Perth Mint Gold Sales Take a Breather In July

July 2016 Sales of Gold at the Perth Mint Fall From First Half Year Levels.

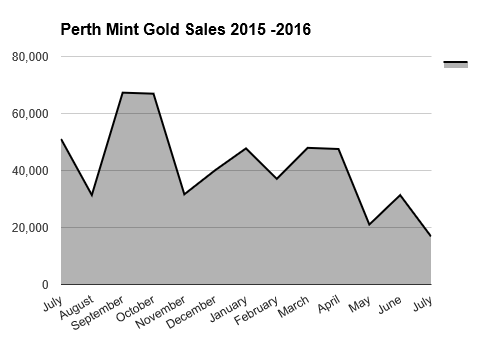

The Perth Mint sold 16,870 ounces of gold in July 2016. This was down by 67% from the Perth Mint’s July 2015 gold sales when the Perth Mint sold 51,088 ounces of gold. Lower July 2016 gold sales at the Perth Mint reflect a pause from higher sales in the run up to the Brexit election in June. The total gold sales reported by the Perth Mint include the wide variety of gold products it sells, the majority of which are in the form of its popular Gold Kangaroo coins (pictured above).

The Perth Mint noted that July’s sales were held back in “North America where distributors reported they were well stocked with product” and by subdued demand in continental Europe in the “post-Brexit, holiday environment.” Higher gold prices appear to have also dented physical gold demand.

In the second half of 2015, gold sales spiked at sovereign mints all over the world as investor concern over political stability (eg. Grexit) and unorthodox central bank policies resulting in ‘stimulus” and negative interest rates drove interest in the yellow metal. Gold sales accelerated at the Austrian, Canadian, U.S. and Perth Mints especially during the second half of the 2015. In 2016, political and economic uncertainty continued as Great Britain took the unprecedented step of voting to leave the European Union and many central banks took their interest rates further into negative territory. The price of gold soared in the first half of 2016 along with record gold investment demand, according to the World Gold Council.

Perth Mint Gold Sales 2015 – 2016

2016 Perth Mint Gold Sales Projection

If gold sales at the Perth Mint in 2016 continue at a pace of an average of 32,650 ounces a month, (January – July sales of 228,550 divided by seven) the Perth Mint will sell about 400,000 ounces of gold in 2016.

Perth Mint Sold 41 Times More Silver Than Gold In July

The Perth Mint sold 693,447 ounces of silver and 16,870 ounces of gold in July 2016 for a silver to gold sales ratio of 41.1 to 1. In comparison, in July, the U.S. Mint sold 1,370M American Silver Eagles and30,000 one ounce American Gold Eagle coins in July 2016 for a silver to gold sales ratio of 45.66 to 1.

In March 2016, in a rare occurrence, Perth Mint’s gold sales of 47,948 ounces were higher than the U.S. Mint’s total gold sales of 46,500 ounces in March that included all denominations of American Gold Eagles and American Gold Buffalo coins. The one off triumph of the Perth Mint in March reversed in April. The U.S. Mint’s 105,500 ounces of gold sold in April was more than double the Perth Mint gold sales. In May, the Perth Mint’s 21,671 ounces was well below the U.S. Mint’s sales of gold attributable American Gold Eagle coins of 76,500 ounces without counting the 18,500 ounces of gold sold in the form of American Gold Buffalo coins. In June, the Perth Mint’s 31,368 ounces of gold sold was about half of the U.S. Mint’s sales of 62,500 one ounce American Gold Eagle coins.

In 2015, the Perth Mint sold 11,775,927 ounces of silver and 457,132 ounces of gold for a silver to gold sales ratio of 25.76 to 1. In 2015, the U.S. Mint sold 47,000,000 one ounce American Silver Eagle coins and 626,500 one ounce American Gold Eagle coins for a silver to gold sales ratio of 75.02 to 1.

While Perth Mint gold sales were up year over year, they have stagnated in recent years as have gold sales at the major sovereign mints – the Canadian, U.S. and Austrian Mints. Retail investors have flocked to silver coins. The second half of 2015 marked a return in the growth of gold coin sales at the world’s largest sovereign mints that continues into 2016 even as silver sales continue at record pace.

About the Perth Mint:

The Perth Mint, located in Western Australia, is historically known for its gold sales. Australia ranks third in global gold production and has about ten percent of the world’s known gold reserves. Many of Australia’s gold mines are located in Western Australia where the Perth Mint was founded in 1899.

As a full service government mint, the Perth Mint produces legal tender gold and silver coins that are not intended, however, for general circulation. Australia’s general circulation coins are produced by the Royal Australian Mint. The Perth Mint focuses on minting precious metal bullion and collector coins and bars.

The Perth Mint has been refining about 300 and 400 tonnes of gold and silver each year and also supplies gold and silver blanks to other government mints. As a major producer of silver blanks, the Perth Mint has not experienced any production halts during the past year.

Perth Mint gold sales data: The Perth Mint Blog

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.