Indian Gold Imports Roar Back After Demonitization

Indian Gold Imports Soar in 2017

Indian Gold Imports

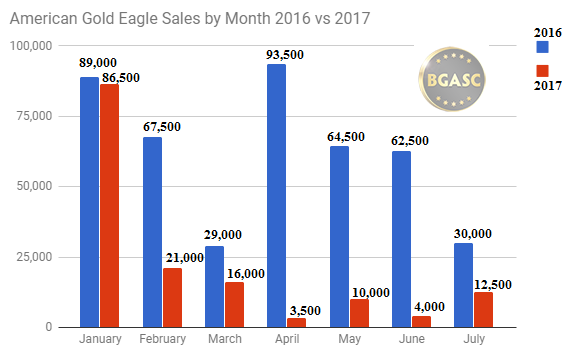

India’s gold imports continue to surprise to the upside. Indian gold demand has soared in the first seven months of 2017, while gold sales at the U.S. Mint Mint (see chart below) have plummeted steadily since the beginning of the year.

The divergence between Indian gold demand as measured by imports, vs U.S. gold demand as measured by U.S. Mint gold sales continues to widen.

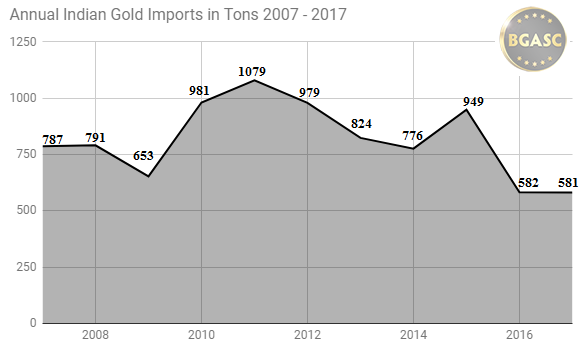

India has imported 581 tons or approximately 20.5 million ounces. At the current pace, India would import about 1,000 tons of gold in 2017 or about 35.27 million ounces or about 40% of the annual global gold mining production of about 2,500 tons a year.

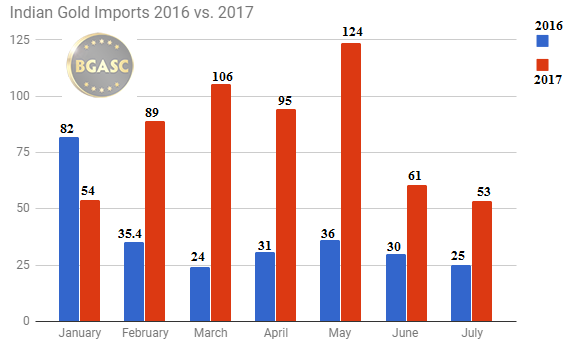

Here is a chart of Indian gold imports for the first seven months of 2016 compared to 2017. Since India has virtually no domestic gold mining production, gold imports are a good proxy for gold demand in India.

Through July, India has imported approximately 581 tons of gold vs 263 tons imported through July 2016, a 121% increase year over year.

India has had a culture affinity with gold for thousands of years. India’s growing population and increase in income levels has created large and steady annual gold demand in the sub-continent over the past decade.

Indian gold demand has been strong the past ten years

Reasons for increase in Indian Gold Demand in 2017

Gold demand in India has increased in 2017 largely due to pent up demand from 2016. Last year, gold imports were down the first half of the year in part due to the spike in gold prices in the run up to the Brexit election. Indians tend to buy more gold when prices drop and hold off on purchases when the price of gold rises. Also at the end of 2016, the Indian government demonitized about 90% of their paper currency, leaving many Indians without cash to make purchases, including gold. Earlier this year India completed its issuance of new currency and Indians were able to use that cash to make gold purchases that they were unable to make at the end of 2016.

Gold demand was also driven higher earlier this year as jewelers and gold dealers stocked up on gold in anticipation of a rollout of the Indian goods and services tax that was anticipated to be 5% for gold bullion. The goods and services tax was finalized at 3% for gold bullion and rolled out in July.

Demand is expected to be strong in the second half of 2017 as a good monsoon season this year has helped rural Indian farmers’ fortunes who traditionally buy gold with the excess farming profits.

Tola Gold Bars – The Weight Used to Measure Gold in India

U.S. Mint Gold Sales Slump in 2017

While Indian gold imports are 121% in the first seven months of 2017, US Mint gold demand as measured by sales of one ounce American Gold Eagles are down 65% during the same period.

Here is a chart showing U.S. Mint Gold Eagle sales from the first seven months of 2016 compared with the first seven months of 2017.

Reasons for Decrease in US Mint Gold Sales in 2017

The decrease in U.S. Mint gold sales can be explained by rising stock and crypto currency markets that has attracted capital away from gold. Also the anticipation that the Federal Reserves will continue to raise interest rates this year has weighed on gold sales. In addition, international and domestic political turmoil so far in 2017 have been fleeting. Lower gold sales can also be blamed on American gold buying patterns. Americans tend to buy gold (or assets in general) when it is going up, unlike the Indians who buy gold when the price is going down or steady.

Some market observers expect a rebound in U.S. Mint Gold sales in the second half of the year as recent pronouncements by Fed officials the Fed is more likely to take a gradual approach to raising rates further, if at all. Ray Dalio, the head of Bridgewater Associates, one of the most successful hedge funds in the world, earlier this month recommended that investors add gold to their portfolio as a hedge against increasing U.S. domestic political uncertainty. The stock market also appears to be in nosebleed territory leading many market participants to worry about a large correction.

With the stock market priced for perfection and domestic turmoil (Charlottesville) and international tensions (North Korea) on the rise, and a more recently dovish Fed, gold demand and prices may increase in the latter part of the year.

U.S. Mint American Gold Eagles

Check out gold for sale at BGASC.com

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.