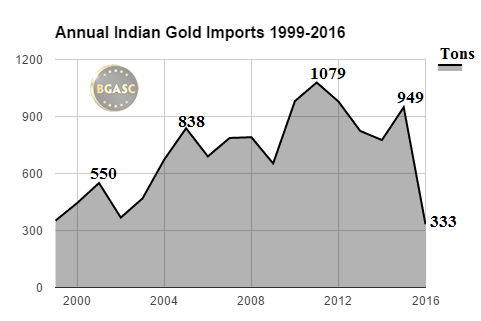

Indian gold demand had been down all year in 2016. Rising gold prices, a jewelry tax and a 10% import duty all acted to curb gold demand in India. India is usually the largest consumer of gold in the world. In recent years, China has challenged India for the title of largest gold consumer.

Gold demand in India has soared in recent weeks due to a shock announcement by the Prime Minister of India that 500 and 1000 Indian Rupee notes would cease to be legal tender, effective almost immediately. This meant that the 500 and 1000 Rupee notes could not be used at all to transact business. Together 500 and 1000 Rupee notes constituted approximately 86% of all currency then circulating in India, in a country where 80% of all transactions are conducted in cash!

The announcement the Prime Minister explained was designed to catch criminals and terrorists trading in cash unaware.

According to the Prime Minister, the 500 and 1000 Rupeee notes, worth approximately $7 and $14, respectively, would have to be either exchanged for new notes (in amounts not to exceed 4,500 Rupees) or deposited in a bank. If either of these actions is not taken by year, the notes would be utterly worthless.

The Prime Minister’s announcement not only caught India’s criminal class unaware, but also its more than one billion law abiding citizens.

The cash ban announcement led initially to a rush to exchange the 500 and 1000 rupee notes for gold at local jewelry shops. Demand was reported to be up nearly 25X on the evening of the Prime Minister’s announcement. Premiums on gold rose to nearly 70% over the spot price.

Since India does not have a domestic mining supply, it relies on gold imports and recycling of domestic gold to meet demand. With demand skyrocketing, we expect October and November legal imports of gold to skyrocket and for gold smuggling into India to increase.

Long lines have formed at the Indian banks with people looking to exchange their notes or deposit them in the bank. To complicate matters, most banks do not have nearly enough new cash notes necessary to make possible the exchange of the old notes for new ones. Sufficient bank notes are not expected to be available for six months, according to Indian officials. Further, nearly half the country and up to 80% of rural Indians do not have bank accounts. These Indians are forced to exchange their notes for new ones if they can find a bank with enough notes to make the exchange or they must open new bank accounts.

Wealthy Indians have sent their servants to deposit or exchange cash on their behalf. In the meantime, commerce has slowed to a standstill. Whether the Indian government’s ban of small bills actually curbs corruption remains to be seen. What is clear is that government can devalue or recall their currencies when and as they see fit.

While governments can attempt to reprice or ban gold as a medium of exchange, their actions can only have a temporary effect, or even be ignored. Indians have a five thousand year history of cherishing gold as a store of value, irrespective of what their rulers or governments may have decreed.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.