Silver Sales Pick up

End of Summer Silver Sales Show Signs of Life

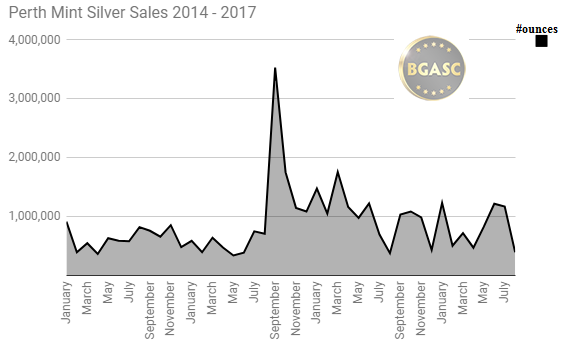

The U.S. Mint sold 3.3 million American Silver Eagles (ASEs) during the months of July and August, up 25% compared to 2.65 million ASEs sold during July and August 2016. The Perth mint sold 1.56 million ounces of silver in July and August this year, up 46% compared to 1.069 million ounces sold during July and August 2016.

Silver Has Become Increasingly a Safe Haven Metal For Retail Investors Over the Past Ten Years

According to the Silver Institute from 2008 – 2016 sales of silver coins rounds and bars exploded from about 5% of overall silver demand to over 20%. The increase in investment silver demand can be traced back to the financial crisis of 2008-2009. Historically, investors flocked to gold as a safe haven when a political and financial crisis hit. The financial crisis of 2008-09 was no different. Gold sales at the U.S. Mint spiked in the fall of 2008 and the mint had difficulty in keeping up with demand.

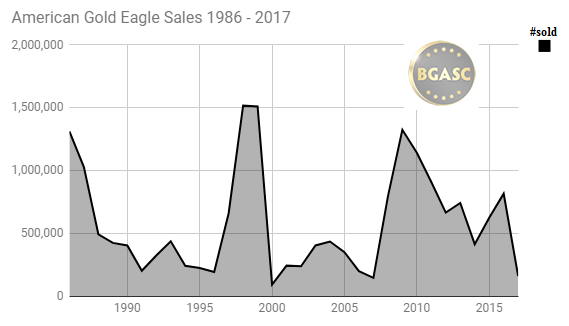

The US Mint sold 860,000 ounces of gold in the form of American Gold Eagles in 2008. Of that total 613,000 ounces or 71% were sold from August-December and a whopping 176,000 ounces of gold in the form of American Gold Eagles was sold in December 2008 alone. Gold sales continued to soar at the U.S. Mint in 2009 with over 1.4 million ounces of gold sold, the most the U.S. Mint had sold since the Y2K scare of 1999 when the U.S. Mint sold over 2 million ounces of gold.

Gold sales trailed off from 2010-2015 only to rebound in 2016 due to Brexit fears and U.S. political uncertainty resulting from the Trump/Clinton presidential campaign. Gold sales at the U.S. and Perth Mints have been muted in 2017, with the U.S. Mint reporting a 67% decline in gold sales year over year through August.

Silver Gains Footing as a Safe Haven Asset

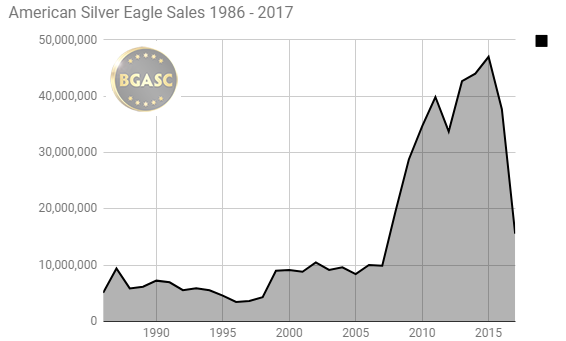

Silver sales at the U.S. Mint also spiked in reaction to the financial crisis of 2008-09. Sales of American Silver Eagles, however, would continue to rise steadily from 2008-2015. Sales of American Silver Eagles peaked in 2015 with 47 million sold -an increase of over 140% from 2008’s sales. The U.S. Mint sold over 40 million American Silver Eagles each year from 2013 -2015. In 2016, the U.S. Mint sold nearly 38 million American Silver Eagles. In 2017, American Silver Eagles are on pace to sell about 22 million. While this amount is about half of 2015’s sales, it is more than 2X 2007 sales when 9.9 million American Silver Eagles were sold.

The elevated gold silver ratio makes silver attractive to many investors.

The prices of silver and gold both peaked in 2011 – Gold at around $1911 an ounce and silver at about $50 an ounce. Gold sales at the U.S. Mint dropped after gold hit its price peak. Silver sales continued to grow as investors saw the price of silver undervalued in comparison to gold as the price of silver fell dramatically from its peak of $50 an ounce to well under $20. The drop in the price of gold after it hit its peak was more moderated. As a result of the drastic silver price decline, the gold silver ratio rose from around 50:1 in 2011 to about 83: 1. Many investors had come to view silver as a safe haven just like gold during the financial crisis of 2008-09 and continued to accumulate it as the price fell relative to gold.

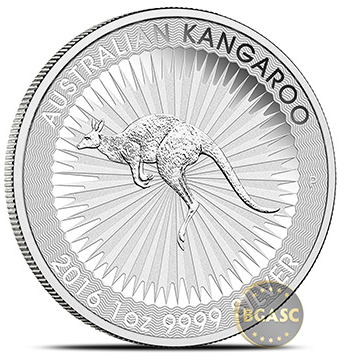

In September 2015, when the U.S. and Canadian Mints ran out of silver planchettes to strike American Silver Eagle and Canadian Silver Maple leaf coins, the Perth Mint introduced the Australian Silver Kangaroo coin, designed to be a bullion coin to be minted in amounts necessary to meet investor demand. Since the introduction of the Australian Silver Kangaroo coin, Perth Mint sales have remained elevated, often exceeding one million ounces a month, amounts rarely reached in the past.

Perth Mint gold sales data: The Perth Mint Blog

US Mint American Gold Eagle sales – USmint.gov

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.