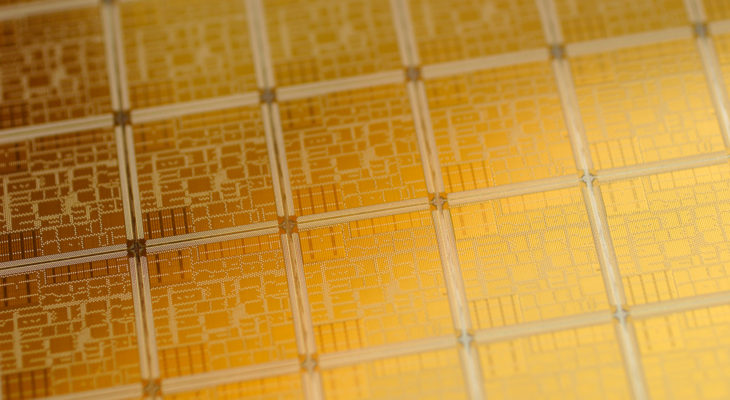

Physical or Digital Gold?

Holding and Controlling Your Metals May Prove Invaluable.

There has been a lot of buzz around “digital gold” offerings that allow purchasers to buy fractional amounts of gold on an exchange whereby the owner is provided with digital proof of ownership backed by physical gold stored in a vault. The Royal Canadian Mint and Australia’s Perth Mint operate such offerings. Earlier this week, the British Royal Mint announced that its plans to offer a similar digital gold product had been put on hold.

Proponents of digital gold argue that it brings gold into the 21st century by allowing gold to be traded on a digital platform similar to cryptocurrencies, like Bitcoin and Litecoin. They add that digital gold platforms may be a better alternative to gold exchange traded funds (ETFS) as digital gold platforms may have 24/7 trading options compared to gold ETFs that trade only during market hours Monday – Friday (excluding holidays). Digital gold may also increase overall demand, by providing a convenient method of buying gold.

There are some significant downsides, however, to buying digital gold. First, gold is not a digital asset, it is a rare inert element with unique properties, including inherent beauty that is best appreciated in physical form.

While considering whether to buy digital gold or to purchase physical gold here some things to consider:

Regulatory Risk

As evidenced this week by the British Royal Mint’s decision to halt plans to launch a digital gold offering, regulatory considerations should be taken seriously. Jurisdictions may change their views and laws regarding digital gold offerings, including increasing reporting and other regulatory requirements on digital gold platforms, the expense of which may be passed along to their customers. It is also possible that such digital gold platforms will either be closed by law or closed by the operator due to the expensive cost of compliance. While you may be fortunate not lose the value of your gold in the event of a closure of your digital gold platform, it may take years to recoup your investment as happened to investors in e-gold, a digital gold platform that was closed due to legal issues in 2009.

Physical Delivery Expensive

While digital gold offerings often have delivery features, they are generally not as cost effective as ordering gold from a trusted bullion dealer and the options for the type of gold you can have delivered are generally limited to less than a handful of gold products.

Storage Costs

Storage costs are fixed on digital gold platforms and can add up over years of holdings.

No Reliance on Third Parties

Once you gain possession of your gold, you own it. There is no need to make requests to third parties to retrieve it or to wonder if your digital gold really exists in the investment vehicle you purchased. When you purchase physical gold, you can see and hold it. You also are not reliant on third parties to store and insure your gold. When you hold precious metals you are not subject to the malfeasance or bankruptcy of the entity holding or insuring your metals.

No Instant Access to Your Gold

Digital gold may not available during events like a currency or banking crisis or an electrical/Internet outage. When you self-store your gold whether at home or offsite- you know where it is at all times and depending on the location of your selected storage location you may be able to access it 24/7/365. If you are buying gold to insure against bad events like stock market crashes, bank holidays, stock market closures or natural disasters that cut off your access to electricity or the Internet, your digital gold may not be available to you to trade or even if the platform is functioning, it may not be able to transfer proceeds to your bank. Only gold in your possession will give you the insurance when you need it most. With physical gold bullion you can exchange it for cash or use it to barter for goods and services.

Annual Reporting Requirements

If your digital gold platform is located outside the United States it may be subject to the annual reporting requirements of the Foreign Account Tax Compliance Act (FATCA) which includes penalties for failing to report your holdings that may significantly exceed the value of your holdings.

While digital gold may offer convenience, the old adage applies when buying gold- if you don’t hold it, you don’t own it.

Browse a wide selection of gold products at BGASC.com

This article by BGASC is not, and should not be regarded as, investment or tax advice or as a recommendation regarding any particular course of action.