Perth Mint February Silver Sales Up 168%

February 2016 Sales of Silver at the Perth Mint Rise 168% Year Over Year.

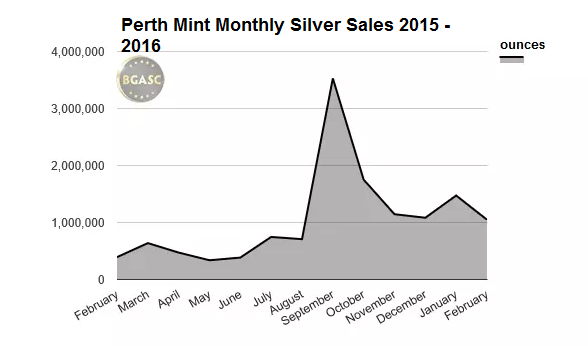

The Perth Mint sold 1,049,062 ounces of silver in February 2016. This was up 168% from February 2015 when the Perth Mint sold 392,114 ounces of silver. February 2016 silver sales at the Perth Mint were down 29% from January 2016 sales of 1,473,408 ounces.

The dramatic increase in silver sales at the Perth Mint is attributable to the introduction of the one ounce silver Australian Kangaroo coin in September 2015. This coin was released at a time when the major sovereign mints like the Canadian and United States Mints were having difficulty meeting demand. The Australian Silver Kangaroo was produced with the intention that it would not have a limited mintage like other Perth Mint silver coins like the silver Koala and silver Kookaburra.

Although the Perth Mint does not provide a break down of monthly sales of each silver coin it mints, the bulk of silver sales at the Perth Mint now come from the silver Kangaroo.

In the first month of mintage of the Australian Silver Kangaroo coin in September of 2015, Perth Mint silver sales topped 3.5 million, up from about 750,000 in September 2014, an increase of over 366%. The Perth Mint has now sold well over a million ounces of silver for the past six months since September 2015 through February 2016.

The Price of Silver in February 2016

According to Kitco, the average spot price of silver in February 2016 was $15.06 an ounce vs. $16.84 an ounce in February 2015, or 10.6% lower.

2016 Perth Mint Silver Sales Projection

If silver sales at the Perth Mint in 2016 continue at a pace of an average of 1,261.235 ounces a month (January’s 1,473,408 ounces and February’s 1,049,062 ounces) the Perth Mint will sell about fifteen million ounces of silver in 2016.

Did you know? The Perth Mint is Australia’s only precious metals refinery and the only major government mint to also operate a refinery.

Perth Mint silver sales data: The Perth Mint Blog

|

|

|

|

This article does not necessarily reflect the explicit views of BGASC, nor should it be construed as financial advice.