Shanghai Gold Exchange Withdrawals Strong in 2017

The Shanghai Gold Exchange Reports Robust Gold Withdrawals through July.

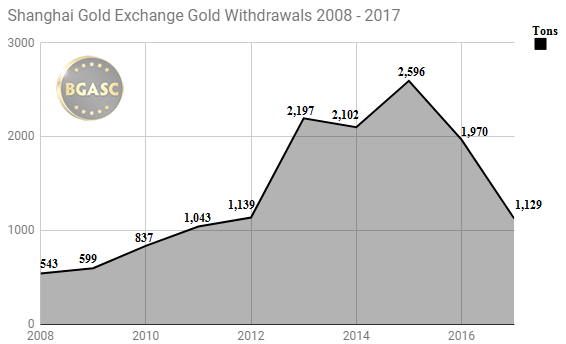

The Shanghai Gold Exchange (SGE) monthly gold withdrawals topped over 144 tons (approximately 4.63 million ounces) in July. The SGE has been reporting significant monthly withdrawals annually since 2013. In 2015, the SGE reported a record 2,597 tons of gold had been withdrawn, an amount roughly equal to the annual global gold mining production.

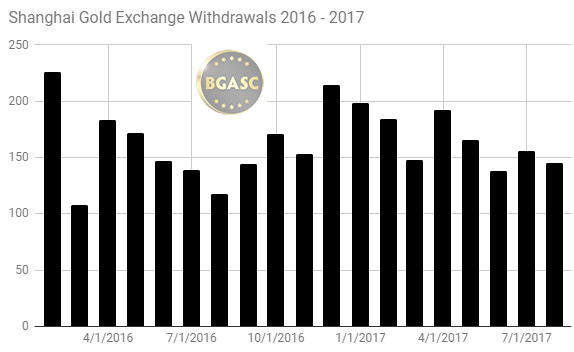

Continued robust gold demand as measured by the Shanghai Gold Exchange has continued in 2017. July 2017’s SGE gold withdrawals were about 23% higher than July 2016 withdrawals of 117 tons. SGE withdrawals through July were 1,129 tons or about 3.5% higher than the 1,091 tons withdrawn during the same time period of 2016.

In addition to a rapidly growing SGE, Chinese gold imports have also soared in recent years through Hong Kong and Shanghai. Chinese gold imports through Hong Kong peaked at 1,158 tons in 2013 and were 861 tons in 2015 and 770 tons in 2016. Through June 2017, Chinese gold imports through Hong Kong were about 400 tons. From 2004- 2008 Chinese gold imports through Hong Kong were only 339 tons.

While China has aimed for increased transparency in its gold holdings and imports, it does not yet disclose gold imports through Shanghai.

China is also the world’s largest producing nation having mined approximately 450 tons of gold a year for the past two years.

The People’s Bank of China’s Gold Reserves

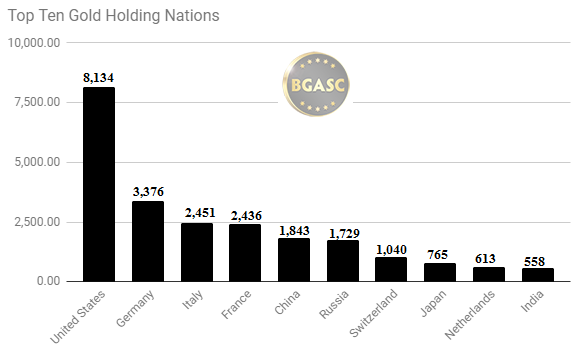

In July 2015, the People’s Bank of China (PBOC) released their first update to gold reserves in six years. The PBOC reported that they had added 604 tons of gold to their 1,054 tons held in reserve, bringing their total to 1,658 tons. Since then, through July 2017, the PBOC has added approximately 185 tons of gold, bringing its total to 1,843 tons. The PBOC gold holdings place it squarely among the top gold holding nations behind only France (2,435.50 tons), Italy (2,451.80 tons), Germany (3,381 tons) and the United States (8,133.50 tons).

With an increasingly wealthy population of well over one billion, China is expected to play a greater role in gold consumption and gold pricing in the coming years.

About the Shanghai Gold Exchange

The Shanghai Gold Exchange on October 30, 2002, by the People’s Bank of China and organizes the trading of gold, silver, platinum and other precious metals.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.