Silver Soars in 2016

Silver is the Best Performing Asset in 2016.

`

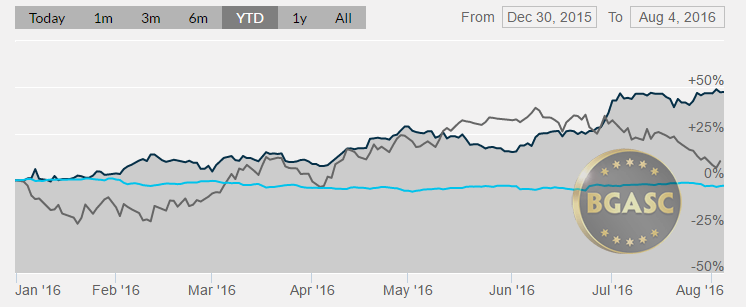

While gold has captured most of the headlines this year for its stunning price rebound and rise in 2016, silver has also rebounded and risen even further than gold. The price of silver peaked in April of 2011 at $50 an ounce and since then it began a long decline that reached its nadir of $13.71 an ounce in December 2015. The price of silver rose sharply in 2016 and by July and August was hovering around $20 an ounce, up almost 50% from its December 2015 lows.

The price of silver is a long way from its all time high but has risen significantly this year, making silver the best performing commodity and asset of 2016. Gold institutional buying has increased during 2016 as evidenced by massive inflows into gold exchange traded funds (ETFs). Silver ETFs, in contrast, have attracted far less institutional attention. Silver ETF flows this year have risen only slightly.

The Price of Silver in 2016 vs. Oil and the Dollar Index

Because the physical silver market is relatively small, large purchases could disproportionately impact the market, and have thereby prevented the same type of surge of institutional buying that we have seen in gold this year. The total value of the annual global mining supply is well under $20 billion. Given there are no known stock piles of silver that are readily accessible, silver is essentially a just in time commodity that relies on annual mining supply to met industrial and investment demand which are split relatively evenly.

Due to the smaller size of the silver market compared to the gold market, gains in silver tend to be larger than gold’s in a bull market, even without large institutional participation . Conversely, silver’s losses also tend to be greater than gold’s in a bear market.

Some of the same factors that supported gold’s rise this year also supported the rise of silver

These factors include highly accommodative monetary policies of the world’s central banks with their low, no and negative interest rates, along with their massive bond and equity purchase programs. While these programs have done little to boost economic activity, they have managed to highlight that holding silver which pays no interest, may be a better bet than holding government bonds, many of which also pay no interest or are issued with negative interest rates.

Slowing global growth and the inability of central banks to do anything about it has created an expectation that central banks will increase their stimulus programs and take interest rates further into negative territory making silver an even more attractive investment proposition

Political uncertainty also plays favorably to silver. 2016 has been fraught with many unique circumstances that have created an unstable political environment in the normally stable countries of Western Europe and the United States. Europe has faced the Brexit vote and the prospect of other European Union member states holding copy-cat referendum to also leave the EU. In addition, Europe is in the midst of a migrant crisis and has been subjected to numerous terrorist attacks this year.

In the United States both the Democratic and Republican candidates are highly controversial. The Democratic candidate, Hillary Clinton has been subject to investigation during most her campaign for the Presidency. The Republican candidate, Donald Trump has never held political office. Not only has he been opposed by Democrats, but Republicans have also tried to thwart his campaign. Both candidates have high unfavorable ratings.

The same factors that have driven gold higher, have acted to drive silver even higher.

We expect political and economic uncertainty to continue. Whether that will continue to be positive for silver we cannot say. Whether silver’s recent rise is the beginning of a spectacular multi-year bull run or destined to flame out, no one can say. Retail investors that buy gold for the long term often engage in a practice called dollar cost averaging; i.e. buying modest amounts of silver at regular intervals in order to protect against mistakes in market timing that may result in buying too much at high prices and not having enough resources to buy at lower prices. While no investment is entirely safe or any investment strategy fool proof, dollar cost averaging can reduce some of the risk caused by large swings in the price of silver.

The foregoing information regarding the price of silver and dollar cost averaging is provided for informational purposes and is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action. Prior price action of silver on the up and downside may not be indicative of future silver price action. The historical prices of silver are retrieved from third party sources deemed to be accurate. BGASC makes no representation, however, as to the accuracy of such information and assumes no responsibility to correct or update any information provided above and assumes no responsibility for reliance on such information.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.