Indian Gold Demand Soars While U.S. Mint Sales Fall

Sales of Gold in India and China Surge, While U.S. Mint Sales Plummet

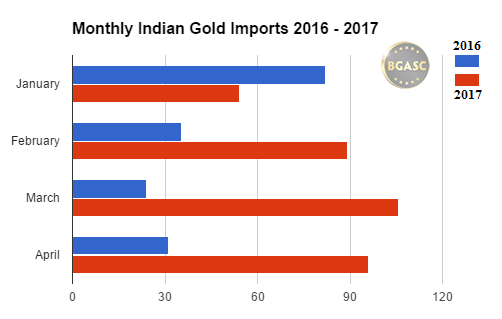

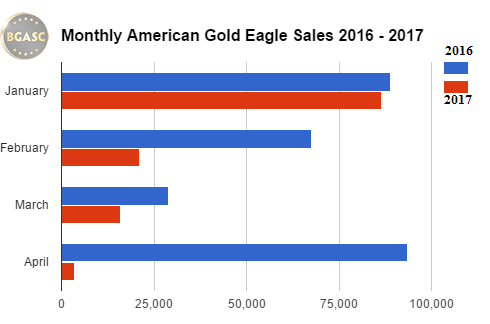

A divergence between gold demand in the East and gold demand in the west is in full swing. Indian gold demand has soared in the first four months of 2017, while gold sales at the U.S. Mint Mint (see charts below) have plummeted steadily since the beginning of the year.

Chinese gold demand is also quite robust with demand for gold bars and withdrawals on the Shanghai Gold Exchange up over 10% on a year over year comparative basis. Combined India and China are rejuvenating physical gold demand globally. In addition, the Central Bank of Russia has added a significant amount of gold to her reserve since the beginning of the year.

Decrease U.S. Mint gold sales are baffling because the economy has not changed significantly since the beginning of the year and there has been no lessening of geopolitical tensions either. Indeed, Chicago Fed President Charles Evans mention the geopolitical issues are more intense now than they were 18 months with events in North Korea and Syria dominating the news. The potential for additional Federal Reserves rates hikes may be weighing on U.S. gold sales. Recent pronouncements by Fed officials, however, indicate the Fed is more likely to take a gradual approach to raising rates further this year, if at all.

Here is a chart of Indian gold imports for the first four months of 2016 compared to 2017. Since India has virtually no domestic gold mining production, gold imports are a good proxy for gold demand in India.

Here is a another chart showing U.S. Mint Gold Eagle sales from the first 4 months of 2016 compared with the first four months of 2017.

The Indians and Chinese have a long history of accumulating gold.

Perhaps, when they are buying it may be a good time to be buying too.

Check out gold for sale at BGASC.com

U.S. Mint American Gold Eagles

Chinese Gold Panadas

Tola Gold Bars – The Weight Used to Measure Gold in India

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.