FX Friday – Global Currency Review & Forecast for 4-1-16

Fed Chair Janet Yellen Speaks, Currency and Equity Markets React

The week opened with mixed economic data releases on Monday. The Dallas Fed February reading was a negative -13.6, which followed a -31.8 reading in January. February pending home sales rose 3.5%, as home price increases moderated. Pending home sales were up 11.4% in the Midwest, up 2.1% in the South, up 0.7% in the West, but down 0.2% in the Northeast. Personal income was up 0.2% in February and personal spending was up 0.1%.

As a result of the tepid growth in personal spending, the Atlanta Fed slashed its fisrt quarter 2016 GDP projections from 1.4% to 0.6%.

This week’s market action has been dominated not by data releases but by Janet Yellen’s speech to the Economic Club of New York on Tuesday. In that speech, Ms. Yellen gave her views on the state of the United State economy. Her assesment was mostly favorable, citing positive increases in job growth and consumer spending. Ms. Yellen noted that manufacturing and net exports, however, had been hit hard by the global economic slowdown.

The portion of Ms. Yellen’s speech that drew the most attention was her statements regarding monetary policy implications in light of her economic assessment.

View Gold & Silver Price Charts; Receive Gold & Silver Price Alerts

Fed Chair Janet Yellen’s “Proceed With Caution” is the New “Patience”

Ms. Yellen noted that the Fed left rates unchanged in January and March of 2016 after having raised them for the first time in ten years in December 2015. Last week, six Fed Presdents intimated that despite holding off on a rate increase in March, that the next Fed rate hike could come as soon as April.

Ms. Yellen threw cold water on that assertion stating: that “developments abroad imply that meeting our objectives…will require a lower path for the Fed funds rate than anticipated in December.” “Given the risks to the outlook , I consider it appropriate for the Committee to proceed cautiously (emphasis added) in adjusting policy”.

Ms. Yellen’s ‘proceed cautiously’ language may portend a long wait before the next rate hike as did the Fed’s ‘patience’ language that was included in Fed statements from 2014 -2015 regarding the timing of its first rate hike.

As the Fed talks rate hikes, Ms. Yellen raises possibility of QE

As a result of the risks to the Fed outlook emanating from abroad, Ms. Yellen stated that the Fed could combat any weakness in the economy by cutting rates back to zero, extending the maturities of the US Treasuries they currently hold OR use “tools” that the Fed used “effectively to strengthen the recovery from the Great Recession”. The foot note in Ms. Yellen’s speech referencing those tools cited a 2015 Federal Reserve staff working paper discussing the efficacy of quantitative easing.

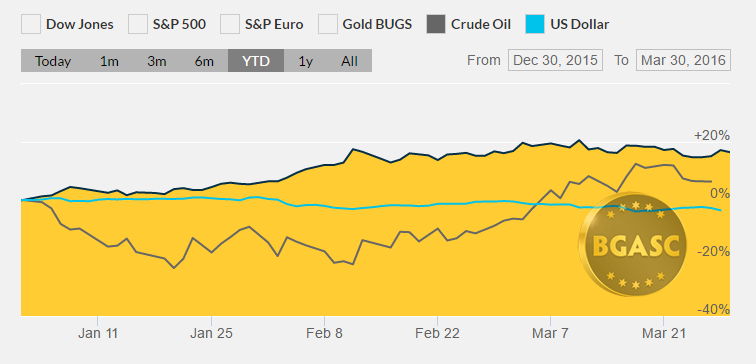

Immediately after Ms. Yellen’s speech, the Dollar Index* fell over 1% to 95.13, while gold, silver and the equity markets rose.

On Wednesday, as the markets digested Ms. Yellen’s speech further, the dollar continued its descent and is heading for its worst quarter in five years. The Dollar Index is down 3.7% year to date. The dollar rose most of 2015 on the anticipation that the Fed would begin to raise interest rates. After the Fed’s meeting in March, the Fed reduced expectations for 2016 rate hikes from four to two. Ms. Yellen’s speech earlier this week called into doubt whether the Fed would raise rates at all in 2016.

Almost as if on cue, Chicago Fed President Charles Evans spoke on Wednesday to dispel any ideas that the Fed was still not serious about raising interest rates in 2016. Mr. Evans indicated that while a rate hike in April was unlikely, one in June could be made “on the basis of further improvements in the labor market.”

A good non farm payroll (NFP) report today may put a rate hike in June or even April back on the table. A poor NFP report may cause market participants to doubt the Fed will raise interest rates in the first half of 2016.

Next week is light on economic reports. The Fed will release its March minutes, but there should be few surprises, if any, as Ms. Yellen’s speech and other Fed President pronouncements have superceded whatever might have been discussed in the Fed’s March meeting.

Here are some reports that could impact currency movements next week:

Apr 4 Factory Orders Feb

Apr 5 Trade Balance Feb

Apr 5 ISM Services Mar

Apr 6 MBA Mortgage Index 04/02

Apr 6 Crude Inventories

Apr 6 FOMC Minutes Mar 16

Apr 7 Continuing Claims 03/26

Apr 7 Initial Claims 04/02

Apr 7 Natural Gas Inventories 04/02

Apr 7 Consumer Credit Feb

Apr 8 Wholesale Inventories Feb

Year to Date Dollar Index, Oil and Gold Prices

* The US Dollar Index tracks the US dollar vs. the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc. The Euro comprises nearly 58% of the index.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.