Gold and Silver Turn in Double Digit Gains in 2019

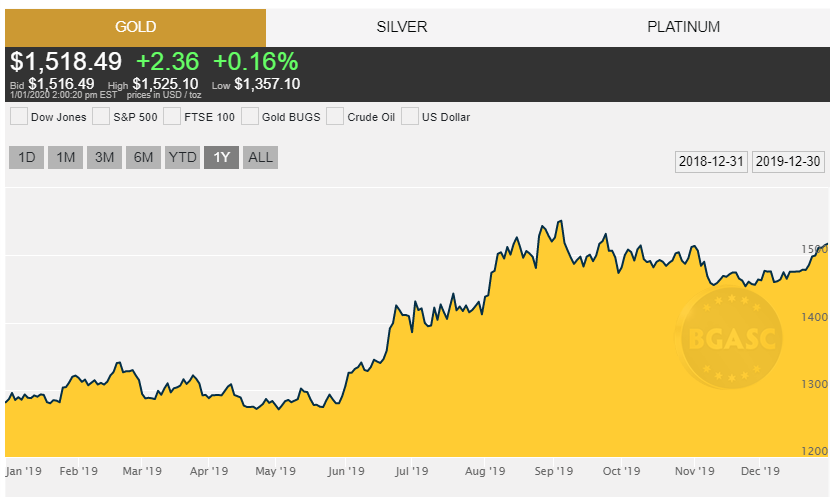

Gold and silver rose 18.9% and 15.5%, respectively and closed 2019 on the upswing. Gold finished the year at $1518.49 and silver at $17.90. Gold hit its high for the year of $1551 on September 4 . Silver peaked at $19.57 on the same date.

Gold and silver turned in their biggest gains of the year after the Federal Reserve reversed course and cut interest rates three times in the second half of the year. The Fed had been expected to continue raising rates throughout 2019.

Trade tensions between China and the United States, uncertainty over the fate of Brexit and the increase in negative yielding bonds globally also fueled gold and silver’s 2019 performance.

Gold and silver’s impressive price gains are remarkable considering the dollar index was up in 2019 and the stock market indexes were also up. Indeed, the Dow slightly outperformed gold and the S&P and Nasdaq index clocked in even greater gains.

The gold silver ratio rose in 2019 to 84.5 to 1, meaning one ounce of gold is worth 84 and a half ounces of silver. When gold and silver peaked at $1911 and $50 an ounce in 2011, the gold and silver ratio fell to 35 to one. In a precious metals bull market silver tends to out perform gold in the later stages, while gold tends to have more limited declines in a bear market than silver.

No one knows whether gold will out perform silver again in 2020. Make your selection. You can order either American Gold or Silver Eagles, or both from BGASC.com at the links below:

| Today’s Gold Prices | Today’s Silver Prices | See Gold & Silver Price Charts | Receive Gold & Silver Price Alerts |

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.