Russia Adds Nearly Twenty-Two Tons of Gold To Reserves

Even as Russia Struggles With Budgetary Issues, it Adds Gold to Reserves.

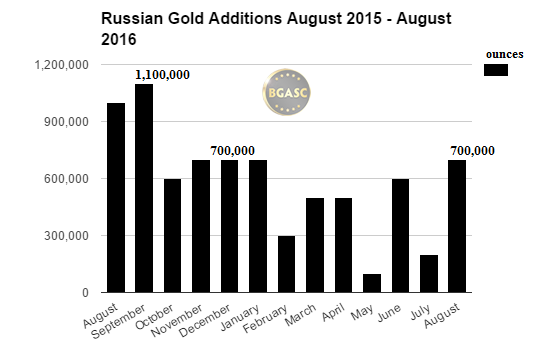

The Russian Central Bank announced this week that its gold reserves had reached 49.1 million troy ounces (approximately 1,527 metric tons). The total included an additional 700,000 ounces (approximately 21.8 metric tons) of gold added in August.

Year to date, the Russian Central Bank has added over 110 tons of gold to reserves. Over the past two years, Russia has led the world in adding gold to her central bank reserves, ahead of the People’s Bank of China, the central bank that has added the second largest of amount of gold.

The Central Bank of Russia added a record 208 tons of gold to reserves in 2015. Last year, Russia suffered financially as international sanctions and plummeting oil prices took their toll on the rouble and the inflation rate reached double digits. According to the World Bank, oil is by far Russia’s largest export and represents about 15-20% of Russia’s GDP and the majority of government revenues. 2016 has started off better for Russia. The price of oil and gold have increased significantly in 2016 and have helped Russia improve its financial situation and reserves.

Russian foreign reserves were at $371 billion in January and have grown to $395.2 billion as at August 31, 2016.

The pace of Russia’s gold purchases has slacked slightly in 2016 compared to 2015. Through August 2016, the Russian Central Bank has added 3.6 million ounces of gold to reserves compared to 3.6 million ounces added in 2015 during the same time period. In 2015, however, Russia did not add any gold to her reserves in January and February, so the pace from March to July 2015 (520,000 ounces per month) was higher than that from March to July 2016 (380,000 ounces per month).

In May, Russia added 100,000 ounces ( approximately 3 tons) to her reserves, the lowest amount that Russia had added since May 2015. Also in May, the Chinese central bank announced that it had added no gold to its reserves. The cessation of the People’s Bank of China’s gold purchases and the relatively small amount of gold added by the Central Bank of Russia in May, caused some gold market observers to suspect that both central banks were winding down their gold purchases, perhaps in reaction to the increasing price of gold.

In June, the People’s Bank of China added 480,000 ounces (approximately 15 tons) of gold to her reserves but added only 5 tons in July and August. The Central Bank of Russia added 18+ tons of gold to reserves in June and 6+ tons in July.

Russia Adds Gold To Reserves Despite Economic Weakness

Despite the weakness in the Russian economy, the Russian Central Bank has bolstered its foreign reserves from about $350 billion a year ago to over $393 billion at the end of July 2016. The Russian Central Bank has a stated goal of increasing reserves to about $500 billion in the coming years. Russian sovereign wealth funds have not fared as well and have lost about $90 billion in value since 2008, falling to about $32 billion.

As of August 31 2016, gold constituted about 12% of the Central Bank of Russia’s $395.2 billion reserves with her gold hoard valued at approximately $52 billion.

U.S. Treasuries as Part of Russia’s Foreign Reserves

In January 2014, Russia’s U.S. Treasury position was $131 billion. In reaction to U.S. inspired sanctions being placed on her, Russia sold a substantial portion of her U.S. Treasury holdings. Russian U.S. Treasury holdings reached a low of $66.5 billion in April 2015. Since then Russia has added back a portion of its U.S. Treasury holdings. As of July 2016, Russia held $88.2 billion in U.S. Treasury Securities.

The Gold Option

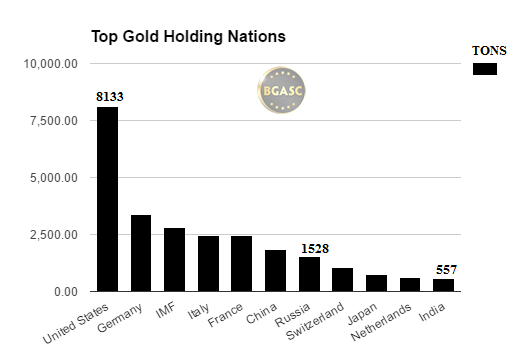

Russia’s pace of adding gold to reserves is the fastest in the world, surpassing China whose gold reserve additions over the past year are the second highest.From August to August 2016 China added 155 tonnes of gold to its reserves, while Russia added 230 tonnes, or 48% more.

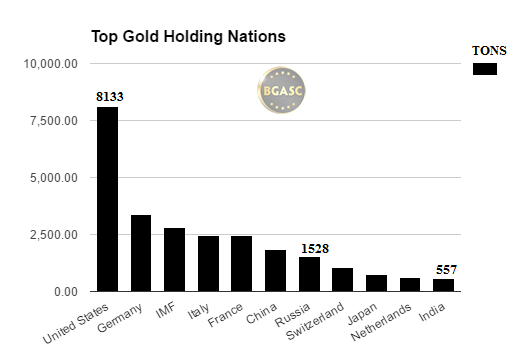

As a result of Russia’s gold buying binge, Russia has vaulted into the top ten gold holding nations and is now the sixth largest.

Russia’s decision to add gold to reserves has paid off as the price of gold has risen nearly 30% over the past year, with most of the gain coming in 2016. Russian gold mining produces the third largest annual output in the world. Exchanging depreciating Roubles for a good portion of their gold mining output has helped increase the value of Russia’s reserves. By retaining an increasing percentage of its gold mining output the Central Bank of Russia has been in effect converting roubles into gold.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.